SoFi stock falls after announcing $1.5B public offering of common stock

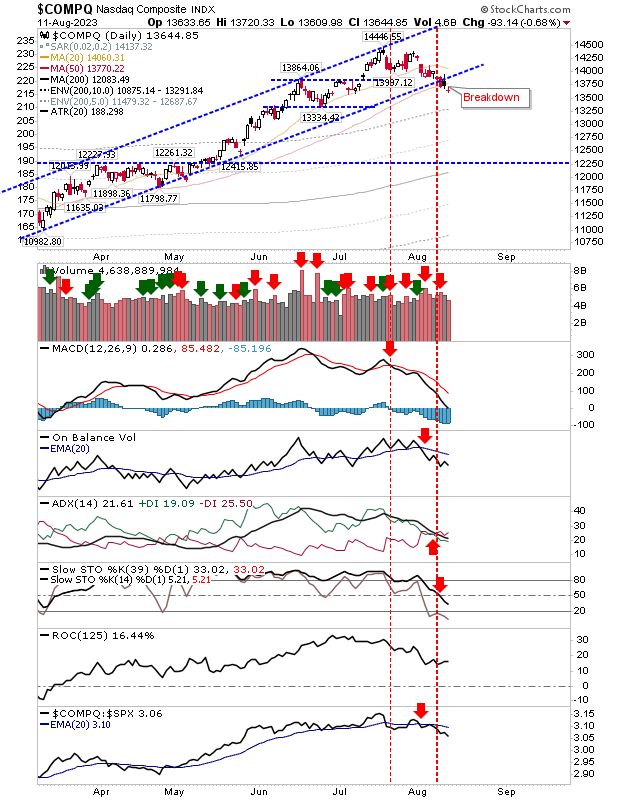

Market weakness continued to strike the market, but selling volume remained light. The Nasdaq moved further away from support, all but confirming the channel break. But, it dropped below its 50-day MA.

Technicals are net negative, but intermediate-length stochastics have some way to go before becoming oversold. While the losses are quite orderly, they could continue for several days, if not weeks.

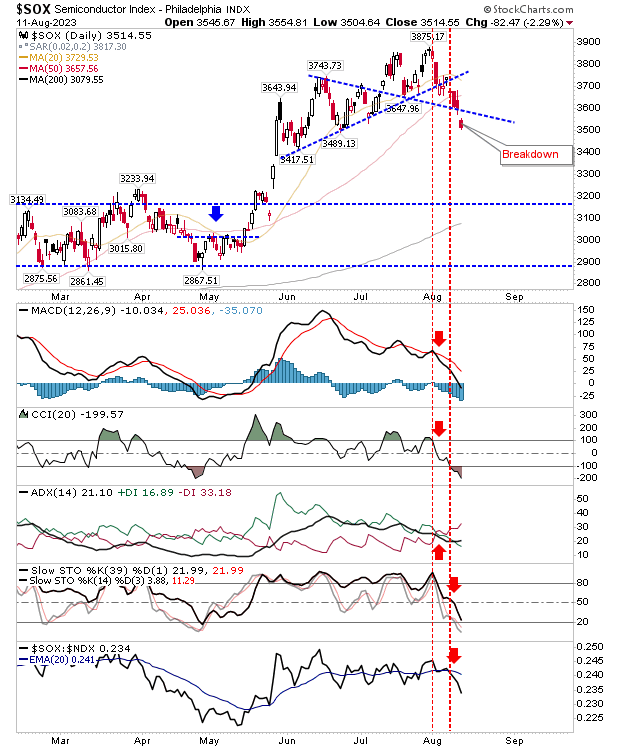

The Semiconductor Index is the problem child. After pushing the breakout from the consolidation, it has since drifted back to the apex, cut below the 50-day MA, and given up support of consolidation resistance-turned-support, which has turned into resistance yet again.

The problem is that while support could reappear at 3,400, it's really the 200-day MA. When it converges with 3,200, we will likely see demand return. Until then, expect further losses.

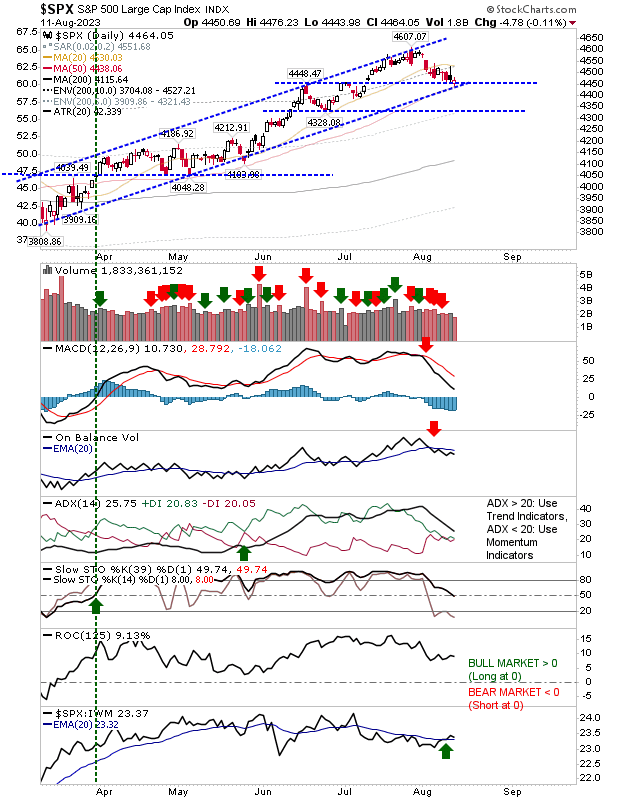

The S&P 500 is now down at channel support, which has also converged with the June peak at 4,450. Intermediate-term stochastics are also at an interesting juncture, finishing the week at bull market support (the midline).

While markets are in a weakening trend, I would expect some form of bounce here, even if temporary.

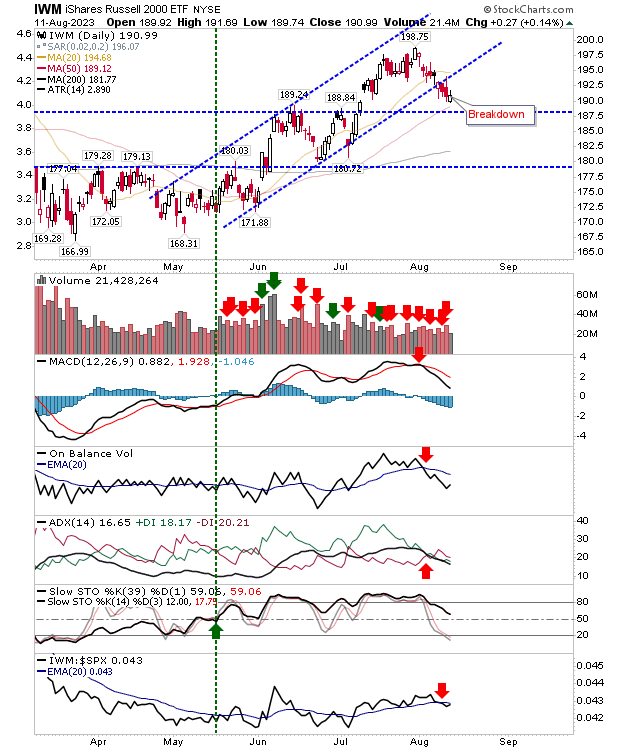

The Russell 2000 (IWM) has its own support level to work with as it fast approaches its 50-day MA, which is just above the June swing peak.

Intermediate-term stochastics is above the mid-line, and as long as this continues, small caps remain bullish.

Trading volumes are still light, so it's hard to get too excited about any breakout or breakdown. Aside from Semiconductors, losses have been relatively orderly. I don't expect this to change unless there is a pick-up in volume.