Hedge funds are buying these two big tech stocks while selling two rivals

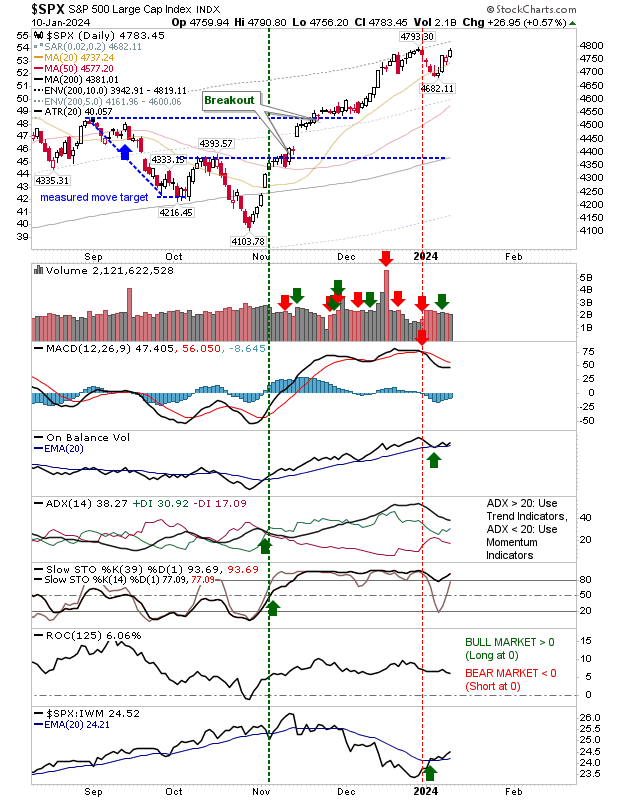

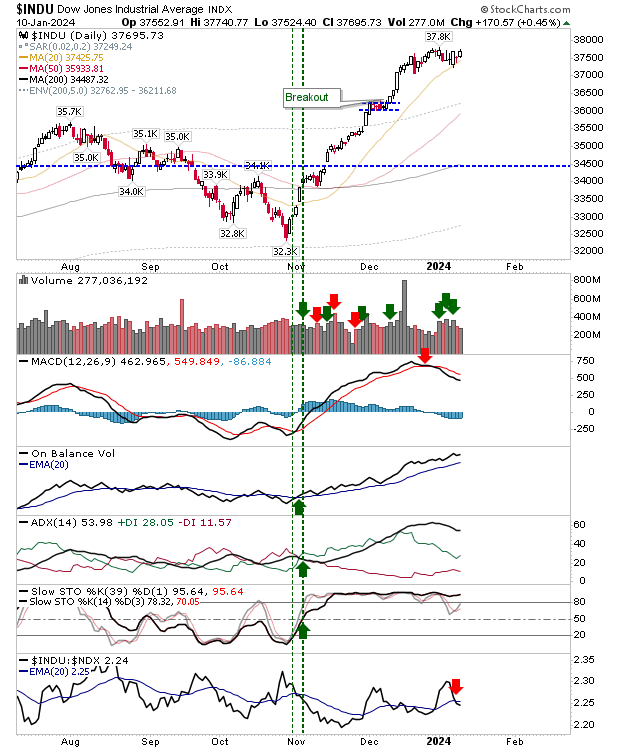

A bit of a mixed bag for indexes. Large caps had the best of the action as the S&P 500 and Dow Jones Industrial approached all-time highs.

Buying volume for Large Caps indexes didn't count as accumulation, but these indexes are outperforming their peers.

The Dow Jones Index is running a tight consolidation after its extensive gains. Only the MACD is on a 'sell' trigger, but the indicator is well above the bullish zero line.

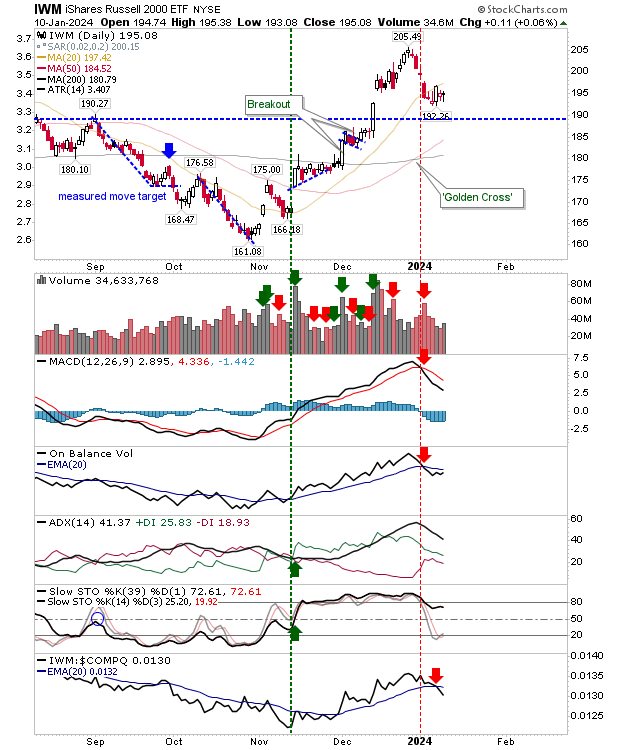

The Russell 2000 (IWM) finished with a doji, a doji that neatly fitted inside the prior day's candlestick, which itself formed part of a bullish harami.

This is a strong bullish signal. Volume rose in confirmed accumulation, although technicals are more bearish with 'sell' triggers in the MACD and On-Balance-Volume.

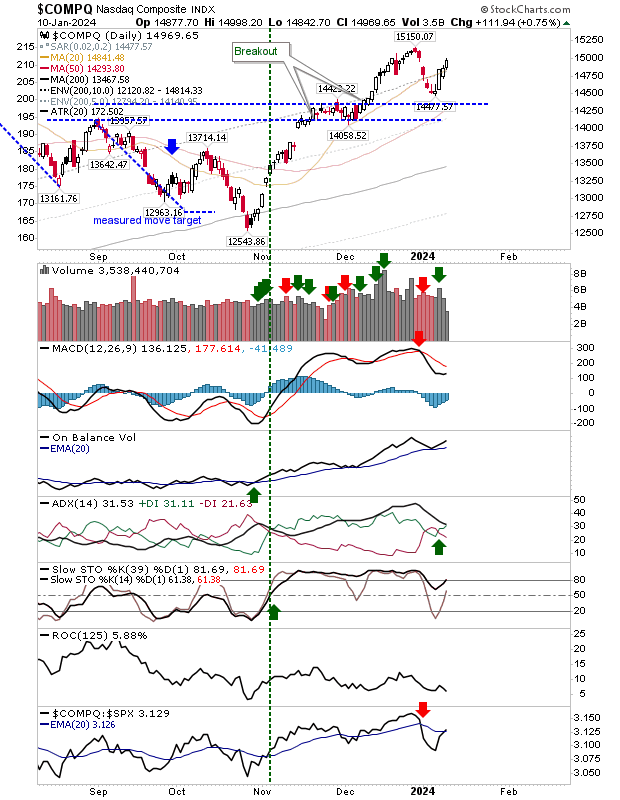

The Nasdaq has almost closed the initial breakdown gap that marked the start of the holiday selling. Gaps tend to act as support or resistance and if this remains true then there should be selling on the closure of the gap.

Today, there is the potential bullishness of the Russell 2000, offset by the potential bearishness of the Nasdaq.

If the Russell 2000 can lead out - the most likely index to initiate a move - then the opportunity for sellers to make a stand in the Nasdaq is reduced.

Large Caps are at resistance, but at a point where breakouts look more likely, adding more weight to the bullish picture.