ServiceNow nears deal to acquire Veza for at least $1 bln - The Information

Seller remorse after a weekend of retrospection might have accounted for some of yesterday's buying, and while bullish haramis left in indexes might offer reversal opportunities, overhead supply at moving averages will likely prove problematic.

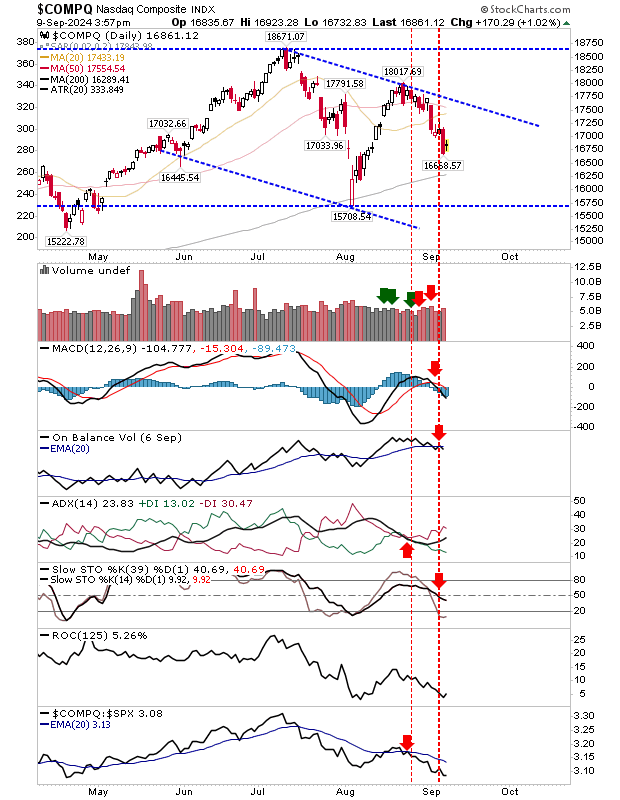

The Nasdaq finished with a bullish harami cross, a more reliable (bullish) reversal candlestick than a standard bullish harami.

The index is close to its 200-day MA, although any hit of this would likely lead to failure given the recency of the last test.

Ideally, it won't get there, and Friday's lows around 16,650s will be enough to act as support and kickstart a new sequence of higher lows.

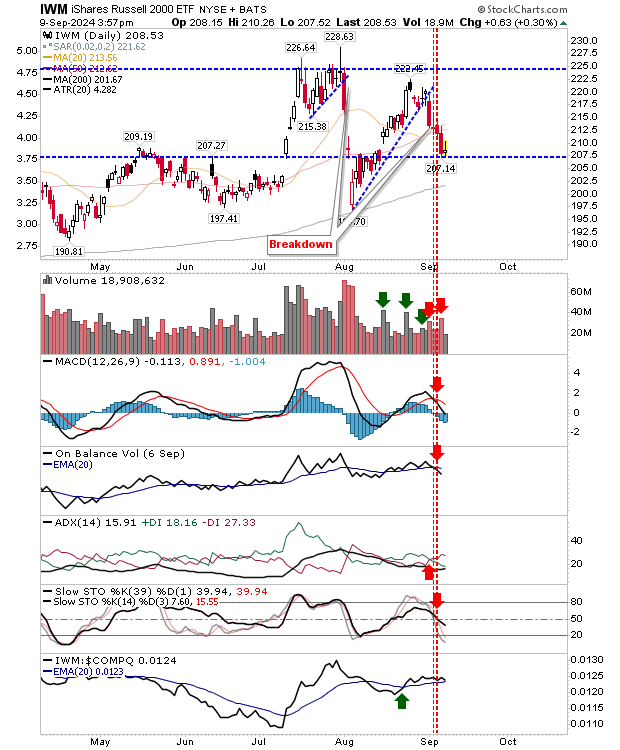

The Russell 2000 (IWM) dug in at $207.50 support, established in part by May swing highs. I'm not sure it's a strong level, particularly as it played a little defensive role during the test of the 200-day MA in August.

Yesterday's buying was low on volume and didn't change the net technical picture. From a trade perspective, a close (intraday violation okay) of $207 would see a move to the 200-day MA and likely lower.

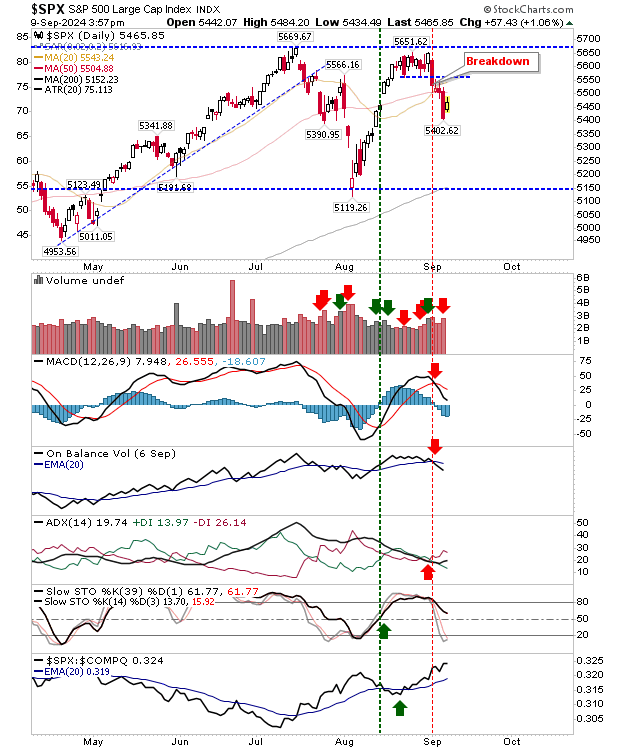

The S&P 500 gapped higher at the open and gained further ground during the trading day.

However, it's a long way from the August swing low or 200-day MA, although has the benefit of bullish Stochastics and is a relative performance leader.

The risk:reward is not as attractive in the short term and has merit if it can get back to challenging 5,650s.

Bullish haramis are good reversals, but for them to come into play they typically require opening gaps higher. Certainly, yesterday's lows can't be violated. Watch pre-market for leads.