China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

- US indexes are entering correction territory as a flurry of bad news rattles global markets.

- As fear spreads, many are running for the hills.

- However, savvy investors may view this as a chance to shed overvalued stocks and acquire high-value opportunities with significant upside potential.

- For less than $8 a month, InvestingPro's Fair Value toll helps you find which stocks to hold and which to dump at the click of a button.

Recessions and market corrections seldom happen in the same way: first slowly, then all at once.

While the jury may still be out on both, global traders were surprised to wake up this morning to a flurry of bad news, pushing Japan's Nikkei index to its biggest one-day crash in 40 years, while the Nasdaq traded 4% lower in the premarket at the time of writing.

Among the various catalysts converging simultaneously, a rate hike from the Bank of Japan has joined growing fears of a US recession, sparked by Friday's sub-par jobs report. And, if that wasn't enough, Warren Buffett's Berkshire Hathaway (NYSE:BRKa) disclosed that it sold massive amounts of stock in Q2, prompting trades to flee household names such as Apple (NASDAQ:AAPL) and Bank of America (NYSE:BAC).

But as the thriving 2024 market hits a pivotal point, the question that lies ahead is what to do now.

While the first human reaction is to drop everything and run for the hills, savvy investors know that profits and emotions don't go hand in hand.

In fact, market corrections (and even market crashes) are normal and can —if you position yourself well—prove to be great opportunities.

And how do you do that? Simple - By running away from overvalued stocks, which present a high risk, and positioning your portfolio on high-value plays that still have room to grow.

Only by knowing the true value of the stocks you own can you succeed in the long-term game.

I know what you're thinking at this point: "Yeah, but that's easier said than done..."

Well, not anymore.

InvestingPro's flagship FairValue tool provides a streamlined view of the true value of every stock in the market, so you don't blindly hold on to stocks beyond their prime, nor miss out on great buying opportunities when they arise.

InvestingPro's exclusive Fair Value indicator leverages 17+ valuation models to analyze a company's financial data and cash flow, providing a target price for each stock.

This makes it easier for investors to assess the potential value of a stock without needing extensive financial expertise. By aggregating and interpreting complex data, InvestingPro helps investors make more informed decisions.

And the best part? It only costs you less than $8 a month if you subscribe today as part of our exclusive summer sale.

Now let's take a look at two of such stocks to understand how Fair Value works and why you should avoid them.

Already a Pro user? Then see the full list of the most undervalued stocks and overvalued stocks on InvestingPro.

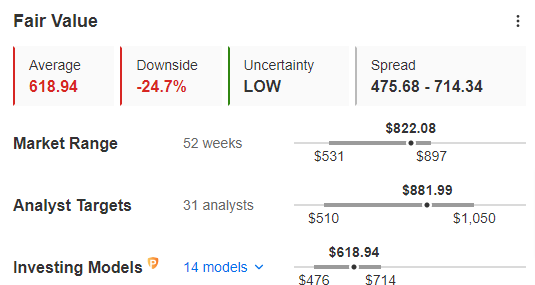

1. Costco – 24.7% Downside in the Offing

Costco (NASDAQ:COST) has significantly outperformed the broader market this year, with its stock rising 24.7%, compared to the retail sector’s (NYSE:XRT) modest 2.43% gain.

With the market selling off and earnings not keeping up with the stock's growth, this is exactly the kind of name investors should avoid as the retail giant’s gains might be at risk.

According to InvestingPro's fair value tool, Costco's stock could lose all its 2024 gains, signaling a potential downside of 24.7%.

Source: InvestingPro

This isn't the only stock facing downside risks according to the fair value tool. One of our previous articles (link to the piece) highlighted two other stocks that, once flagged by the indicator, eventually suffered losses exceeding 35%.

Those unaware of these warnings were caught off guard.

Now, this isn’t the only stock with a significant downside risk.

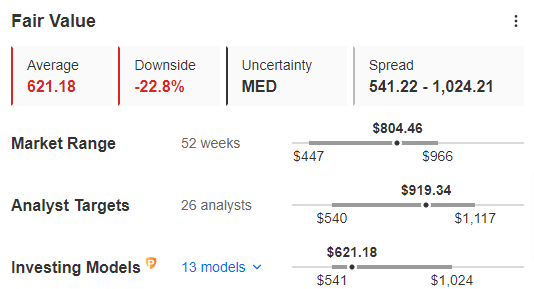

2. Eli Lilly - Ripe for a 22.8% Correction?

Eli Lilly's (NYSE:LLY) stock has been on a roll so far this year, posting some tremendous gains of about 39% YTD.

But as the bulls run for the exits and market correction deepens, would it be wise to hold on to the stock that’s sitting on these amazing gains?

Well, we can look to smart tools like fair value for the answer.

Source: InvestingPro

Right now, the fair value tool signals that the stock is ripe for a correction, and at risk of losing more than half of its gains this year.

And we would also have to factor in the fact that the stock has seen a meteoric rise of about 345%+ since January 2021.

This makes the case for locking in profits on this stock even stronger.

Those who subscribe to InvestingPro can harness the power of the fair value tool to pick the right time to exit a stock, especially when the broader market is selling off.

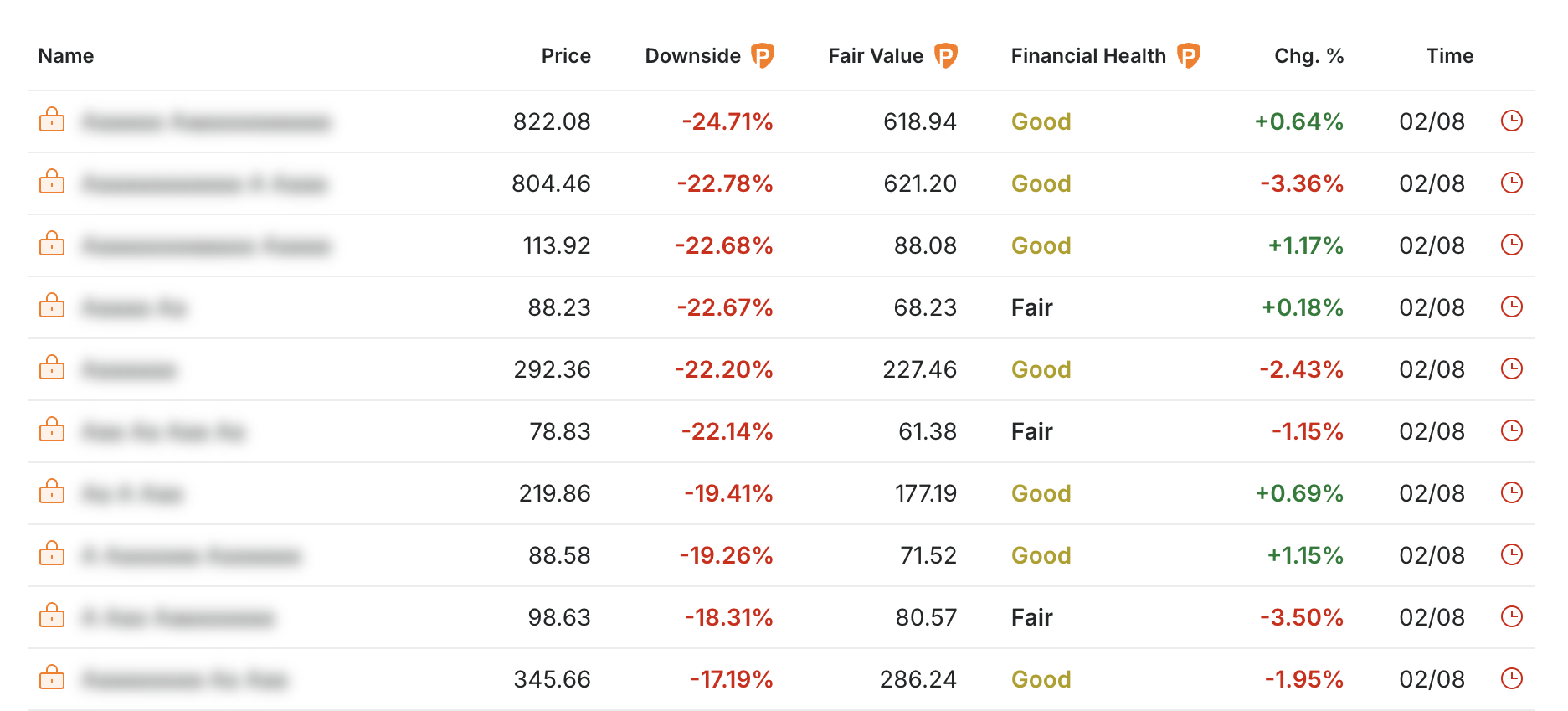

Bottom Line: Other Stocks Vulnerable to a Selloff

Eli Lilly and Costco aren’t the only stocks vulnerable to a selloff, according to fair value.

Here’s the list of stocks alongside their downsides as indicated by the tool:

Source: InvestingPro

The top two in this list were the stocks discussed in the article above, Eli Lilly, and Costco.

The 8 other stocks mentioned in the list are showing a downside risk as well.

Already a Pro user? Subscribe to InvestingPro today to see the full list of overvalued stocks.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.