ION expands ETF trading capabilities with Tradeweb integration

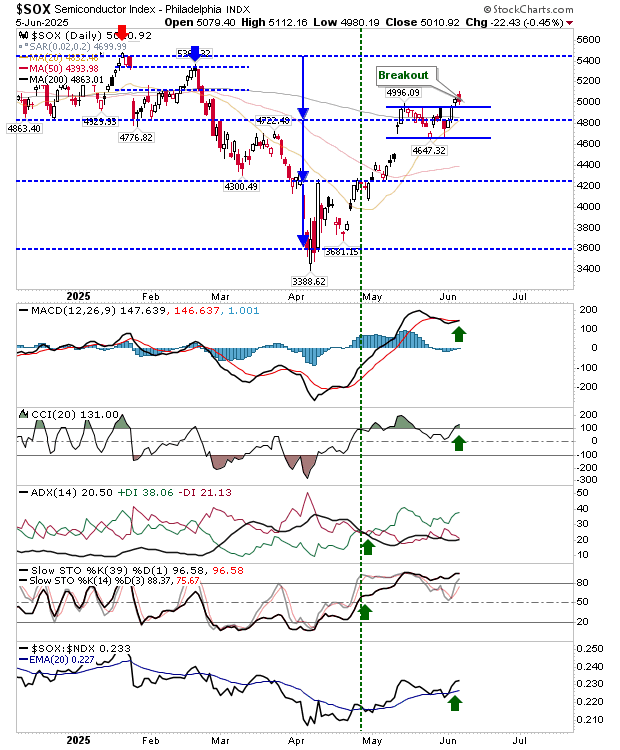

Indices are still holding to their (pending) breakout, although the Semiconductor Index is playing the primary lead as it keeps its head above water on net bullish technicals.

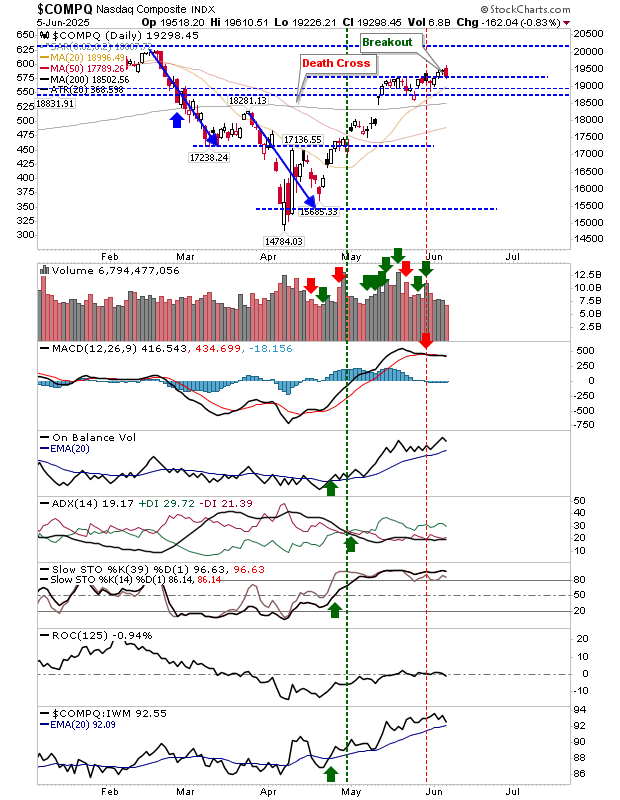

The Nasdaq had registered a breakout, but Thursday’s losses (on light volume) took it back to breakout support.

The breakout hasn’t been violated - yet - but another day’s loss will kill it and leave a ’bull trap’. Unlike the S&P 500, technicals are not yet net positive.

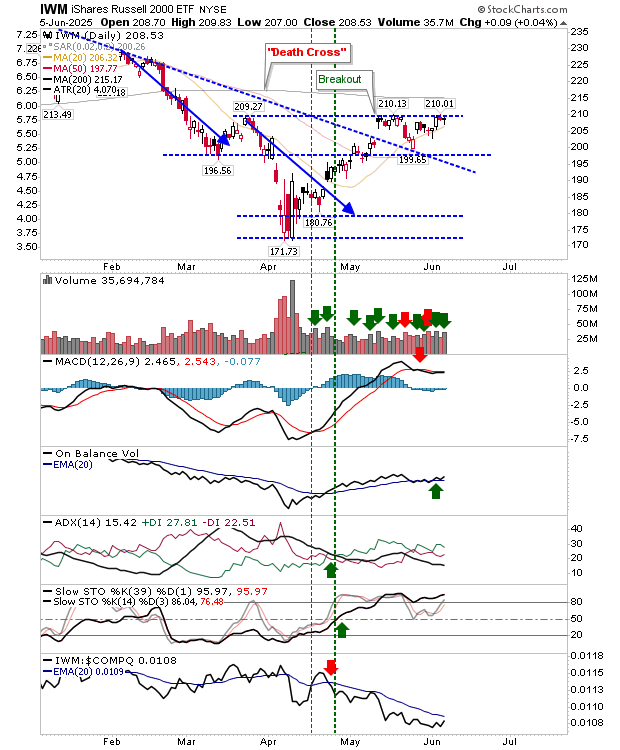

The Russell 2000 (IWM) continues to trade below breakout levels, but is knocking on the door of higher prices.

It registered a higher volume accumulation day, but it hasn’t yet fulfilled a new ’buy’ trigger in the MACD, but is close to outperforming the Nasdaq.

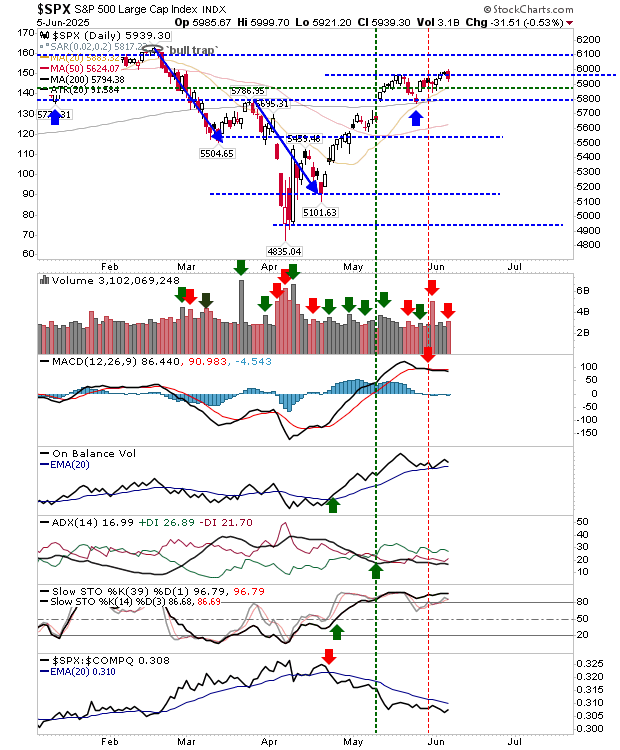

The S&P 500 started the day above its breakout level, but ended the day below it. Watch for a test of the 20-day MA where buyers can be expected to step in. It, too, is waiting for a new ’buy’ trigger in the MACD.

So, heading into today’s session, we remain in much the same predicament we have seen the past few days; waiting for a substantial breakout to clear the consolidation.