European shares fall: Trump threatens ’massive’ tariff increase on China

Investing.com-- Chinese stock markets are still set for more gains after a stellar rally over the past two months, Alpine Macro analysts wrote in a note, citing improved economic conditions on the back of more stimulus measures from Beijing.

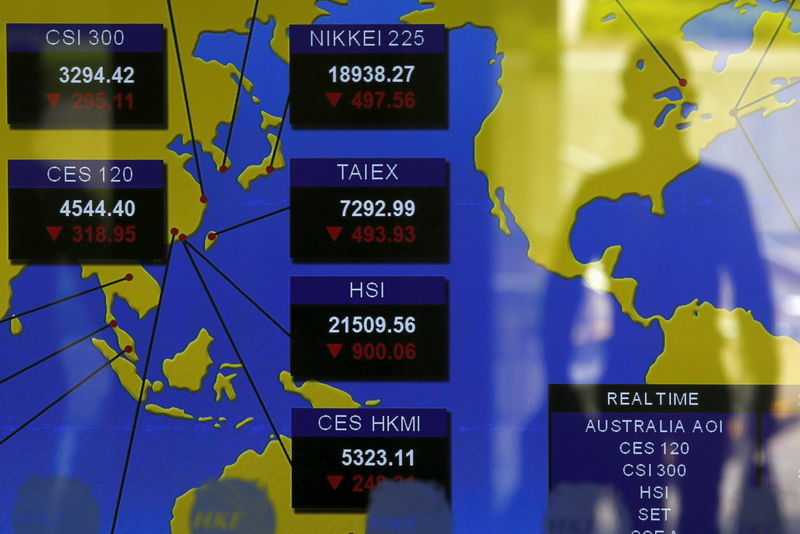

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes surged between 16% and 18% from multi-year lows hit in February, with recent gains also coming as the government rolled out its most targeted measures yet for the beleaguered property market.

Alpine Macro analysts said that the recent rally was driven by an unwinding of negative expectations that had battered Chinese markets through the beginning of 2024.

They said that increased fiscal support from Beijing will help the economy reach the government’s 5% annual gross domestic product target this year.

Analysts noted that Chinese stocks were still trading at “extremely depressed multiples,” especially in contrast to their emerging market peers. This made them an attractive buy on the prospect of improving economic conditions.

They also noted increased overall participation in Chinese markets, and that short positions on local equities still remained in play.

Looser lending conditions in Chinese markets also pointed to more liquidity that could be deployed towards equities.

China’s property sector a point of focus

Alpine Macro analysts said that Beijing’s “bazooka” announcement on more housing support marked a drastic u-turn in the country’s stance to the property downturn, and reflected a “whatever it takes” attitude to stemming further weakness in the sector.

Beijing recently loosened home buying rules across several major cities, and was also seen instructing state governments to begin buying up some loose inventory from property developers.

A nearly four-year slump in the property market has been a key point of pressure on the Chinese economy, given that the sector accounts for roughly a quarter of overall economic growth.

Alpine Macro analysts said that they did not see Chinese property stocks offering any better returns in comparison to other sectors, they did see relief for the housing market easing concerns over the broader economy.

“Beijing’s housing policy U-turn will help reduce financial stress on developers and put a floor under their asset prices. This will likely prevent them from being a source of negative surprises for Chinese equities,” analysts said in a note.

Alpine Macro analyst said they still preferred major benchmarks to drive a broader market rally.