Raymond James raises Fulgent Genetics stock price target to $36 on strong performance

The unofficial start of the next earnings season is still roughly a month away, but recent research out of the University of California, San Diego and Aarhus University (featuring Wall Street Horizon data) might have investors preparing differently for Q2 2025 results.

The study, “Warp Speed Price Moves: Jumps after Earnings Announcements,” recently published in the Journal of Financial Economics, shows how efficient markets are at pricing in earnings results. The authors found that earnings reports can move stock prices in milliseconds, and not just the stock of the reporting company, but often the stocks of peers in the industry, or even entire markets as a whole.

The research also shows that the effect is strongest from companies that report early in the season, and for companies that report after market close. After-hours earnings announcements cause stock prices to move over 90% of the time, while significant price movements during regular trading hours or in non-announcement sessions were less common.

Co-Author of the study, Allan Timmermann of UCSD’s Rady School of Business commented: “With earnings announcements, traders deal with these every day and they are very good at gauging the impact of companies being able to meet and beat expectations or missing them. We find that it can be very costly to miss expectations - this often leads to sharp drops in prices, sometimes affecting entire sectors.”

Oracle Earnings Push the Tech Sector Higher

A good example of this occurred just last Wednesday, June 11, 2025. Oracle Corporation (NYSE:ORCL), one of the early reporters each earnings season, released their results for fiscal Q4 2025 (equivalent to calendar Q2 2025) after-the-bell. The mega-tech company beat Wall Street’s expectations on the top and bottom-line due to strength in their cloud segment. The company also commented that AI demand would drive cloud infrastructure revenue up 70% for fiscal 2026. Such bullish comments lifted the stock more than 11% after the report, and into Thursday big tech stocks also surged with the S&P 500 tech sector leading the index higher for the day. The strength of tech lifted equity markets higher on Thursday, with S&P 500 up 0.36% and the Nasdaq Composite gaining 0.21%, and Oracle closed out the week at a record high.

On Deck for Q2 2025 Earnings Season

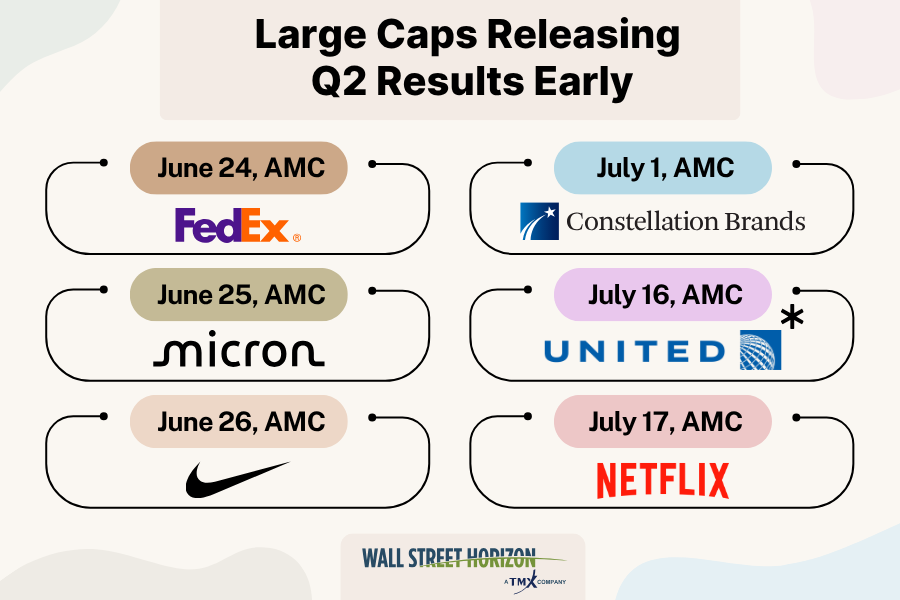

Given this information, we took a look at the large cap names that are releasing results early in the reporting season for Q2, and after-the-bell. According to the study these could be some names to keep an eye on in the coming weeks: Source: Wall Street Horizon, Note: United Airlines is currently unconfirmed as of June 13, 2025.

Source: Wall Street Horizon, Note: United Airlines is currently unconfirmed as of June 13, 2025.

The Bottom-Line

As the unofficial start of the Q2 earnings season draws near, the research suggests that not all earnings reports are created equal in their market-moving potential. The combination of an early reporting date and an after-hours release appears to be a potent formula for influencing not just a single stock, but entire sectors and the market as a whole. The reports from the companies listed above, among others, could therefore be critical viewing for investors looking to gauge how Q2 reports could impact markets this summer.