Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

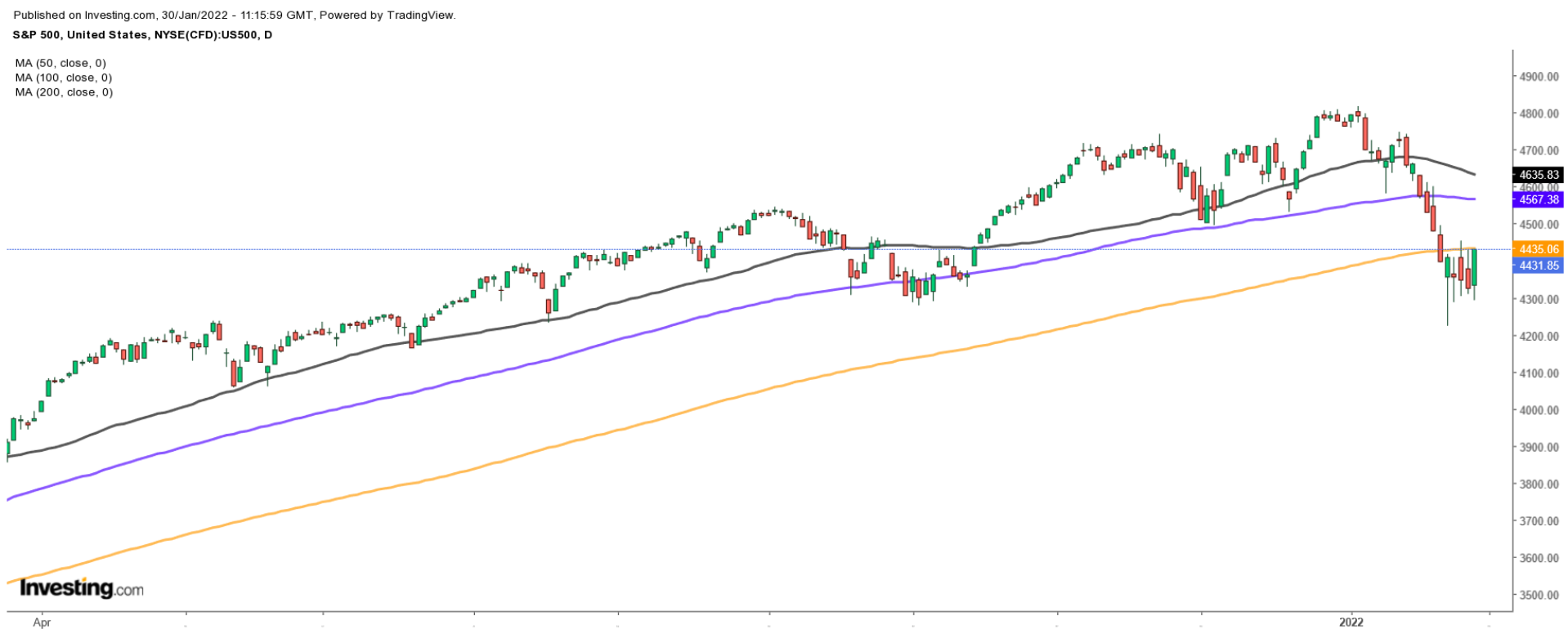

Stocks rallied on Friday, with the major averages notching their biggest one-day gain of the year to wrap up a rollercoaster week in financial markets.

Highlighting the extreme volatility, the benchmark S&P 500 index posted an intraday range of at least 2.2% during every session of the week.

The coming week is expected to be another busy one amid more earnings from notable tech companies, including Google-parent Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Facebook-parent Meta Platforms, Advanced Micro Devices (NASDAQ:AMD), Qualcomm (NASDAQ:QCOM), PayPal (NASDAQ:PYPL), Snap (NYSE:SNAP), Spotify (NYSE:SPOT), and Pinterest (NYSE:PINS).

Additional, high-profile industrials and discretionary companies such as Exxon Mobil, Ford (NYSE:F), General Motors (NYSE:GM), United Parcel Service (NYSE:UPS), Starbucks (NASDAQ:SBUX), and ConocoPhillips (NYSE:COP) will also release their latest results.

Add to that important economic data coming our way, including the latest ISM PMI surveys, and the U.S. employment report on Friday, and the coming week is expected to be a busy one.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Exxon Mobil

After getting off to one of its best starts to a year ever, Exxon Mobil's (NYSE:XOM) stock could see further buying activity in the coming week as investors look ahead to strong fourth-quarter financial results from one of the world’s largest energy companies.

Consensus expectations call for the Irving, Texas-based oil-and-gas giant to post earnings per share of $1.93 when it reports Q4 numbers ahead of the opening bell on Tuesday, Feb. 1, soaring more than 6,000% from EPS of $0.03 in the turbulent year-ago period.

Revenue is forecast to climb roughly 83% year-over-year to $85.0 billion, as the company reaps the benefits of higher commodity prices, improving global demand, and streamlined operations.

If confirmed, Exxon’s quarterly profit and sales totals would mark the energy supermajor's highest since 2014, reflecting a robust recovery from the negative impact of the coronavirus pandemic. In 2020, the largest U.S. energy producer suffered a massive loss of $22.4 billion amid falling oil prices and weak worldwide demand.

Beyond the top- and bottom-line numbers, investors will be eager to hear if the ‘Big Oil’ major plans to return more cash to shareholders in the form of higher stock buybacks and dividend payouts.

Exxon’s board previously said that starting in 2022, it will begin a share repurchase program of up to $10 billion spanning over the next 12 to 24 months. It also authorized its first dividend hike in more than two years, a sign of how well the energy sector has performed amid the current environment. Exxon currently offers an annualized dividend of $3.52 per share at a relatively-high yield of 4.68%.

Exxon Mobil—which has gained 23% year-to-date—has been a standout performer in the booming energy space this year, ending higher in 14 out of the first 19 trading sessions of 2022.

XOM stock, which climbed to $76.01 on Thursday to touch its best level since July 2019, closed Friday’s session at $75.28. At current valuations, Exxon has a market cap of $318.7 billion.

Stock To Sell: Meta Platforms

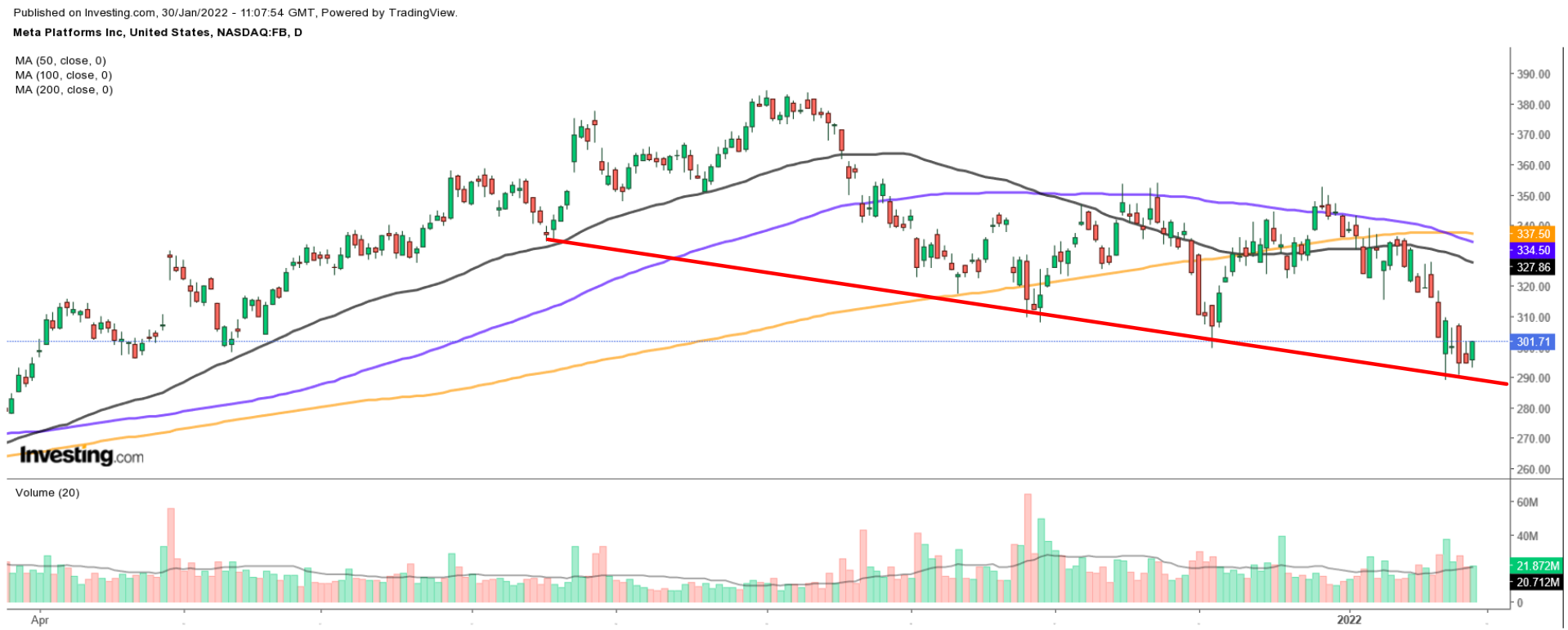

Facebook-parent Meta Platforms (NASDAQ:FB) is expected to suffer another volatile week as investors brace for disappointing financial results from the social media giant, due after the U.S. market closes on Wednesday, Feb. 2.

Shares of the Menlo Park, California-based company have gotten off to an awful start to 2022, sliding nearly 11% so far this year amid a selloff in many top-rated technology names due to worries surrounding the Federal Reserve’s plans to raise interest rates.

FB—which sank to a 10-month low of $289.01 on Jan. 24—closed at $301.71 on Friday, roughly 21.5% below its September all-time high. At current levels, Meta is valued at $839.2 billion, making it the fifth most valuable company traded on the U.S. stock market.

Analysts call for fourth-quarter earnings per share of $3.85, dipping about 1% from EPS of $3.88 in the same period a year earlier, due to higher costs and investments related to Meta’s hardware and Virtual Reality (VR) segment. If confirmed, it would mark the tech company’s first profit decline in more than two years.

Revenue, meanwhile, is forecast to rise 19% Y-o-Y to $33.3 billion, driven by recovering advertiser demand and higher ad prices on Facebook and Instagram, which took a hit following privacy changes to Apple's (NASDAQ:AAPL) iOS operating system last year.

For the first time in the company’s history, Meta will break out its ‘Facebook Reality Labs’—which focuses on consumer hardware such as Oculus virtual reality headsets—into its own reporting segment. It will also release growth metrics for its ‘Family of Apps’ unit, which includes Facebook, Instagram, Messenger, and WhatsApp.

In addition, investors will focus on comments on the post-earnings call from CEO Mark Zuckerberg regarding Meta’s big bet to build and develop the metaverse, a virtual world simulation viewed as the next-generation version of the internet.