Wall St futures flat amid US-China trade jitters; bank earnings in focus

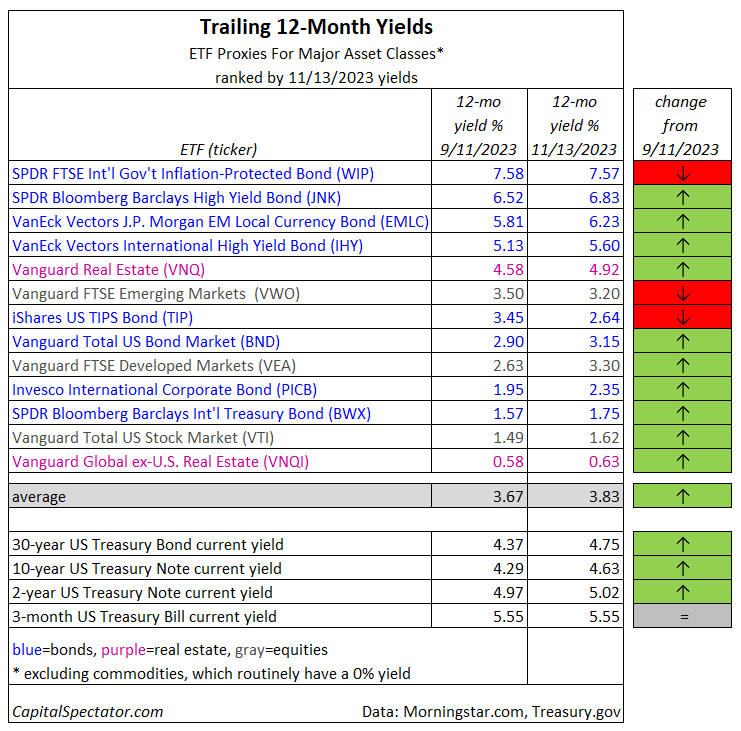

Current yields for the major asset classes edged higher recently, based on a set of proxy ETFs through the close of trading on Monday, Nov. 13.

The average yield for global risk assets ticked up to 3.83%, modestly above the previous update’s 3.67%. The peak for these irregular updates on CapitalSpectator.com in the current cycle is 4.50% (Dec. 19, 2022).

For context, a US 10-year Treasury currently yields 4.63% — 80 basis points above the average yield for global risk assets. Although the 10-year rate has increased recently, more analysts are forecasting that the Federal Reserve’s rate hikes are done.

UBS goes further and now expects that the central bank will cut rates several times in 2024, citing higher odds for softer economic conditions next year. If correct, current yields for bonds will look more attractive in the months ahead as rates decline.

Fed funds futures, however, are still pricing in expectations that the central bank will leave its target rate unchanged at the next three FOMC meetings. For the upcoming Dec. 13 announcement, the market is pricing in an 86% probability that the Fed will stand pat with the current 5.25%-5.50% range.

“I think the Fed’s last rate hike was in July,” writes Tim Duy, chief US economist at SGH Macro Advisors in a note to clients on Monday. “Still, the Fed is not ready to declare that the rate hike cycle ended in July because when that happens, the market will go straight to rate cuts.”

Current payout rates in financial markets still look relatively attractive, but it’s important to remember that trailing yields for stocks and other risk assets listed above aren’t guaranteed (in contrast with current yields from government bonds for buy-and-hold investors).

Keep in mind, too, the ever-present possibility that whatever you earn in yields via ETFs fund could be wiped out, and more, with lower share prices.