Williams Wesley Hastie sells $328k in Cipher Mining shares

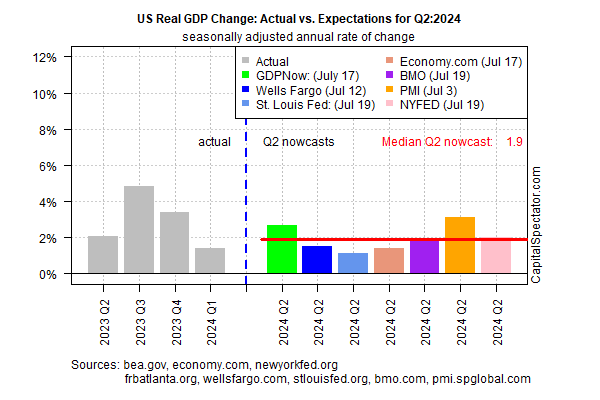

US economic activity is on track to post a modestly firmer growth rate for the second quarter GDP report scheduled for release on Thursday, July 25.

The estimate is based on the median estimate for a set of projections compiled by CapitalSpectator.com. Today’s revised median nowcast indicates output rising 1.9% in Q2, up from Q1’s sluggish 1.4% advance.

Although nowcasts should be viewed cautiously, today’s data suggests that the economy is stabilizing if not strengthening relative to the start of the year. Note that the current nowcast marks a slight improvement vs. last week’s 1.6% median estimate for Q2.

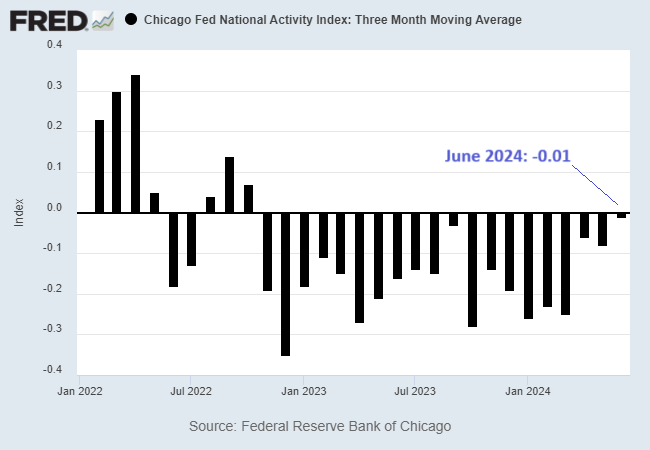

Yesterday’s June report for the Chicago Fed National Activity Index (CFNAI) also suggested that the economy is stabilizing, albeit at a modest pace. In particular, CFNAI’s 3-month average rose to -0.01, the strongest reading since Oct. 2022 and a reflection of economic activity that’s expanding close to its historical trend (a pace indicated by a zero reading).

Although the economic trend has been below trend for much of the past two years, the uptick in CFNAI’s 3-month average offers an encouraging profile for Q2’s final month.

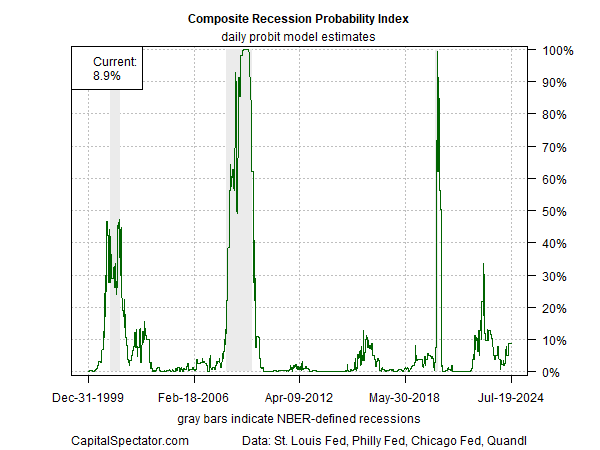

It follows, then, that recession risk for the US remains low. Although some analysts in recent months have been warning that the threat of an NBER-defined downturn has increased, a suite of analytics published in the weekly updates of The US Business Cycle Risk Report have consistently advised that the broad macro trend’s recent slowdown has been stabilizing and that recession risk remained low.

A summary of the newsletter’s analytics — informed by several business-cycle indicators — estimate the probability that a downturn has started or is imminent at roughly 9% (see chart below).

Thursday’s Q2 GDP report looks set to confirm that recession risk remains low.