Futures slip, bank earnings ahead, Powell to speak - what’s moving markets

Universities and mainstream economic courses teach us that governments need money to fund their spending, Central Banks have the authority to print money we use, and commercial banks lend and multiply customers’ money in a fractional reserve banking system.

That’s literally all wrong.

- Our monetary and credit system envisages two distinct tiers of money: real-economy money and financial-sector money.

- Governments (via deficits) and commercial banks (via lending) have the ability to print real-economy money.

- Central Banks have the ability to only print financial-sector money (also known as bank reserves, created mostly via QE).

Real-Economy Money Printing - Bank Lending

Real-economy money is the one used by non-financial private sector agents (e.g. households, corporates) to make transactions tha contribute to economic activity.

The more real-economy money out there, ceteris paribus the more likely economic growth will be stronger.

Also, a rapid increase in real-economy money at a time when the supply of goods and services can’t keep up will most likely generate strong inflationary pressures.

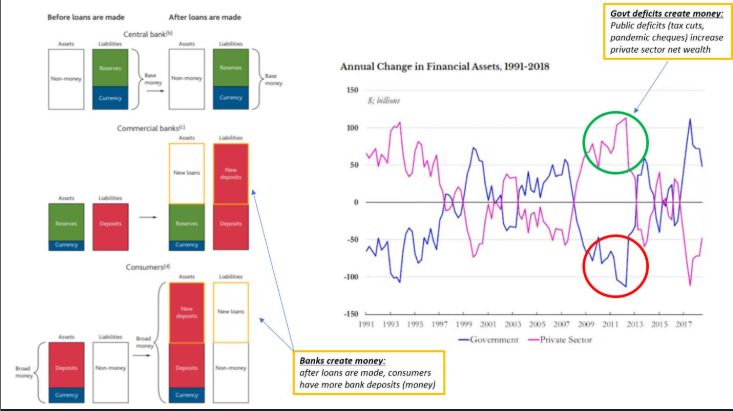

Every time commercial banks make a loan, new real-economy money is created. Banks don’t lend reserves or existing deposits: as the Bank of England itself shows, when making new loans banks expand their balance sheet and literally credit your account out of nowhere. By doing so, they create new deposits for the non-financial private sector (e.g. people).

Real-Economy Money Printing - Government Deficits

If the government spends more than it plans to collect taxes for (deficits), in most cases new real-economy money has been created. Government deficit spending increases the net worth of the private sector…without adding a liability to it!

The chart below shows you how this process works.

Financial-Sector Money Printing - QE

Financial-Sector Money Printing - QE

Central Banks can increase or decrease the amount of financial-sector money.

Via QE and other monetary policy operations, Central Banks print bank reserves - you can think of them as money for banks.

QE only prints financial-sector money which banks can use to transact with each others. Nearly zero direct impact on inflation!

Conclusions

- Central Banks print financial-sector money.

Governments and commercial banks print real-economy money.

Understanding money is crucial to become a better macro investor.

Agree or disagree?