Eos Energy stock falls after Fuzzy Panda issues short report

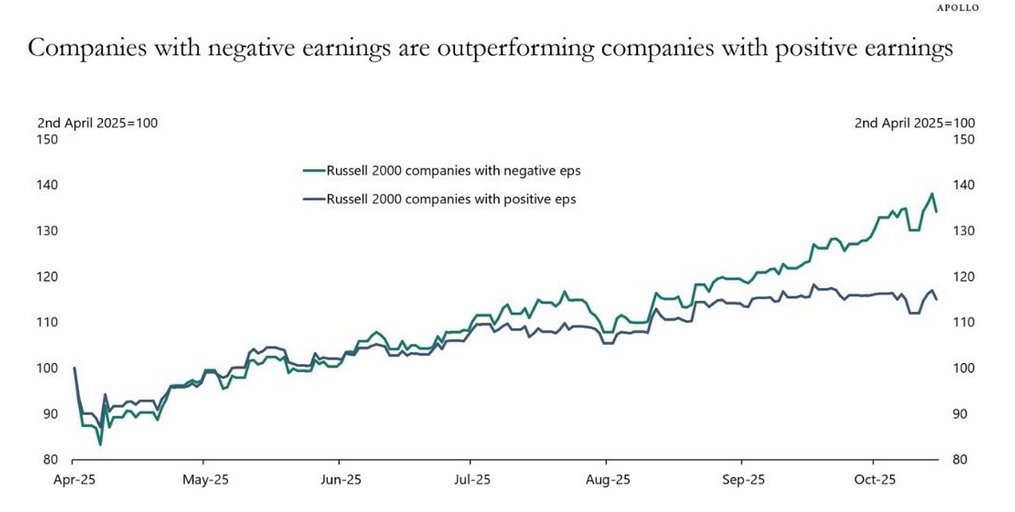

The chart below, courtesy of Apollo’s Torsten Slok, shows that small-cap companies with negative earnings have outperformed small-cap companies with positive earnings by about 30% since early April. Per Torsten:

“Something remarkable is going on in the equity market. Stock prices of companies with negative earnings have in recent months outperformed stock prices of companies with positive earnings.”

This performance divergence, in which companies with negative earnings outperform those with positive earnings, is just a part of a broader trend in which investors are increasingly willing to take on more speculative assets and rely less on stocks with more sound fundamentals as they reach for extra returns. A better way to define the trend: investors are betting on estimates of future earnings growth rather than on the stability of actual earnings.

Another instance is the ARKK fund run by Cathy Wood. Of the 46 equity positions, six have positive earnings over the last twelve months. However, comparing small-cap stocks to ARKK is not entirely fair, as her fund invests in early-stage innovators, where expected growth is often prioritized over current profits.

This positive-versus-negative earnings divergence reminds us of a phrase worth considering: Is a bird in hand worth two in the bush? The market says no, what do you say?

CPI and The Week Ahead

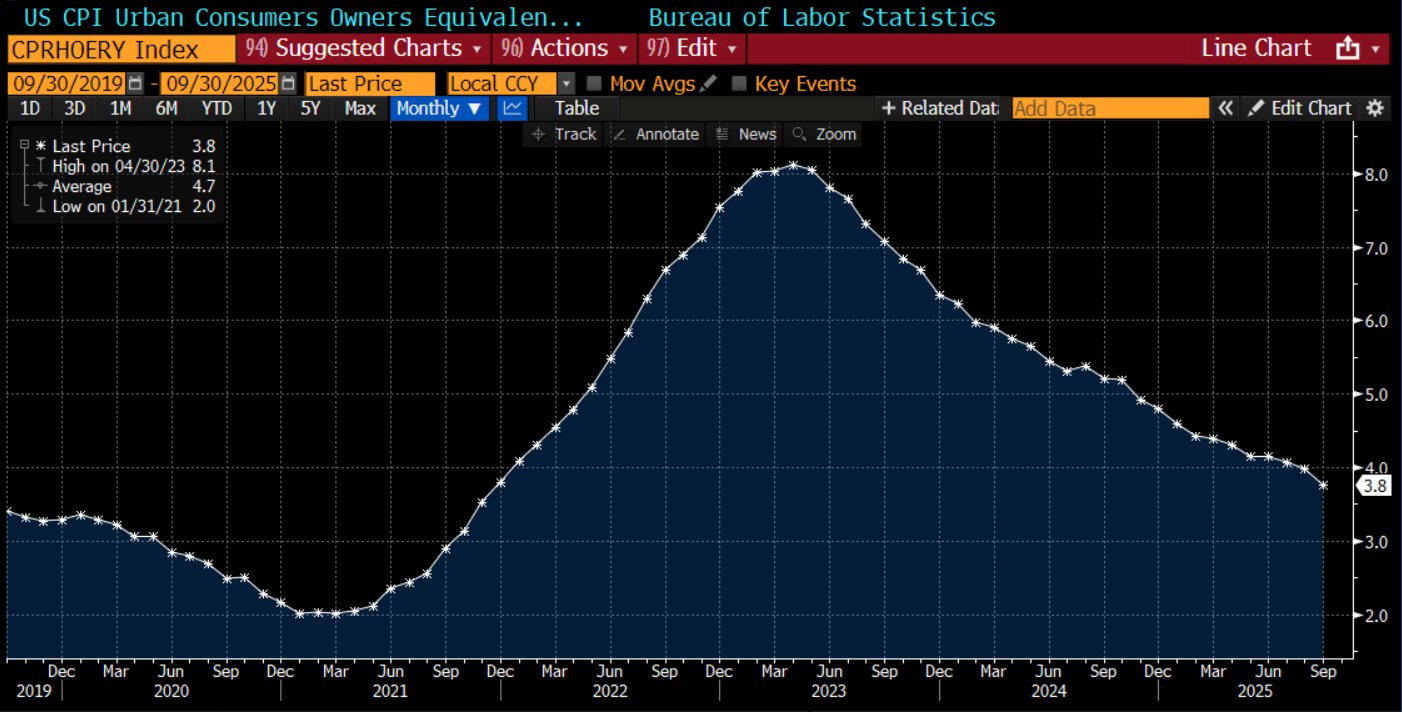

On Friday, the BLS published its “rare exception” CPI inflation report despite the government shutdown. Inflation was 0.1% weaker than expected, with CPI rising 0.2% in August and Core CPI rising 0.3%. The data had little impact on the bond market, likely because it was stale and did little to change expectations for the Fed’s actions this week at its FOMC meeting.

A driving force of inflation continues to be the declining inflation rate of shelter prices, as shown below. Given that CPI shelter data lags significantly and accounts for 40% of CPI, we can expect shelter prices to continue to dampen CPI for many months to come.

With the government shutdown continuing, economic data will be light. We suspect that the employment report will come out over the next week or two, regardless of whether the shutdown ends. The Fed meets on Wednesday with market expectations nearing 100% that they will cut rates by 25bps. Given Powell’s recent comments on QT and signs that liquidity is becoming scarcer, we expect the Fed to announce a plan to end QT by year’s end. It is possible they could stop it at this meeting.

Earnings will again be prominent this week with the large technology companies reporting. Of note will be the following:

- Tuesday: Visa (NYSE:V) and Unitedhealth (NYSE:UNH)

- Wednesday: Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), Google (NASDAQ:GOOGL), and Caterpillar (NYSE:CAT)

- Thursday: Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Eli Lilly (NYSE:LLY), and Mastercard (NYSE:MA)

- Friday: Exxon Mobil (NYSE:XOM), AbbVie (NYSE:ABBV), and Chevron (NYSE:CVX)

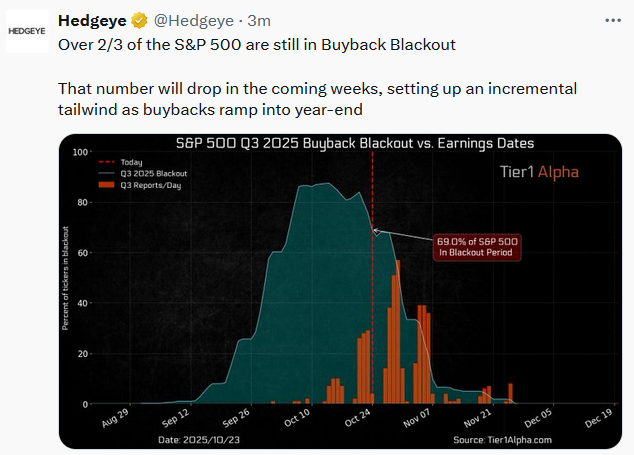

The Tweet of the Day at the bottom shows that next week will feature the most earnings announcements of the cycle. Further, it highlights that the percentage of companies in share buyback blackouts will decline rapidly over the next few weeks.

Tweet of the Day