Stock market today: Nasdaq closes above 23,000 for first time as tech rebounds

By Geoffrey Smith

Investing.com -- Jeff Bezos bows out of Amazon on a high note, as Alphabet also blows past forecasts in the fourth quarter. ADP payrolls are due, Mario Draghi is set to be invited to be Italy’s next Prime Minister, and OPEC meets to congratulate itself on rebalancing the world oil market. Here’s what you need to know in financial markets on Wednesday, February 3rd.

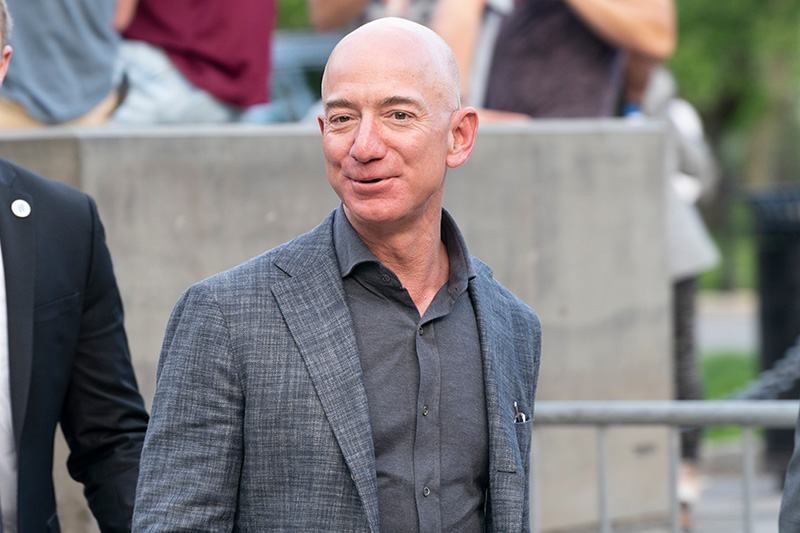

1. Bezos bows out on a high

Jeff Bezos, arguably the most influential man in global business over the last 30 years, is to step down as chief executive of Amazon (NASDAQ:AMZN). He’ll be succeeded by Andrew Jassy, the head of Amazon Web Services, the division that accounts for most of the group’s profits. The succession symbolizes how the company has moved away somewhat from its original e-commerce roots.

Bezos made his announcement as Amazon delivered another forecast-crushing set of quarterly results, cashing in heavily on trends to online shopping and remote working that have been mightily accelerated by the pandemic.

Revenue rose 44% on the quarter, while profit more than doubled. The stock fell 0.1% in premarket trading, perhaps mindful of the increasingly challenging regulatory outlook that will face Jassy.

2. The Return of Super Mario?

Mario Draghi will be asked by Italy’s President Sergio Mattarella to form Italy’s next government. If he agrees, it is expected that he would form a cabinet largely of technocrats until the next elections, which are scheduled for May 2023.

Draghi will need promises of support from Italy’s main parties, many of which have been critical of him in the past for pushing a reform agenda advocated by the European Commission. However, his high standing in financial markets as former ECB President gave a clear boost to Italian stock and bond markets, which prefer the idea of a Draghi government to the in-fighting that led to the collapse of the last one.

By 6:30 AM ET (1130 GMT), the FTSE MIB was up 2.7%, while the spread between the Italian and German benchmark 10-year bond yields was down 10 basis points at 105, its lowest since 2016.

3. Wall Street set to open higher; Paypal, Qualcomm due

U.S. stock markets are set to open higher later, albeit not with the energy which saw them post gains of over 1% on Tuesday.

By 6:30 AM ET, Dow Jones futures were up 29 points, or 0.1%, while S&P 500 futures were up 0.4% and Nasdaq futures were up 0.7%.

Stocks in focus later are likely to include Alphabet (NASDAQ:GOOGL), which soared 7.4% in premarket trading after it reported fourth-quarter earnings well ahead of expectations thanks to heavy ad spending during the holiday season.

The day’s earnings roster begins with a batch of life sciences and health companies, including Biogen (NASDAQ:BIIB), AbbVie (NYSE:ABBV) and Humana (NYSE:HUM). Paypal, eBay (NASDAQ:EBAY), Qualcomm (NASDAQ:QCOM) and MetLife (NYSE:MET) report after the closing bell.

4. ADP jobs report due

The warmup act for the monthly payrolls report is due at 8:15 AM ET, when ADP gives its estimate of private-sector hiring in January.

Analysts expect a modest return to payroll growth, seeing net job creation of 49,000 after a shock drop of 123,000 in December. The figure will reflect the struggles of many businesses to stay open during another wave of lockdowns to combat the coronavirus.

Overnight, final PMI data for China disappointed again, while the Eurozone’s composite PMI was revised higher from initial estimates. There’s a wave of speakers from the Federal Reserve in the course of the day, starting with St. Louis Fed President James Bullard at 1 PM ET and ending with Dallas’ Robert Kaplan at 5:05 PM ET.

5. EIA inventories to underline oil market tightening; OPEC meets

The U.S. government will release official inventory data for last week, a day after the American Petroleum Institute reported a surprisingly sharp drop of over 2 million barrels in crude stocks.

Elsewhere, Chinese crude stocks have also fallen to their lowest in a year, Bloomberg reported.

The Organization of Petroleum Exporting Countries’ Joint Technical Committee said on Tuesday that it expects world stockpiles to fall to their five-year average by the middle of the year. That’s been its quantitative objective in keeping supply off the market since the pandemic exploded last spring.

OPEC’s Joint Ministerial Monitoring Committee is expected to decide against any immediate changes to output when it meets later.