Bubble or no bubble, this is the best stock for AI exposure: analyst

Despite recession concerns, economic growth showed resilience, while equities retreated in October and inflation continued its slow decline. Nuclear energy was poised to power the future of AI, while the market suggested buying "Trump" and selling "Kamala” when referring to U.S. Election bets. Here are 10 charts to review what happened in the markets during October and what it could mean for markets heading into 2025.

1. Economic Growth Resilience Amid Recession Concerns

In October, global economic sentiment remained cautious, with recession risks still a prominent concern. Nevertheless, a baseline scenario of a soft landing, characterized by easing inflation and declining interest rates, continues to hold for major economies.

The U.S. economy showed resilience, with estimates for Q3 GDP reflecting a healthy 2.8% quarter-on-quarter annualized growth rate, slightly below the 3.0% rate in Q2, but above trend. Labor market conditions, however, displayed signs of cooling: the unemployment rate stayed steady at 4.1% between September and October.

October's nonfarm payroll growth was subdued, with only 12,000 jobs added, the lowest monthly figure since December 2020 and well below expectations of 100,000 jobs. The shortfall is partly attributed to the impact of recent hurricanes and a dockworker strike. On the manufacturing front, the U.S. ISM Manufacturing PMI continued its contractionary trend, declining to 46.50. Conversely, the Services PMI increased to 54.90, indicating strength in the services sector.

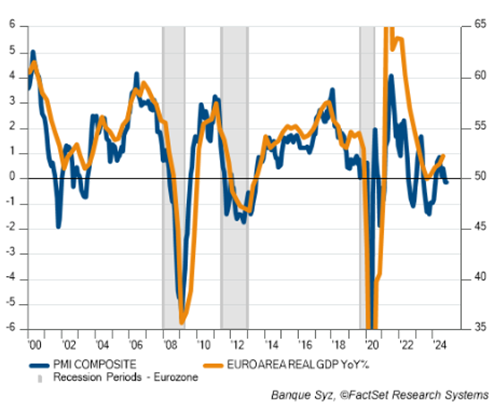

In Europe, economic headwinds intensified, with Germany at the center of a broader slowdown. The Eurozone’s third-quarter GDP showed a modest 0.4% growth, exceeding the 0.2% forecast. Industrial data highlighted persistent declines in manufacturing and automotive production, and the manufacturing PMI is back in contraction territory in October. Unemployment has risen from 5% in 2022 to 6.3% in September 2024.

In China, the government took significant steps to stabilize its economy. Initiatives included permitting local governments to use special bonds for purchasing land from troubled developers and hinting at an upcoming debt ceiling adjustment. These actions underscore Beijing's commitment to address the real estate bubble and stimulate consumption. While the impact remains to be seen, these policy shifts suggest a potential for recovery in 2025 if fiscal and monetary easing continues.

Source: Growth in Europe has picked up in Q3 due to seasonal factors, but the trend for Q4 is not encouraging.

2. Inflation on a Slow Downward Path

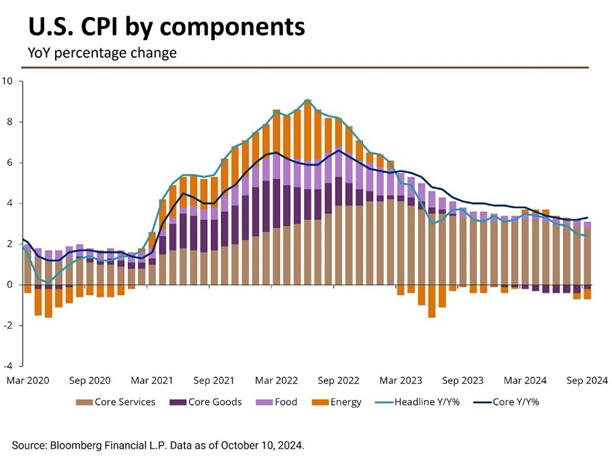

In the U.S., inflationary pressures continued to ease for the sixth consecutive month to 2.44% in September. However, core inflation rose for the second month, reaching 3.31%, primarily driven by rising costs in healthcare, auto insurance, and air travel. The upcoming Federal Reserve FOMC meeting on November 7 is expected to bring a 25-basis point reduction to the Fed Funds Rate, setting the target range to 4.50%-4.75% and marking the second rate cut since March 2020.

In Europe, inflation dynamics were mixed. September's headline inflation was revised to 1.7%, but October saw a slight uptick to 2.0%, largely due to energy price effects. The European Central Bank (ECB) reported signs of weakening economic activity across Europe, particularly within the manufacturing sector.

In response, the ECB cut its interest rates by 25 basis points for the third time of the year, lowering the deposit rate to 3.25%, as expected. President Lagarde reinforced confidence in a steady disinflation process but emphasised that future policy adjustments will depend on incoming economic data.

In the UK, headline inflation in September fell sharply to 1.7% year-over-year, while core inflation remained elevated at 3.2%.

Meanwhile, in Japan, Tokyo’s core inflation stood at 1.8% year-over-year in October, supported by solid wage gains. At its October meeting, the Bank of Japan (BoJ) held rates steady as anticipated but adopted a notably hawkish stance.

Source: J.P. Morgan

3. Equities Retreat in October

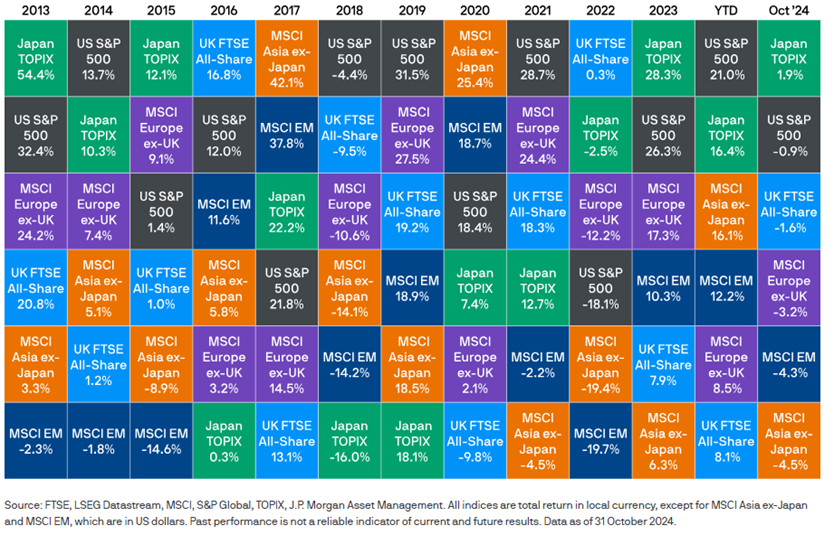

Despite stable economic data, developed market equities declined by 2%, weighed down by political uncertainty and currency pressures. The S&P 500 was down 0.9% over the month, the Nasdaq Composite slipped 0.5%, and the Dow Jones Industrial Average dropped 1.3%. Growth stocks modestly outperformed value stocks, but still dropped 1.8% for the month. Small caps posted a negative return of 2.7% amid signs of slowing economic momentum.

Japanese equities emerged as the winners of the month, despite potential headwinds from tighter monetary policy and a stronger yen, as well as political uncertainties stemming from recent elections. Meanwhile, broader Asian and emerging markets faced a 4.3% and 4.5% decline respectively, largely due to a strengthening US dollar, profit-taking in Indian stocks, and continued volatility in China, where investors questioned the impact of September’s economic support measures. Indian equities, which had shown strong performance throughout 2024, corrected sharply by 7.3% in local currency terms, pressured by disappointing corporate earnings.

Source: J.P. Morgan

4. Disappointing Tech Q3 Earnings

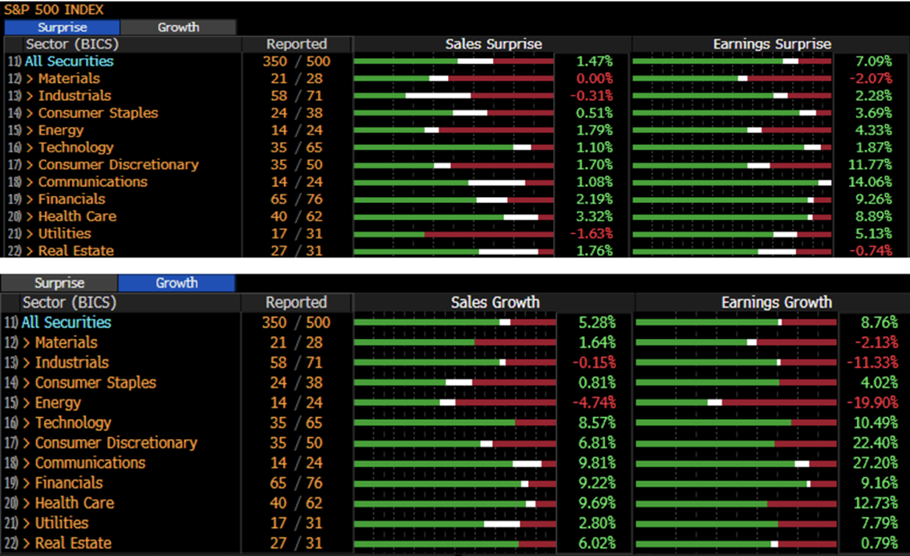

70% of S&P 500 companies reported Q3 2024 earnings, and results were mixed. The earnings season began on a high note with strong performances from the banking sector, making Financials one of the three sectors, alongside Communication Services and Energy, to post positive returns in October. In contrast, Health Care (-4.6%), Consumer Staples (-3.5%), and Real Estate (-3.3%) lagged.

Investor enthusiasm for AI-driven tech stocks cooled as heavy spending and cautious guidance, particularly in the semiconductor sector, came under greater scrutiny. Four of the ten worst-performing S&P 500 stocks in October were semiconductor-related companies. Super Micro Computer (NASDAQ:SMCI) lost over 39% in October, largely due to the resignation of its auditor, Ernst & Young, over concerns about the company's financial statements.

The Magnificent 7 reported mixed results. Among the six companies that reported, Amazon (NASDAQ:AMZN) (-3% in October) and Tesla's (NASDAQ:TSLA) (+2%) earnings sparked optimism.

In contrast, despite meeting or beating estimates, Apple (NASDAQ:AAPL) (-2%), Microsoft (NASDAQ:MSFT) (-6%), and Meta (NASDAQ:META) (-4%) faced heightened scrutiny.

Source: Nasdaq, Bloomberg

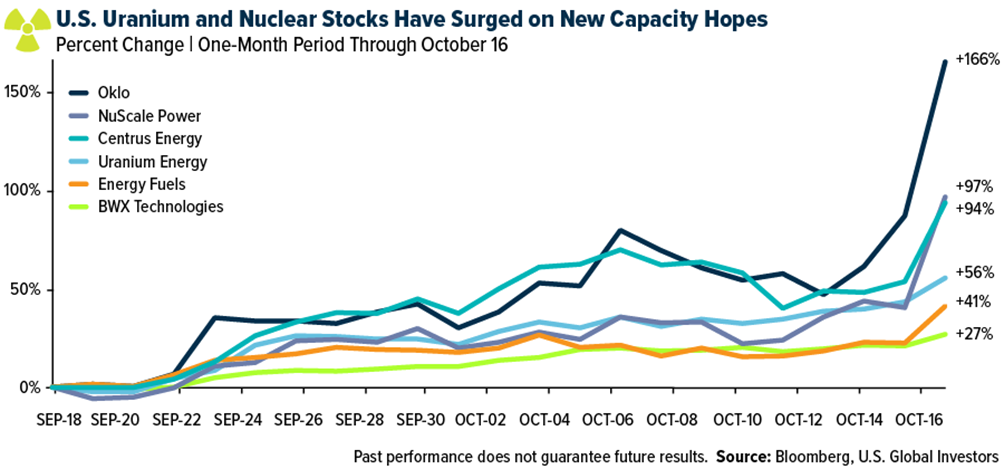

5. Nuclear Energy to Power the Future of AI

Nuclear energy was a prominent topic of discussion in October in relation to meeting the substantial energy demands of artificial intelligence. Major tech companies are increasingly investing in small modular reactors (SMRs) to power their data centers. Google (NASDAQ:GOOGL) announced a deal to support the construction of seven small nuclear power reactors with Kairos Power. Amazon unveiled a $500 million investment across three new initiatives: building four SMRs with Energy Northwest, exploring development with Dominion Energy (NYSE:D), and participating in a funding round for leading SMR developer X-Energy.

Shares of nuclear energy companies soared to record highs, with U.S.-listed SMR developers Oklo Inc (NYSE:OKLO) and NuScale Power (NYSE:SMR) experiencing remarkable increases of 99% and 36%, respectively, in the week following these announcements.

Other companies, including Cameco (NYSE:CCJ), Constellation, and BWX Technologies (NYSE:BWXT), also saw their share prices reach unprecedented levels throughout the month.

Source: U.S. Global Investors

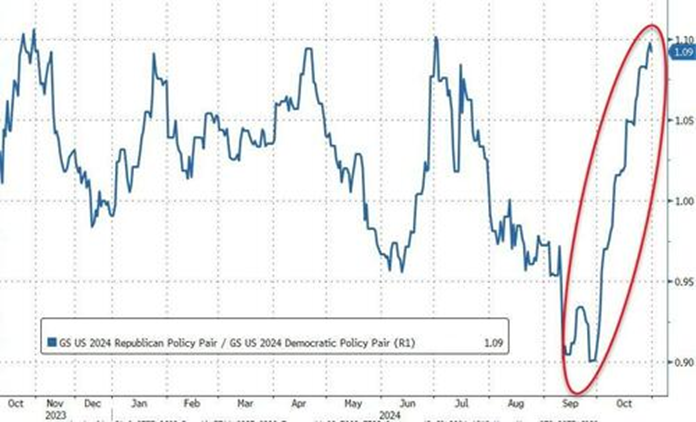

6. Buy "Trump" and Sell "Kamala"

Despite major indices ending the month in the red, buying Trump-linked stocks and selling Harris-linked stocks was a winning strategy in October, capitalising on pre-election sentiment. Trump-associated instruments encompass energy, especially fossil fuels, financial services, defense and aerospace, and cryptocurrency. Conversely, Harris-associated securities include renewable energy, electric vehicles, excluding Tesla, healthcare, and infrastructure.

Source: ZeroHedge, Bloomberg

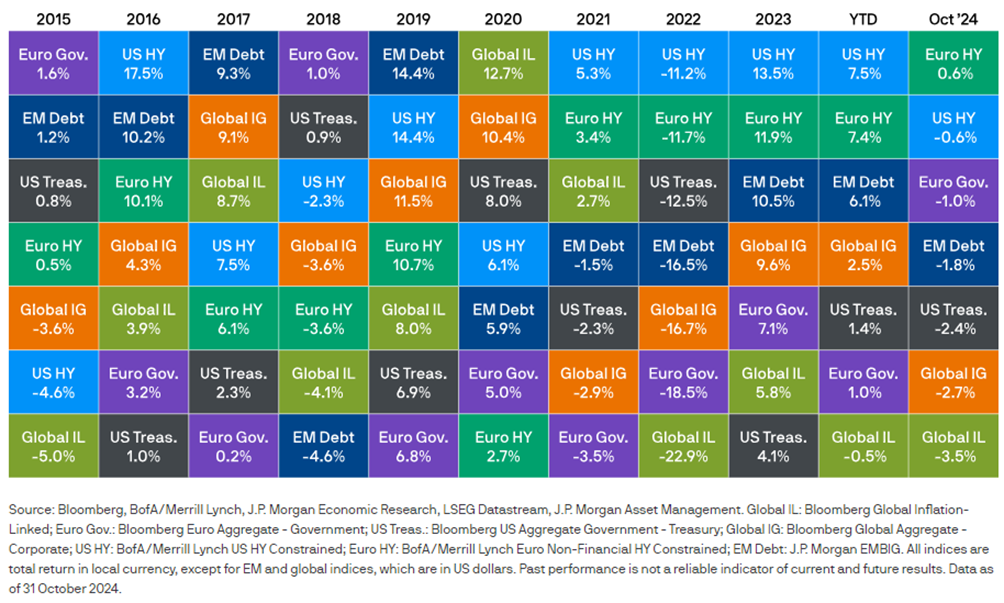

7. Bond Market Volatility Surges

This month, the spotlight was on rising Treasury yields, which experienced their largest selloff since September 2022. Treasury yields surged in the mid- to long-term portion of the yield curve. Both 2-year and 10-year Treasury yields rose above 4.0%. Conversely, yields on 1-month and 3-month Treasury bills decreased in October. In aggregate, U.S. Treasuries returned -2.4% for the month. This was driven by increased concerns about the national debt and deficit, optimism for a soft landing, and rising political uncertainty.

Several bond funds were adversely affected by the rising yields, with the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) declining by 5.5%, and the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD) dropping by 3.2%. In contrast, the short-duration SPDR® Bloomberg 1-3 Month T-Bill ETF (NYSE:BIL) gained 0.4% due to falling yields on 1-month and 3-month T-Bills.

Bond market volatility intensified, with the Bank of America MOVE index hitting a year-to-date high. The Barclays (LON:BARC) Global Aggregate Index posted a negative return of -3.4%, and Emerging Market Debt (EMD) finished the month down 1.8%, impacted by a robust U.S. dollar.

In Europe, despite a recent rate cut and dovish commentary, sovereign bonds suffered from the broader global weakness in fixed income markets, resulting in a -1.0% return for the month. Japanese government bonds also faced a selloff, finishing with a -0.6% return.

Towards the end of October, the UK budget announcement exerted additional pressure on the Gilt market due to unexpectedly high spending plans for 2025, causing Gilts to underperform with a return of -2.8%.

Source: Fixed income sector returns, J.P. Morgan

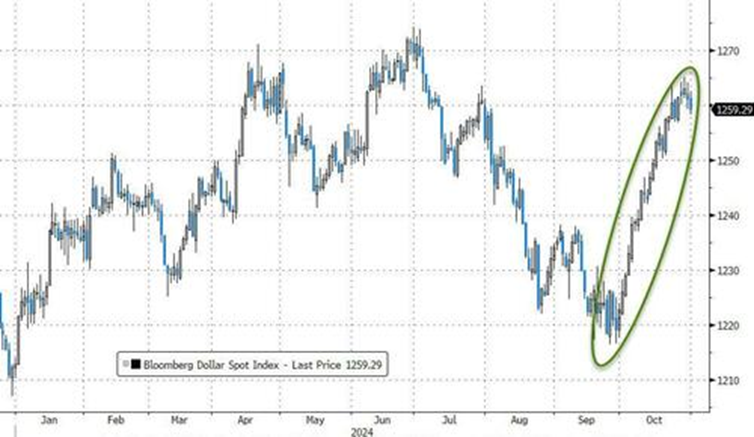

8. The Dollar Is at Multi-Month High

The U.S. dollar experienced its biggest monthly gain since September 2022, rising by 4% as measured by the US Dollar Index (DXY). Some analysts attributed the dollar's increase to speculation surrounding the outcome of the U.S. Presidential Election. Others argue that the primary driver is the robust economic activity in the United States, particularly the strong consumer spending and labor market data.

Source: ZeroHedge, Bloomberg

9. Gold Shines While Oil Stabilises

Gold continued its strong performance in 2024, rising an additional 4% in October to USD $2,734.20 per ounce, resulting in a year-to-date gain of 31.6%. Despite the strengthening dollar, gold prices surged higher for the eighth time in the past nine months, although some weakness was noted at the month's end.

Tensions between Israel and Iran initially spiked oil prices, but subsequent de-escalation eased market pressure. With over a year since the Middle East conflict began, the oil market has become less reactive to regional unrest, returning focus to traditional supply-and-demand dynamics. Mixed signals from OPEC+ suggest a potential shift away from their production discipline, as Saudi Arabia prioritises market share. Additionally, China's rapid shift to electric vehicles may temper bullish sentiment in the oil market. Crude oil prices dipped slightly, with West Texas Intermediate (WTI) falling 1.6% and Brent crude declining 0.7% over the month. Overall, the commodity index fell by 1.9% in October.

Source: ZeroHedge, Bloomberg

10. Bitcoin Coming Back Stronger Than Ever

Bitcoin experienced its best performance in October since May. After months of fluctuations, Bitcoin successfully broke through the USD $70,000 threshold, for the first time since June, reaching USD $72,342.62 by October 31, and resulting in a monthly gain of 10.2%. Substantial inflows into Bitcoin ETFs have driven this rally, coinciding with rising interest in digital assets that surrounded the American Presidential Election. Year-to-date, Bitcoin has surged by 71.3%.

Source: ZeroHedge, Bloomberg