Street Calls of the Week

- Glencore has asset quality and diversification like no other

- These strengths mean it will outperform competitors

- But stock still trades at a discount to peers

Glencore's (LON:GLEN) (OTC:GLNCY) Q3 production results confirm that it is unlike any other commodity trading and mining giant out there.

The Swiss-based commodity trader and mining giant's asset quality and product diversification are vastly better than its peers which will be crucial over the medium and long term due to the ongoing energy crisis.

The energy transition also offers a strong tailwind thanks to Glencore’s exposure to copper, nickel, and lithium. Trading at 2.3x 2024 expected EBITDA, there is still an opportunity to buy into this high-quality growth asset.

Tesla, Musk and the Global Auto Industry

The FT recently reported that Tesla (NASDAQ:TSLA) and Glencore were in talks to discuss the auto company taking a 10% to 20% stake in the mining giant. This came following calls from Tesla CEO Elon Musk that "[Tesla] might actually have to get into refining and mining directly at scale unless costs improve." The prices for nickel, cobalt, and lithium (i.e. the battery metals) have risen exponentially since early 2021, imposing a serious challenge on electric car producers (and soon, all car producers). The deal fell through because of the environmental impact of Glencore's coal business or, more likely, because costs had begun to decrease as the economy deflates.

Russia’s invasion of Ukraine led to a serious shake up in global metals markets, with Russia-based Norilsk Nickel—among the world’s largest nickel miners—facing heavy sanctions. This was good news for competitors such as Glencore, which has taken over much of the Russian miner’s business. The fact remains that demand for these metals is very strong, and will only continue to grow, and Glencore is well positioned to produce much of the supply, especially with Nornickel out of the picture in the medium term.

Q3 Production Results

Glencore’s third quarter fell shy of Wall Street estimates due to unfavorable weather conditions, industrial action, and supply chain issues. The mining giant was thus forced to lower its FY 2022 guidance for all segments with the sole exception of marketing, which continues to prosper.

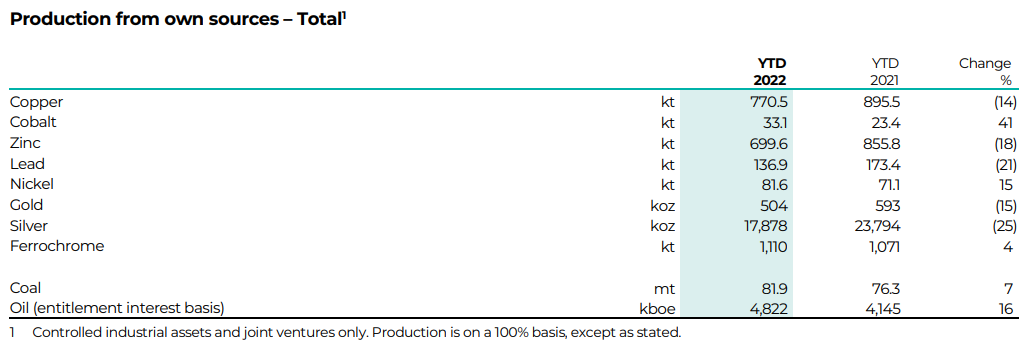

Source: Glencore

Coal production lagged heavily due to supply chain issues and unfavorable weather conditions—results were well under estimates and full year guidance was reduced by—10%. Copper output also disappointed, though the main problems have since been resolved and guidance has not been adjusted. Zinc was downgraded by 6% as a result of logistical limitations which continue to affect production in Australia. Though below the record results achieved during H1, Glencore’s Marketing division continues to outperform and has improved its Marketing guidance with H2 2022 EBIT expected over $1.6 billion (30% above estimates).

The results may seem disappointing when compared to previous quarters of >100% year on year (yoy) EBIT and EBITDA growth, which was obviously unsustainable. The key is that Glencore's production mix is still well-diversified which gives it a great competitive edge.

Asset Diversification

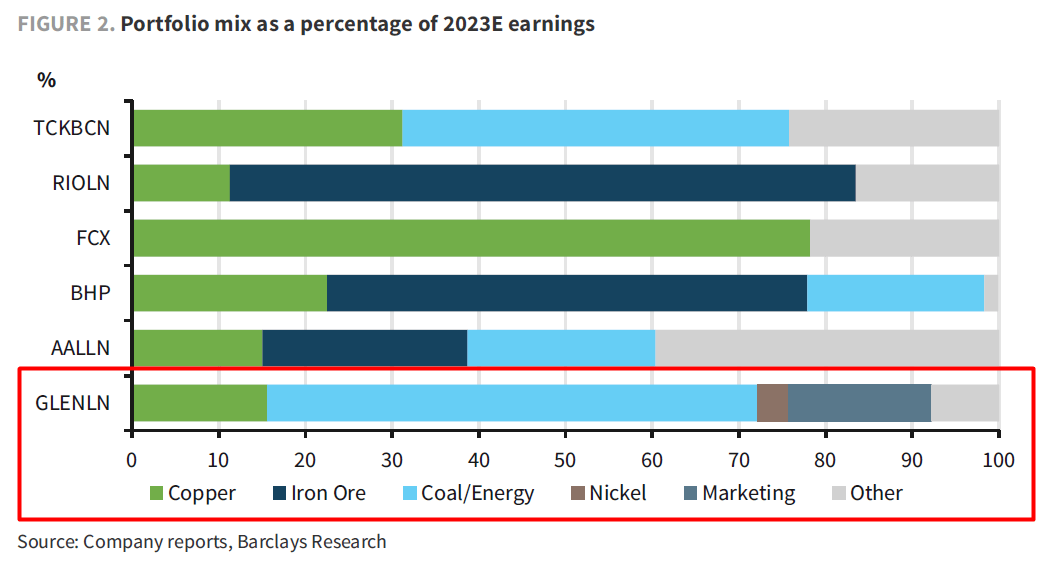

Glencore’s superior portfolio mix makes it a leader within the battery metals segment. Competitors such as Australian BHP (ASX:BHP) and Brazilian Rio Tinto (LON:RIO) are much too centered on iron ore, while Freeport-McMoRan (NYSE:FCX) almost uniquely produces copper.

Glencore's business includes a sizeable portion of mining and marketing of energy resources, particularly coal. Overall, the energy business provides a short-term advantage, while its extensive diversification in metals will help in the long-term.

Marketing also stands out among comps and was the main profit driver in these last quarters. This ties to its roots as trading giant March Rich + Co. The impressive results and guidance in this segment are perhaps the only positive notes from Q3.

Recent Fines and ESG

Investors are paying more attention to ESG, even in the mining sector. At the beginning of the month, Glencore was fined £275 million due to bribery offenses related to its oil activities in West Africa. The news was quite positive as it had allocated a provision of £1.25 billion. More importantly, the Court noted how the company "appears to be a very different corporation than it was at the time of these offenses," proof to investors of Glencore’s steps forward.

Valuation

Glencore's above-industry dividend and buybacks ($3 billion) are well covered by its free cash flow (FCF) generation, given a ∼25% FCF yield. The company also trades at an EV/LTM EBITDA of 3.41x: a discount compared to its peers Rio Tinto and BHP. With a P/NTM EPS of 4.8x, Glencore is reaching an unforeseen low, far beneath the multiple recorded at the height of the pandemic.

Source: CIQ

Like most companies operating in this segment, Glencore doesn’t come without its fair number of risks including a downturn in the volatile commodities market, higher input prices, as well as political and regulatory restrictions.

Given the continued energy crisis and the persistence of the current bull cycle in commodities, Glencore outperforms its competitors in terms of asset quality and diversification and this competitive edge was confirmed in the latest results.

Despite the recent spike in the stock price, at only 2.3x 2024 expected EBITDA, Glencore remains a solid opportunity.

Disclosure: The author does not currently hold a position in Glencore plc. This article is written for informational purposes only. It does not constitute a solicitation, offer, advice, counseling, or an investment recommendation.