IonQ CRO Alameddine Rima sells $4.6m in shares

- Japan’s inflation and global trade tensions heavily influence the Bank of Japan’s policy decisions.

- US-Japan trade talks stall over automotive sector; Japan sets aside $6.3 billion for protection.

- USD/JPY fell after hitting resistance near 142; a break below may target 140 support level.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

Japan’s inflation rate is an important factor in predicting what the Bank of Japan (BoJ) might do next. At its recent meeting, the BoJ chose not to change interest rates. This decision was mainly due to the uncertain global economy, especially because of a growing trade war.

However, if inflation keeps rising, the BoJ may have to raise interest rates later this year. At the same time, the US Federal Reserve is expected to cut rates. If that happens, the USD/JPY could strengthen against the US Dollar.

Today, Japan is hosting a major meeting of central bankers in Tokyo, similar to the Jackson Hole event in the US, where they are discussing current monetary policy issues.

Tough US-Japan Trade Negotiations

Talks between the US and Japan are ongoing, but there is still no trade deal in sight. Japan insists that any agreement must include the automotive sector, which has been a sticking point. Expecting a long negotiation process, the Japanese government has set aside $6.3 billion from its financial reserves to protect its economy. The money will mainly support small and medium-sized businesses.

Last month, forecasts warned that the trade conflict could slow Japan’s economic growth by up to 2%. Given that risk, Japan’s protective measures seem necessary.

Japan is not the only country facing trade tensions. Recently, Donald Trump said the US would impose 50% tariffs on goods from the European Union starting in early June due to stalled talks. After further discussions, the deadline was delayed to July 9. This shows how uncertain and unstable the global economy has become, affecting not just markets but businesses and governments worldwide.

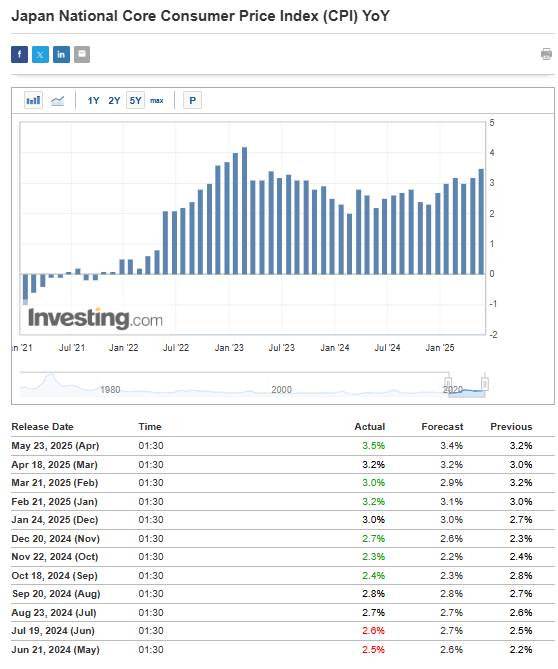

Inflation in Japan Above Forecasts, Again

Inflation data released late last week shows that prices are still rising. The core CPI came in at 3.5% year-on-year, which was higher than expected. The last time inflation came in below forecasts was in July of last year. If this trend continues, we may soon match or even surpass the high levels seen in early 2023, when inflation was above 4%.

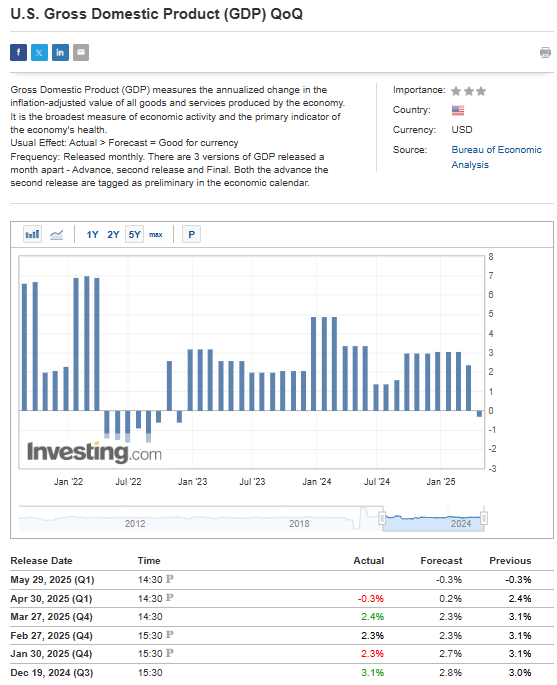

This week, investors should keep a close eye on two key US data points: PCE inflation and GDP growth. Market expectations suggest that GDP will likely show slower quarter-on-quarter growth once again.

USD/JPY Technical Outlook

Over the past two weeks, the USD/JPY currency pair has been moving downward after hitting resistance around the 142 yen per dollar level. During this decline, sellers pushed the price down to a key demand zone, where the pair has now started to bounce back.

The main expectation is that the price will break below this level, which would likely lead to a move toward the key support around 140 yen per dollar.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.