SoFi stock falls after announcing $1.5B public offering of common stock

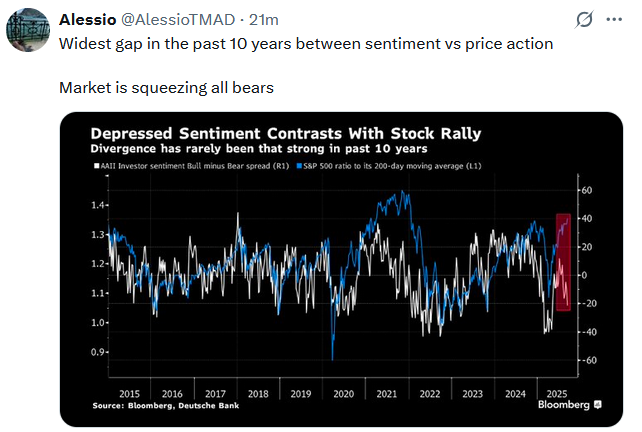

Since the middle of July, UST 10-year yields have fallen from 4.50% to 4.00%. While the yield decline has been profitable for bondholders, it has also aided many other investors. Such a finding may seem counterintuitive, considering that lower yields are the result of a significant weakening in the labor market and a range of other economic indicators suggesting an economic slowdown. Slower economic growth hurts corporate earnings. Thus, the environment should not be favorable for stocks. However, at times, as we see today, the market is willing to overlook potential earnings weakness and let market mechanics take over. Let’s discuss some of those market mechanics.

- Collateral Is More Valuable – Trades on margin are most often collateralized with Treasury securities. As bond yields fall and bond prices rise, the collateral becomes worth more and can thus support a greater number of assets.

- Passive Rebalancing – Portfolios that run a balance of stocks and bonds rebalance on a semi-regular basis. When the value of the bonds rises, the portfolios may need to sell bonds and buy equities if they underperformed.

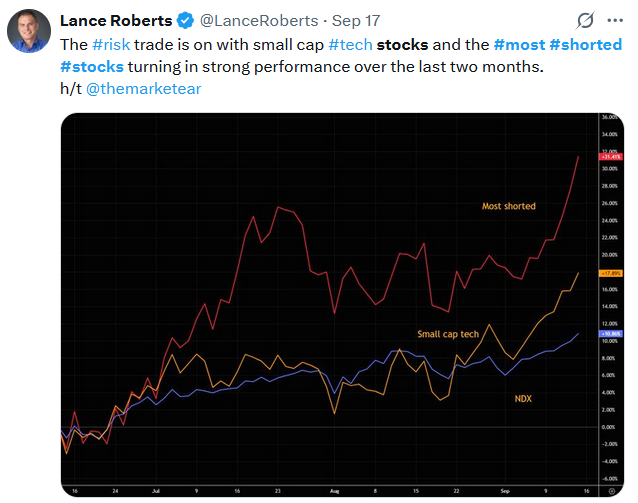

- Lower Margin Costs – A lower Fed Funds rate will result in a lower interest rate on margin loans. Accordingly, lower margin fees make buying assets more attractive. This helps explain why the most shorted stocks, whose trade economics are dependent on margin costs, are leading the rally, as shown in Lance’s tweet below.

In the longer run, we may find that the benefits of lower yields and the resulting market mechanics that support risk assets are insufficient to outweigh weakening economic conditions and earnings. However, in the short run, these market mechanics may help some risk assets look past the weakening economic outlook.

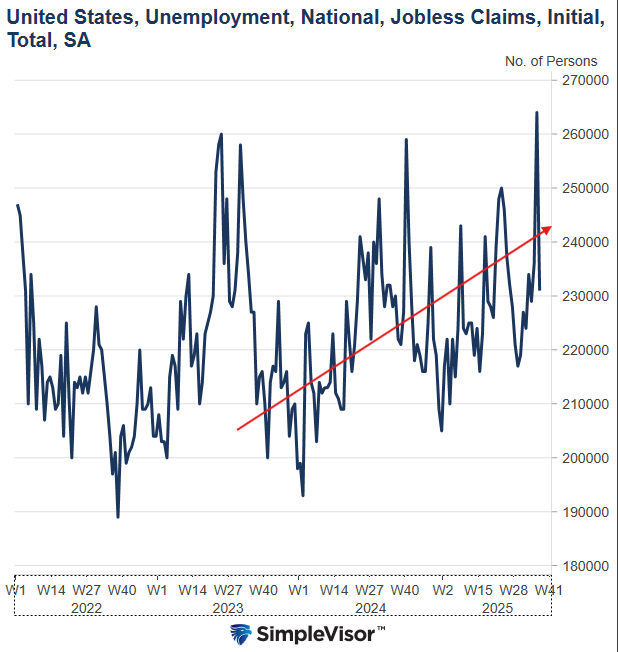

The Jobless Claims Rollercoaster

The weekly jobless claims data is the most real-time gauge of the labor market. While it can be extremely helpful to assess trends, we must be careful not to read too much into each data point. For instance, last week the number of initial jobless claims was 265k, up from 236k the prior week. That surprise jump made the number the highest since early 2022. The data was concerning, but yesterday we learned that this week’s initial jobless claims were back to 231k, in line with recent levels. There are two predominant reasons for the spike two weeks ago. First, the week included the Labor Day weekend. Holidays often result in more volatile economic data, including jobless claims. Second, there were a large number of fraudulent attempts to collect jobless claims in Texas. Per Axios:

Minutes after the report, economists flagged that the overall spike in weekly claims was a result of an unusual surge in Texas — a quirk some attributed to holiday effects or the state’s flood disaster claims program. But now the state’s labor office, which reports the data to the national Labor Department, said it was a direct result of fraudulent attempts to collect unemployment benefits.

The graph below shows the volatile nature of the weekly jobless claims data. To reiterate, the trend, not the individual weekly data points, is what matters most. As the graph indicates, the trend has remained upward over the last two years.

Tweet of the Day