SoFi shares rise as record revenue, member growth drive strong Q3 results

-

Global economic surprises suggest that GDP growth could be better than feared

-

Investors can gain insight into the state of the domestic and international economy from retailers, automakers, and financial trading hub companies this week

-

Forming a mosaic on the state of markets at the macro and micro levels is critical to managing risk as volatility ticks back up

It’s the ever-looming recession. Traders have been waiting for signs that the domestic economy is cooling, but while one indicator here or there reveals weakness, economic surprises have generally been on the positive side lately. Last week, the global read on broad global manufacturing, services, and consumer activity showed some of the best figures (relative to expectations) in months. As the ‘economic surprise index’ baffles prognosticators, the Federal Reserve is watching with a hawkish eye. Meanwhile, corporate uncertainty just hit a 3-quarter high according to Wall Street Horizon’s proprietary data.

A Key Stretch of Macro News

Last week’s Fed minutes didn’t unveil any major revelations. Inflation pressures are easing, but the core CPI and PCE are much too hot while the labor market remains too tight for comfort. Amid more Fed Speak over the coming days, surely attempting to jawbone investors, a slew of major economic data hits the tape. By Friday afternoon, we will know a whole lot more about the state of the economy and upcoming Fed policy.

Pay Attention to Economy-Wide Reports, but Don’t Ignore Industry Trends

And while data points like the ISM Manufacturing report, JOLTS, ADP employment, jobless claims, and the May payrolls report capture headlines, traders must also keep a watchful eye on events at the firm-specific level. The turn of the month features key interim business updates that span industries and sectors. This week, we get a retail read from Costco (NASDAQ:COST) and The Buckle (NYSE:BKE) along with trading volume totals from Cboe Global Markets (NYSE:CBOE) and CME Group (NASDAQ:CME), among others. Also, the automakers will provide their May sales figures.

May Retail Roundup

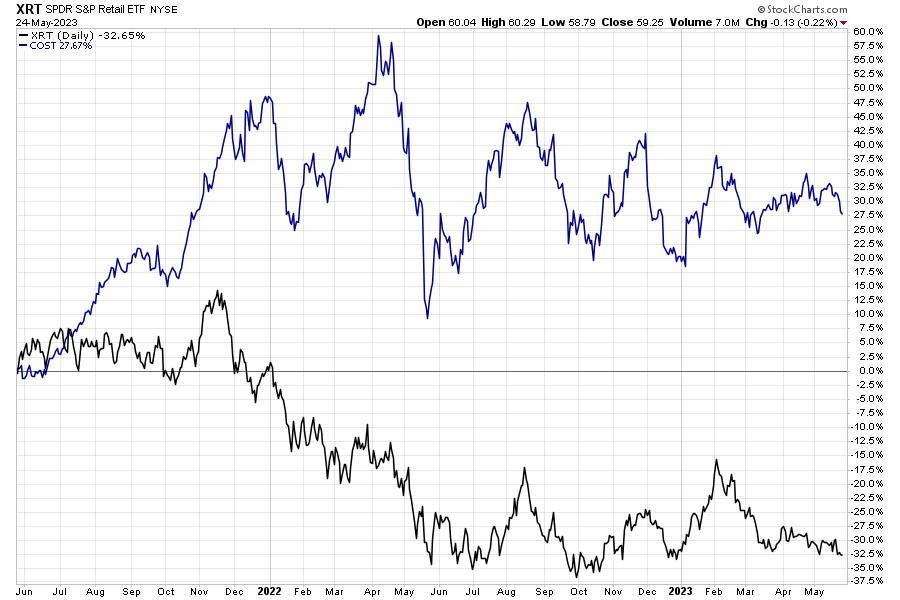

Kicking things off with the consumer, the April retail sales report included some internal data that were better than feared as excess savings dwindles and consumer credit rises. Skeptics wonder how long that trend can sustain itself. Following a mixed Q1 reported by Costco last Thursday night, with signs that the higher-end consumer is now starting to feel some pain, its May report on comparable-store sales due out Thursday afternoon may drive volatility among retail stocks.

Retail ETF (XRT) Struggles as Costco Shares Consolidate

Source: Stockcharts.com

Additionally, The Buckle, a small apparel retailer, normally doesn’t move markets – and we do not expect it to this time either – but last week’s range of apparel-company results and outlooks was tough to sift through. While Abercrombie & Fitch Company (NYSE:ANF) had a very strong start to the year, there’s uncertainty ahead of the back-to-school season among its peers. Investors may be able to spot trends in BKE’s May sales update to be released on Thursday.

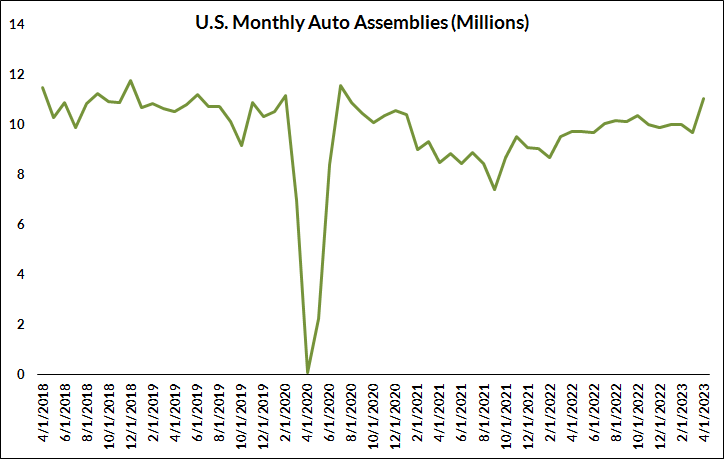

Start Your Engines: Better Auto Production Numbers

Alas, it’s too soon to talk about the fall semester, right? How about a summer road trip? The good news is that gas prices are down huge from 12 months ago (helping to drive the Headline CPI rate lower from year-ago levels), and auto production has ticked up. April’s industrial production report included a surprising jump in auto assemblies – more than 11 million units was the best amount since July 2020 while new car inventories crept up. If that trend persists, there could be an upside bias to the industry this week. Ford Motor Company (NYSE:F), Kia Corp (KS:000270), Subaru (OTC:FUJHY) (7270.JP), Hyundai Motor (KS:005380), and Tata Motors Ltd (NS:TAMO) all issue May production and sales reports.

An Auto Achievement: Best Monthly Production in Nearly 3 Years

Source: St. Louis Federal Reserve

Where’s the Froth? Trading Volume Metrics Could Show New Signs of Retail Investor Hope

May interim event data may also offer insights into trading activity and retail investor sentiment. Last month featured several noticeably light trading volume sessions on the NYSE and across global markets despite fervor around the AI theme and some heightened volatility concerning the U.S. debt ceiling debacle.

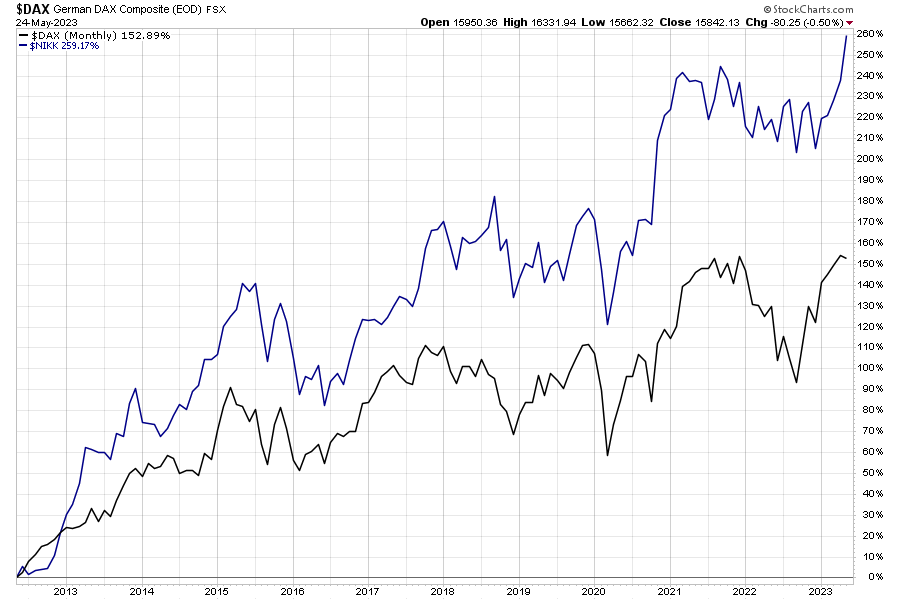

Cboe issues its May trading update report on Friday while rival CME Group posts its monthly market summary the same day. Before that, Interactive Brokers (NASDAQ:IBKR) reports last month’s brokerage metrics. Overseas, Japan Exchange Group Inc (TYO:8697) and Deutsche Boerse (ETR:DB1Gn) (OTC:DBOEY) give their May trading volume figures, too. Those could be particularly interesting considering a recent all-time high in the German DAX Index while Japan’s Nikkei 225 notched its best level in more than 30 years last month.

International Intrigue: Germany and Japan Equities Participating in the Rally

Source: Stockcharts.com

The Bottom Line

A flurry of macro data may dominate the headline this week, but traders should devote attention to key company-specific interim event details. Three key economic bellwether industries each feature a host of firms offering May updates on business activity. It will be critical to manage volatility under the market’s surface as economic uncertainty increases.