Bubble or no bubble, this is the best stock for AI exposure: analyst

Yesterday was a very dull day overall in markets. The S&P 500 attempted to rally but couldn’t maintain its gains, finishing up just nine basis points. Both the S&P 500 and NASDAQ 100 futures show classic rising wedge patterns accompanied by declining volume.

However, after two previous patterns suggested an imminent reversal, as previously noted, the market has merely consolidated sideways so far.

In the NASDAQ 100 futures, the pattern is clearer when using closing prices, particularly alongside declining volumes. Typically, a rising wedge (also known as an ending diagonal triangle) is considered a reversal pattern, suggesting a break lower. This doesn’t guarantee a downward move, but that’s what the odds currently favor.

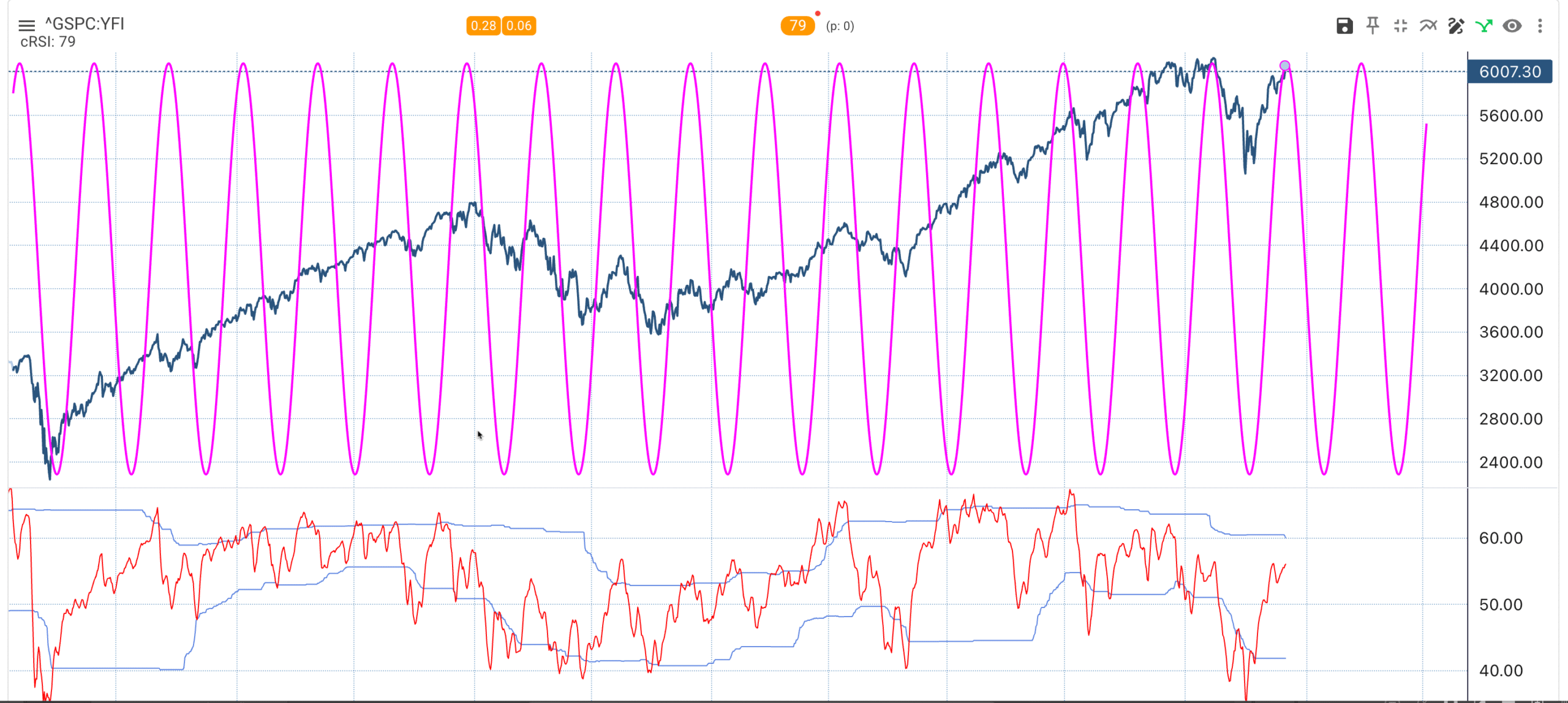

From another perspective, the 79-day cycle is nearing completion. Historically, this cycle has been reliable in terms of timing, suggesting that the index may also be approaching a turning point.

(Cycles.org)

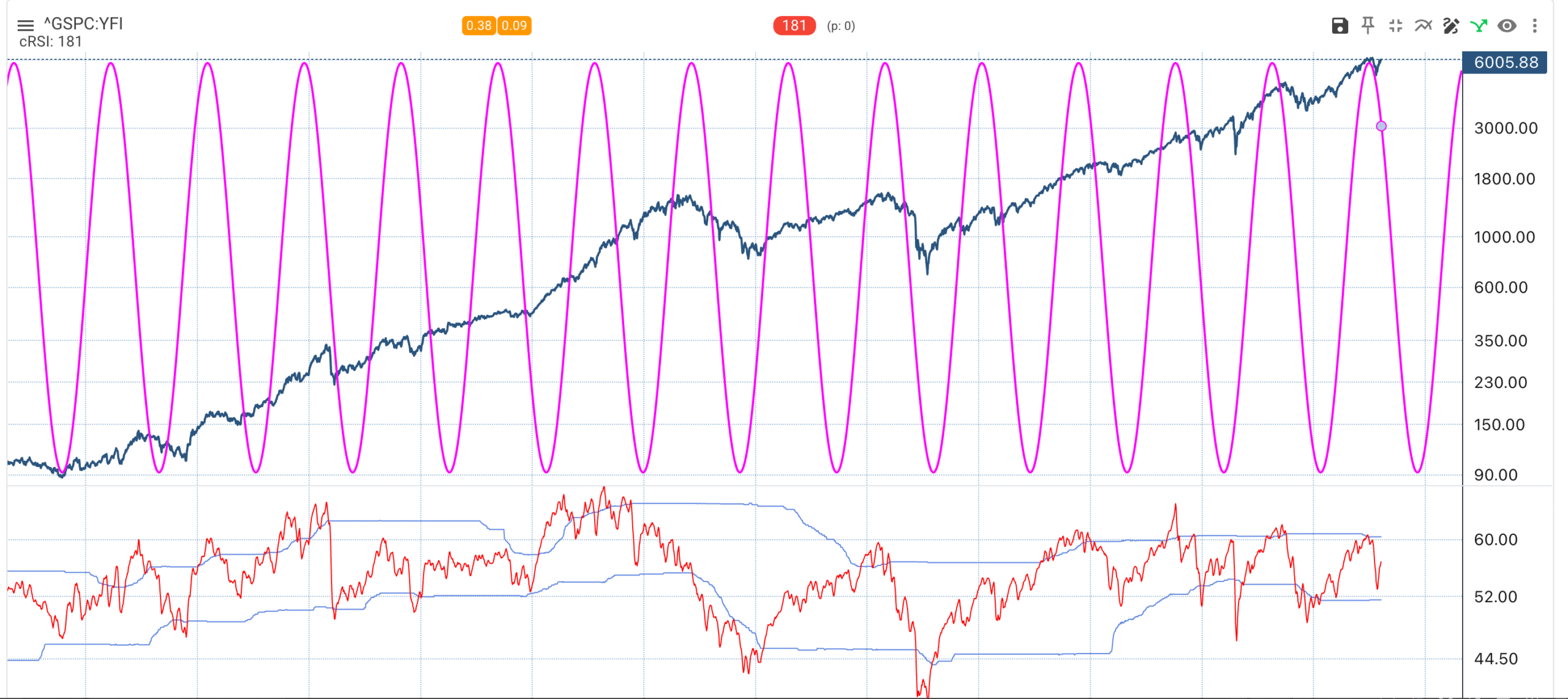

Meanwhile, the longer-term 180-week cycle, which remains the dominant cycle, is still firmly in a downtrend and is not projected to complete until October 2026. The previous cycle peaked in August 2021 and was originally scheduled to bottom in March 2023, but the market actually peaked six months later (January 2022) and bottomed six months earlier (October 2022).

Given this, it’s possible the current cycle could end earlier than expected. However, I’d be surprised if it had already concluded, suggesting either another move lower or an extended period of sideways price action.

(Cycles.org)