Street Calls of the Week

Meme stock trading has returned in force. As discussed last week, the fear of missing out (FOMO) continues to dominate investor sentiment. The meme stock movement is again dominated by speculative retail trading driven by online forums, social media hype, and short-term momentum.

Unlike GameStop (NYSE:GME) and AMC in 2021, the current cycle revolves around names like Krispy Kreme (NASDAQ:DNUT), GoPro (NASDAQ:GPRO), Kohl’s (NYSE:KSS), Opendoor (NASDAQ:OPEN), and American Eagle (NYSE:AEO) as the favorites.

These stocks, grouped by traders into the acronym “DORK,” move not on earnings strength but on the collective sentiment of retail investors chasing quick gains.

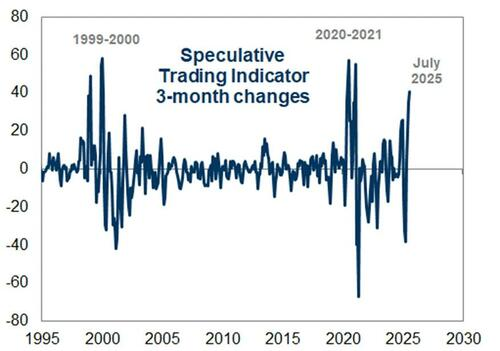

The data confirms the surge. Call-to-put ratios have spiked, reflecting a rush into bullish options positions. Zero-days-to-expiration (0DTE) contracts dominate speculative retail trading. These contracts offer a high-risk, high-reward setup with minimal capital. Goldman Sachs’ speculative trading index is now at levels that historically preceded sharp market pullbacks. That is a warning that current conditions are fragile.

“This isn’t a healthy sign of a broad-based bull market. Instead, it reflects a market driven by liquidity, leverage, and sheer momentum. In other words, we are once again in a “lottery ticket” market where risk management takes a back seat to gambling. History has shown that the house usually wins when market participants treat equities like casinos.”

Like the “boy who cried wolf,” the warning of a coming correction due to the speculative excess has failed to come to fruition. Unsurprisingly, retail investors are now ignoring those warnings as they “buy every dip.”

While fundamentals may no longer seem to apply in the current market environment, Benjamin Graham wrote about speculative fervor in markets more than 75 years ago.

“Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis.

Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly.

If you are a prudent investor, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interesr in the enterprise? Only in case you agree with him, or in case you want to trade with him. You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low. But the rest of the time you will be wiser to form your own ideas of the value of your holdings, based on full reports from the company about its operations and financial position.

Price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market.” – The Intelligent Investor

In the current environment, Mr. Market is overly enthusiastic and continues to reward risk-taking. That is, until Mr. Market doesn’t.

The GameStop episode in 2021 showed how speculative retail trading can create violent short squeezes followed by rapid collapses. Many retail traders assume they will exit at the top, but the shift from euphoria to panic often happens too quickly.

Passive Index Concentration Is Driving Market Structure

While meme stock trading dominates headlines, the deeper structural story is the concentration of market gains in a few mega-cap stocks due to passive index flows.

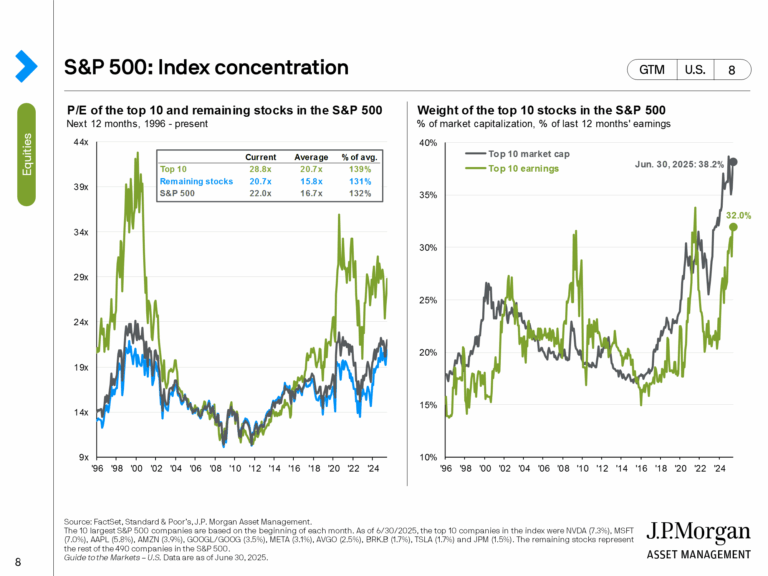

Passive funds track indexes weighted by market capitalization. As stock prices rise, these funds buy more of the same names, regardless of valuation or fundamentals. This mechanical process has inflated the market value of the largest companies. The top 10 stocks in the S&P 500 now account for more than 38% of the index.

That level of passive index concentration has not been seen since the peak of the dot-com bubble. While such concentration may be worrisome, as it elicits memories of the “Dot.com crash,” in the short term, this handful of companies’ performance determines the entire market’s direction.

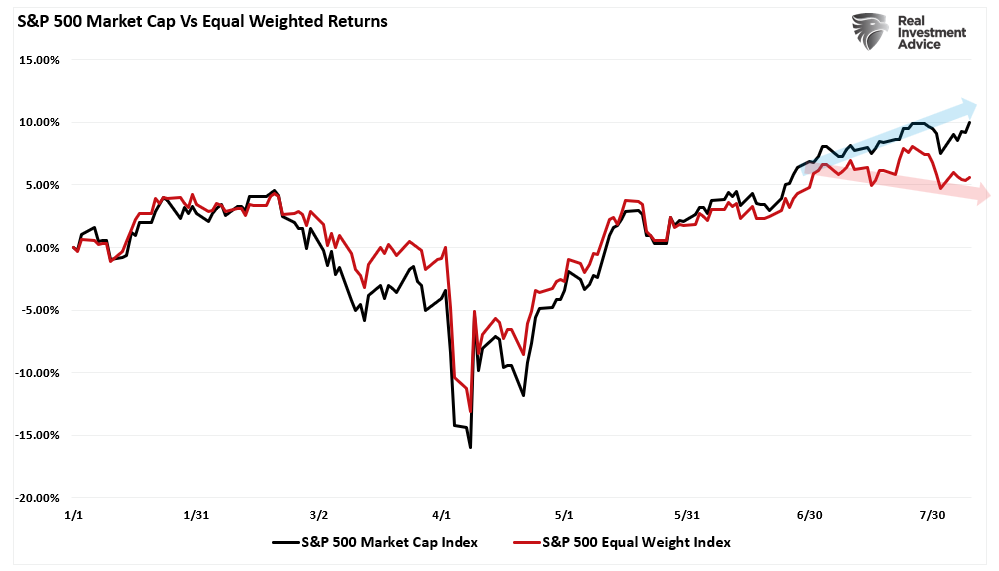

However, like an iceberg where we only witness the 10% rising above the water, the passive index concentration hides underlying weakness. Equal-weight versions of the S&P 500, which give each stock the same importance, are underperforming. That shows that the broader market is struggling outside of the top names. When gains are so concentrated, the market’s foundation is narrower than it appears.

To better understand that performance gap, it is currently the largest since the “Financial Crisis.”

This passive concentration also fuels speculative retail trading. As retail investors see the market rise, the urge to “get rich quick” initially sucks money into passive index ETFs. Those inflows push markets higher, particularly the mega-cap leaders, which provides the illusion that the trend is unbreakable.

Retail traders, emboldened by these moves, began to increase their risk profile to enhance returns by piling into options and short-term trades. The feedback loop between passive buying and retail speculation accelerates price moves and disconnects valuations from economic reality.

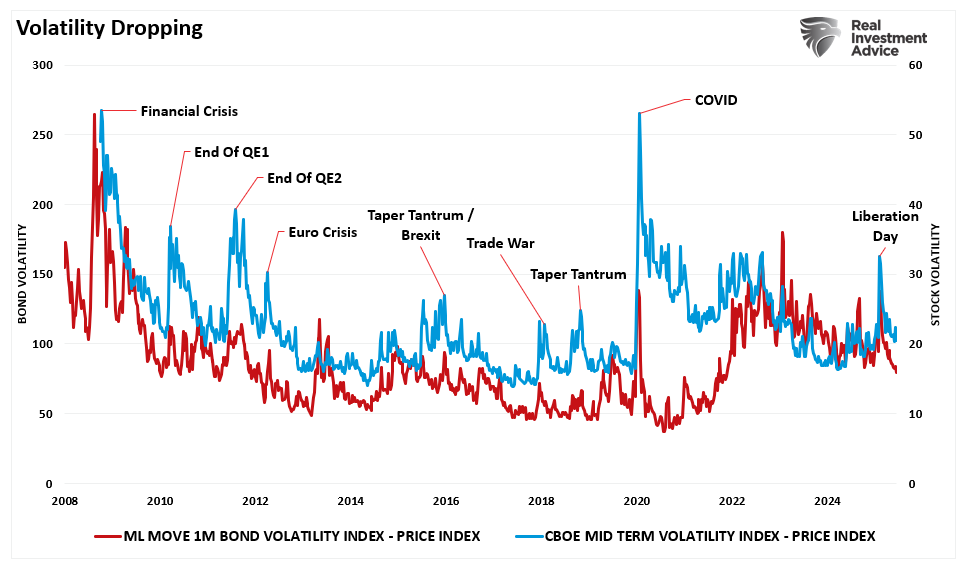

While the short-term effect is a resilient-looking market, the feedback loop increases market fragility as volatility declines. Currently, volatility is dropping in both the stock and bond markets as investor complacency increases.

Of course, despite warnings from analysts, historical comparisons to past bubbles, and narrow breadth, the market keeps making new highs. The primary reasons are momentum, liquidity, and sentiment. Passive flows buy relentlessly. Speculative retail trading fuels momentum in high-beta names. Mega-caps keep leading.

As noted above, as that process continues, investors become more emboldened to take on risk, ignoring the “boy who cried wolf.”

However, just as in the parable, eventually the “cry for help,” which went unheeded, led to a disastrous outcome. The same is true in the market today. If, for any reason, money stops flowing into passive funds, or worse, starts flowing out, the same mechanical process that lifted mega-caps will push them down. Given their size, this would impact the entire market.

Until then, the market’s path of least resistance is higher. Fighting the trend is unproductive. The strategy is to participate with discipline, stay alert for signs of leadership weakness, and prepare for volatility when it returns.

Jesse Livermore’s Approach To Speculative Trading

So, how do you navigate a “meme stock trading” market and “live to tell about it?”

Jesse Livermore’s approach in 1916 remains relevant in an era defined by meme stock trading, speculative retail trading, and extreme passive index concentration. Livermore understood that the market is rarely rational in the short term. Prices can extend beyond fundamental value when driven by sentiment, liquidity, or herd behavior. His method was not about predicting tops or bottoms but identifying when the market’s internal strength was shifting.

Livermore stayed long when the leaders, the strongest stocks, continued to rise. However, he watched for early cracks, like when those leaders began underperforming the broader market or when volume patterns signaled distribution rather than accumulation. When leadership broke down, he reduced exposure gradually, moving from aggressive long positions to a balanced stance, and only then to outright bearish trades when weakness spread across the board.

What is crucial about risk management is that in speculative phases, timing is not about guessing the exact turning point. It is about recognizing when the odds have shifted. Today, that means paying close attention to mega-cap stocks that dominate passive index flows and monitoring speculative hot spots like meme stocks, small caps, and high-beta sectors.

In the current market environment, a disciplined, rules-based approach is necessary. Here are practical tactics you can use now:

- Monitor Leadership Daily: Track the performance of the top 10 S&P 500 stocks relative to the equal-weight S&P. Weakness in leaders is often the first warning sign before broader declines.

- Watch Breadth Indicators: Use advance/decline lines and percentage of stocks above their 50-day moving average to gauge internal health. Narrowing breadth while the index rises signals fragility.

- Scale Exposure Gradually: Avoid going from fully invested to entirely in cash in one move. Reduce position sizes incrementally as signals deteriorate.

- Set Predefined Exit Rules: Use technical levels, trailing stops, or volatility triggers to exit positions without hesitation. Do not wait for confirmation from the news cycle; the market moves first.

- Limit Meme Stock Trading to Speculative Capital: Allocate only a small portion of your portfolio to high-risk trades. Treat them as tactical opportunities, not core holdings.

- Avoid Excessive Leverage: High leverage can magnify small market moves into portfolio-damaging losses. Keep margin use conservative, especially when volatility is suppressed.

- Maintain Liquidity: Hold cash reserves to take advantage of dislocations when sentiment flips. Liquidity is an asset in itself during corrections.

- Track Passive Flow Data: Watch ETF flow reports to spot shifts in passive buying. A slowdown or reversal in passive flows can be a key turning point.

- Diversify Outside Mega-Caps: Include mid-caps, value sectors, and international exposure to avoid overreliance on passive index concentration leaders.

- Stay Process-Oriented, Not Emotion-Oriented: Follow your risk management rules regardless of social media sentiment or hype cycles. In speculative markets, discipline is your only defense against emotional decision-making.

Livermore’s legacy is not about being a legendary market timer, it is about being a disciplined trend follower who adapts to changing conditions. In a market shaped by meme stock trading, speculative retail trading, and passive index concentration, the principles are the same: ride the trend while it works, identify the cracks early, and adjust before the herd sees the danger.