Wall St futures flat amid US-China trade jitters; bank earnings in focus

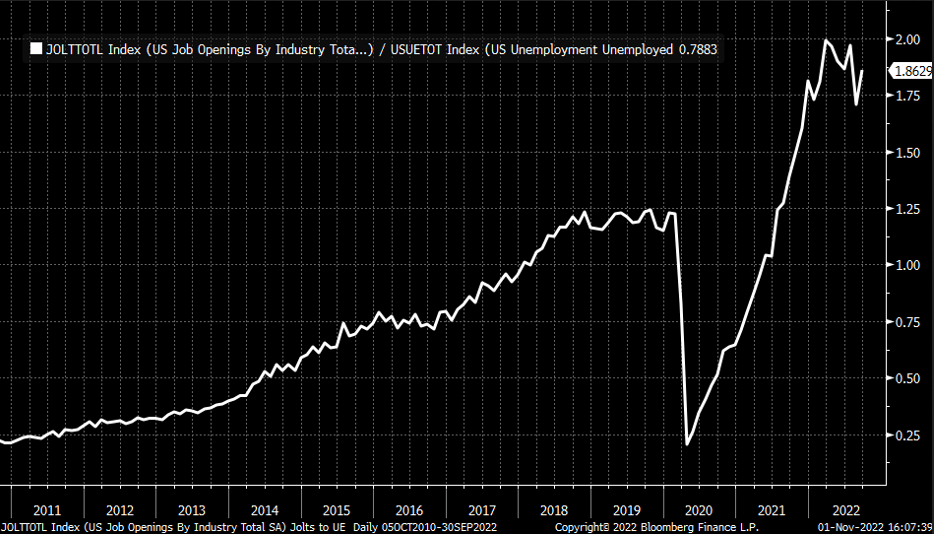

The S&P 500 finished lower by 30 bps, despite rising by more than 1% at the open yesterday. The market fell after the hotter-than-expected JOLTS data showed 10.7 million job openings versus a forecast for 9.7 million. The data also sent rates and the dollar higher. The Fed references the JOLTS data a lot, especially when it comes to the number of Job openings to the number of unemployed people.

That ratio rose back to 1.9, which is going in the undesired direction of the Fed. Pre-pandemic, that value was just 1.25%. Based on the Jolts to Unemployed ratio, there has been very little, if any progress.

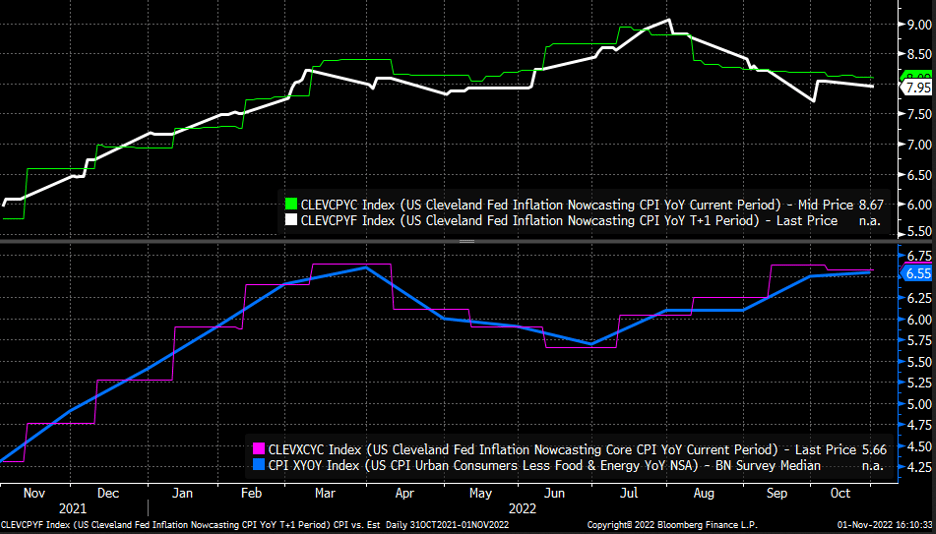

Meanwhile, according to the latest estimates from the Cleveland Fed, October is expected to see CPI rise 8.1% and core rise 6.5%. It won’t improve in November, with CPI rising by 8% and core rising by 6.6%. So very little progress is being made on inflation.

Despite very little progress on inflation and jobs, the equity market thinks the Fed will show its hand and tell the market it will slow the rate hikes so that stocks can rise and financial conditions can ease. Seems unlikely to me. The Fed Fund Futures, seem to think the terminal rate is going higher from here. Yesterday, futures saw the overnight rate over 5% through July of 2023. That is higher than where they were on October 20, the day before the WSJ article piece dropped.

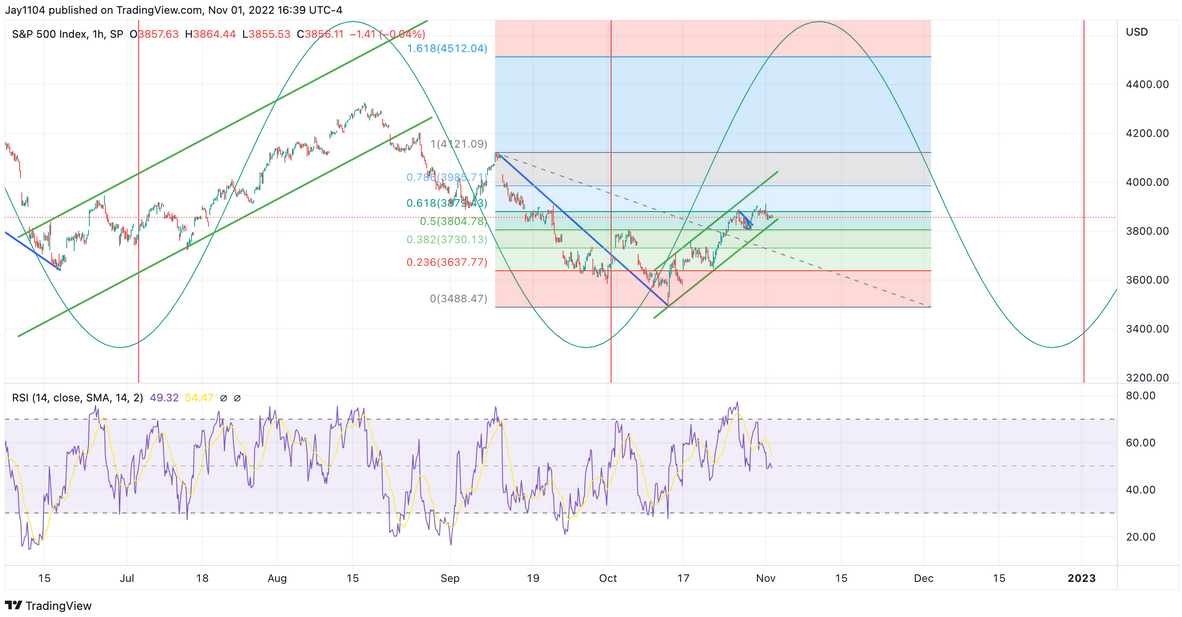

S&P 500

Stocks tried to break out yesterday but failed, and I view that negatively. Additionally, the S&P 500 has retraced 61.8% of the drop starting September 12. So if the index stopped rising here, it would not surprise me. The index tried to break out of that bull flag yesterday and failed, and the longer-term trends have been bearish this whole time. If rates are going to rise and the dollar is too strengthen, then it just isn’t good for stocks.

AMD

I’m not sure why Advanced Micro Devices (NASDAQ:AMD) didn't fall further yesterday. The company gave disappointing guidance. Gross margin guidance was a miss; revenue guidance missed by a lot at the mid-point of the range. A clear bear flag has formed in the chart, and should it fall below the uptrend; the stock probably has a long way to fall.

Qualcomm

It has been a long time, but Qualcomm (NASDAQ:QCOM) never did fill the gap at $92 from the summer of 2020. Maybe it will soon get that chance. The RSI in Qualcomm is very bearish, with that long steep downtrend. Not looking good, in my opinion, for where this one is heading.