Berkshire Hathaway reveals $4.3 billion stake in Alphabet, cuts Apple

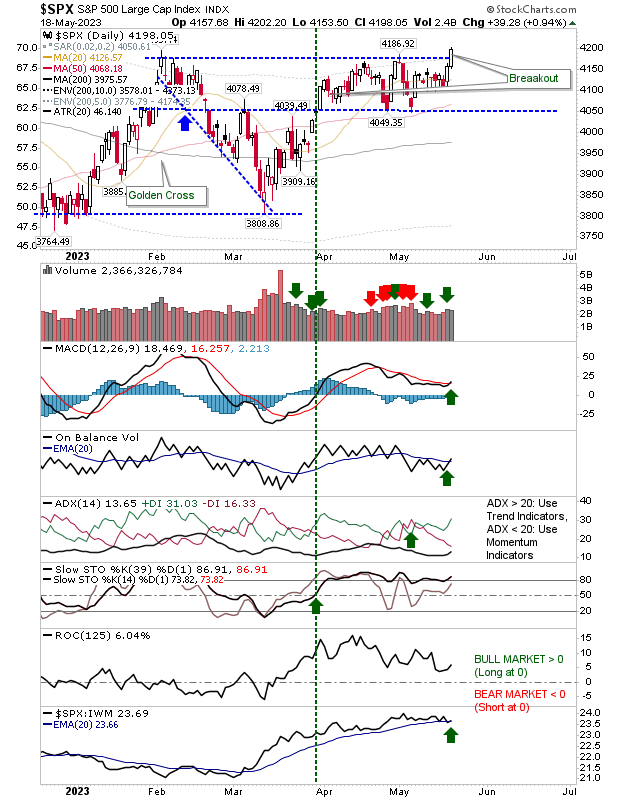

If you missed the morning or were waiting for confirmation, well the S&P 500 delivered a solid breakout yesterday, albeit on modest volume. The development came with a MACD trigger 'buy' and On-Balance-Volume 'buy' signal, leaving technicals net bullish.

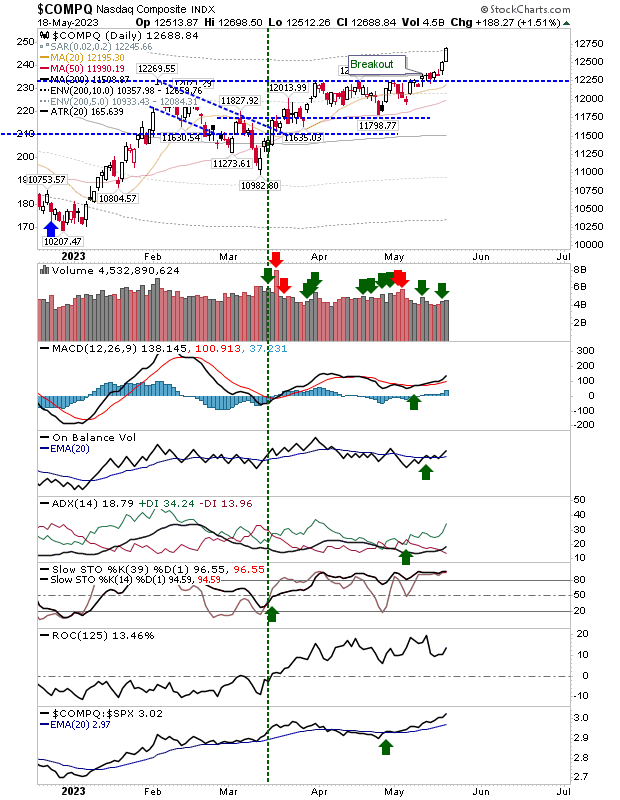

The NASDAQ Composite added to its breakout with another decent white candlestick on a 1.5% gain. This added to the technical strength of the index. The only disappointment was the generally light buying volume.

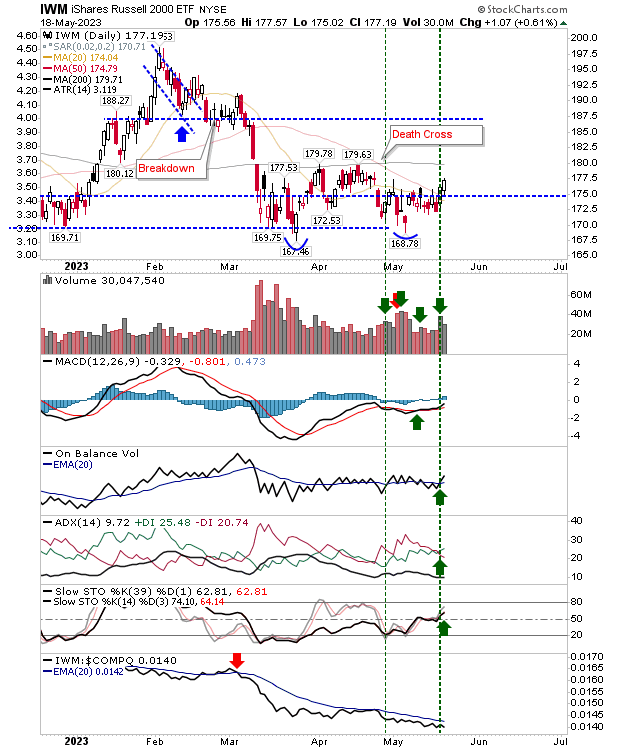

The Russell 2000 ($IWM) built on Wednesday's breach of its 50-day MA. There is still lots of work to do before the index clears $180 and begins a right-hand base. Technicals are net bullish although the index is still underpeforming relative to the Nasdaq and S&P.

The coming days will be about consolidation when sellers return. We have a solid breakout in the S&P 500, a consolidated breakout in the Nasdaq, and a bullish cross of the 50-day MA for the Russell 2000. All of these point to a positive few weeks (and months) ahead. Getting back to 2021 highs seems reasonable from here.