Raymond James raises Fulgent Genetics stock price target to $36 on strong performance

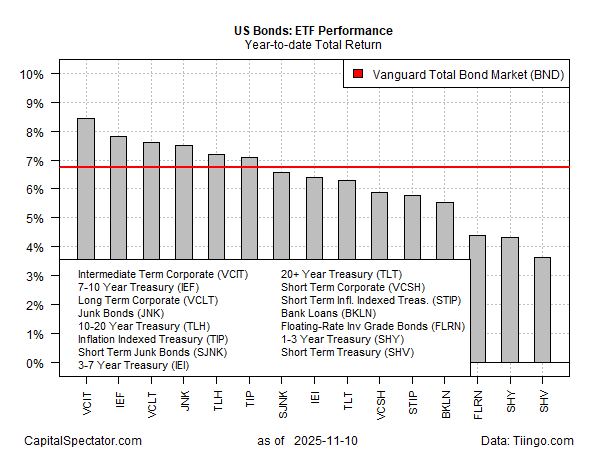

The Wall Street maxim that markets climb a wall of worry seems to apply to the bond market this year. Despite a range of concerns, including tariff-related inflation to government debt, fixed-income securities are posting strong year-to-date gains through Monday’s close (Oct. 10), based on a set of ETFs.

Leading 2025’s rally: intermediate-term corporates. The Vanguard Intermediate Term Corporate ETF (NASDAQ:VCIT) is up 8.5% so far this year. The fund is on track to report its third straight annual gain, improving on 2024’s 3.2% increase by a wide margin.

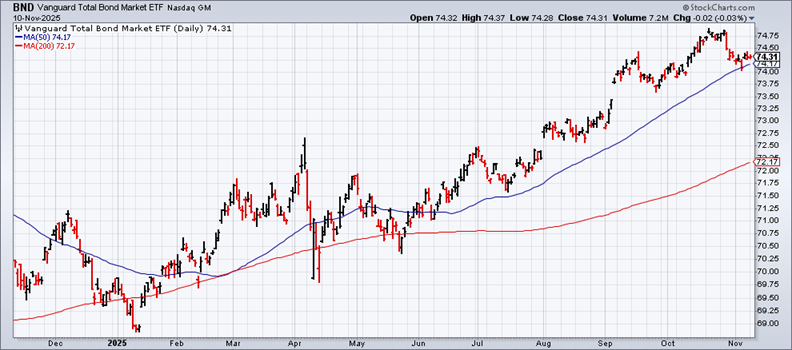

Notably, all the major categories of US fixed income are posting year-to-date gains at the moment. The investment-grade benchmark fund – Vanguard Total Bond Market (NASDAQ:BND) – has rallied 6.7% year to date. The current 2025 rally ranks as the strongest calendar year so far for the ETF since 2020.

Cash in the form of short-term Treasuries (SHV), not surprisingly, is the laggard, posting a 3.6% total return this year.

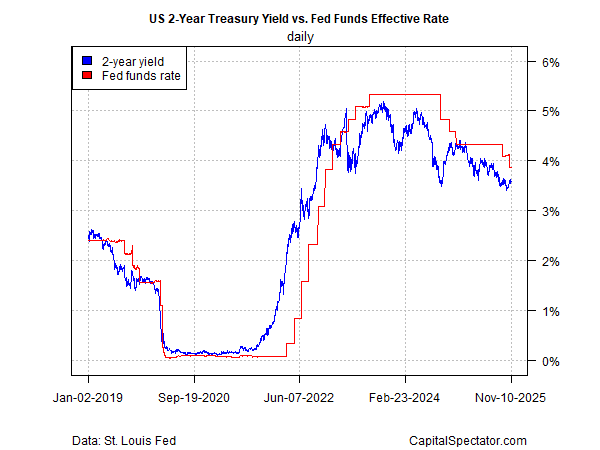

Fueling the bond market’s gains recently: Ongoing confidence that the Federal Reserve will continue to cut interest rates, a policy decision that tends to boost purchases of fixed-income securities to lock in relatively higher yields. Concerns about slowing economic growth remain front and center. The Fed has cut rates twice this year, in September and October, and markets are betting that a third cut is on tap for the next FOMC announcement on Dec. 10.

Fed Chairman Powell recently raised some doubts about a third cut. Speaking at the Oct. 30 policy meeting, he said: “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

The Fed funds futures market, however, continues to price in moderately favorable odds for another round of policy easing next month.

Sentiment in the Treasury market is also reflecting a bias for additional easing, based on the policy-sensitive 2-year yield, which continues to trade well below the effective Fed funds rate – an implied forecast of more easing.

Leading the doves at the Fed is recently appointed Governor Stephen Miran, who on Monday reaffirmed his preference for ongoing cuts, advocating for a ½-point reduction. Speaking on CNBC on Monday, he said: “Nothing is certain. We could get data that would make me change my mind between now and then [Dec. 10].

But failing new information that’s made me update my forecasts, looking out in time, yeah, I would think that 50 [basis points cut] is appropriate, as I have in the past, but at a minimum 25 [basis points cut].”