Sun Valley Gold sells Vista Gold (VGZ) shares worth $2.16 million

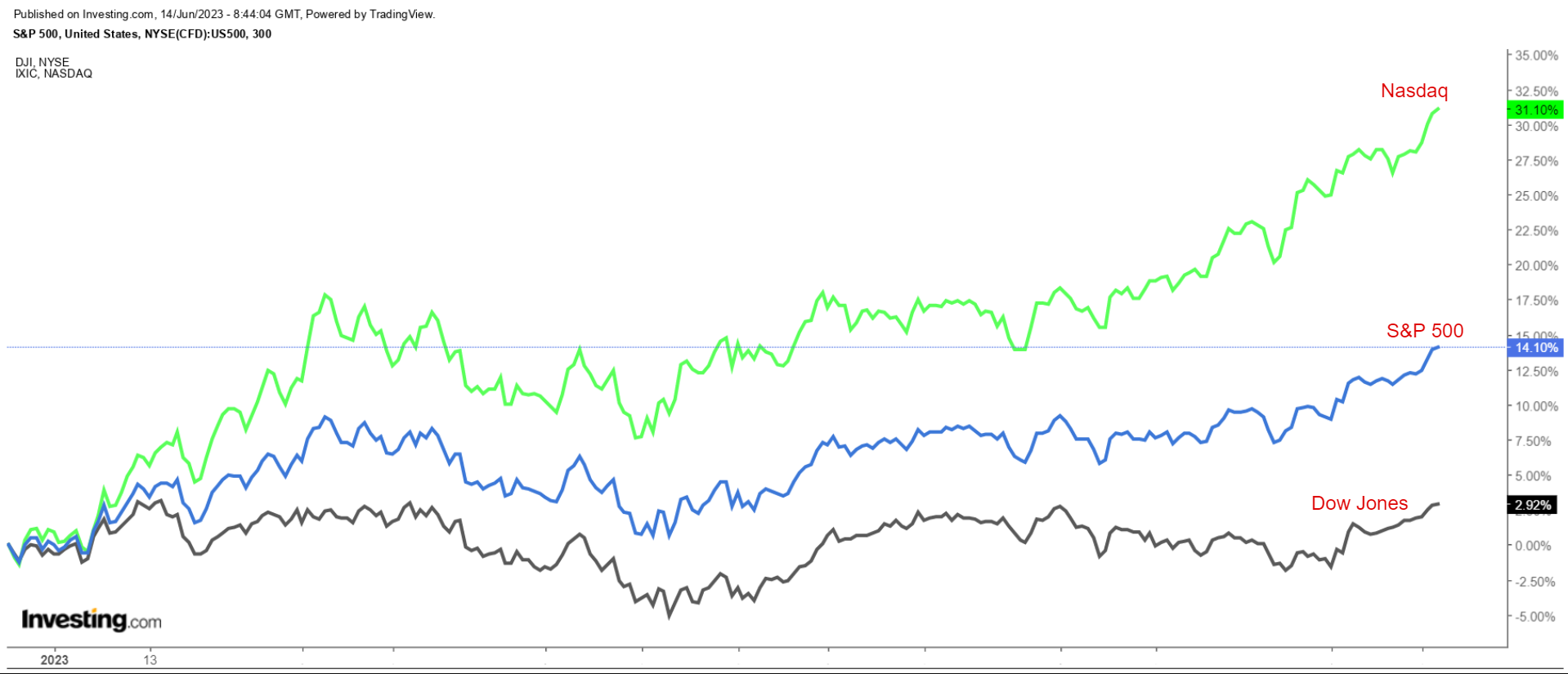

- The tech-heavy Nasdaq has outperformed the S&P 500 and the Dow Jones Industrial Average by a wide margin in 2023.

- Receding inflation worries and easing fears about further Fed rate hikes will likely continue to boost companies in the tech sector.

- As such, I used the InvestingPro stock screener to find high-quality, undervalued technology gems to buy now with strong upside ahead.

The technology-heavy Nasdaq Composite has been the top performer of the three major U.S. indices by a wide margin thus far in 2023, soaring 29.7% year-to-date.

That compares to an increase of 13.8% for the benchmark S&P 500 over the same time span and a 3.2% gain for the blue-chip Dow Jones Industrial Average.

The ongoing tech rally has been fueled by growing signs that U.S. inflation may have peaked, raising hopes the Federal Reserve will end its year-long rate hike cycle.

That, in turn, has boosted shares of the mega-cap tech companies, with Nvidia (NASDAQ:NVDA), Meta Platforms (NASDAQ:META), Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL), and Microsoft (NASDAQ:MSFT) all posting double-digit year-to-date percentage increases thus far.

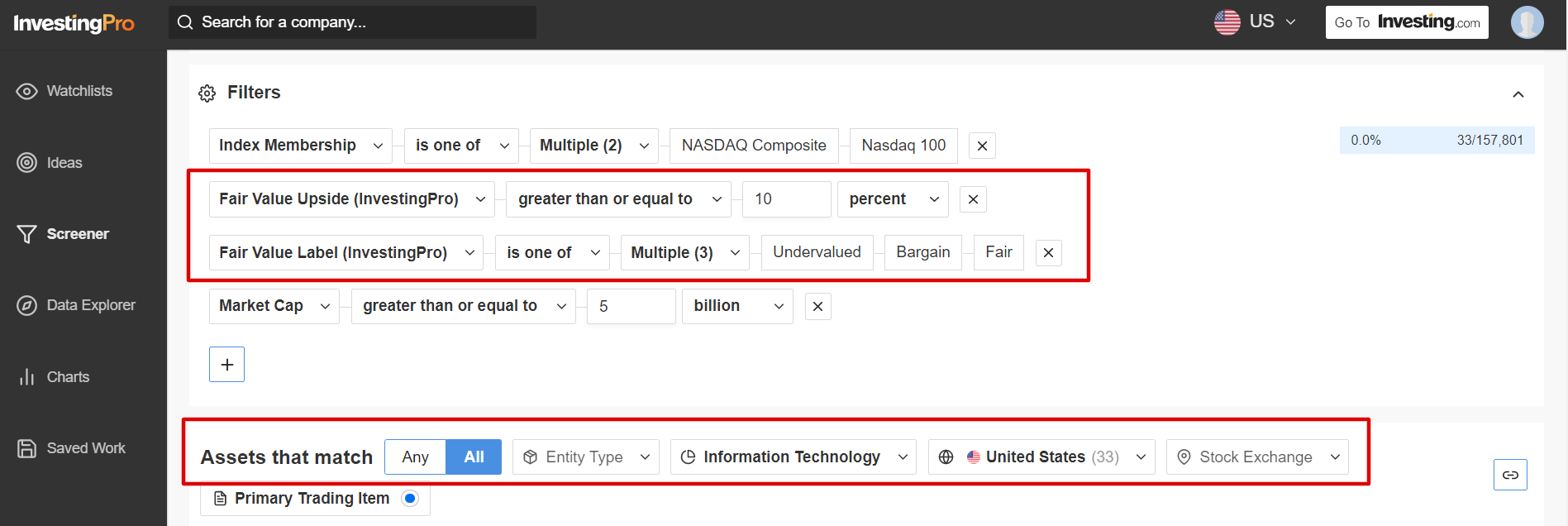

Against this backdrop, I used the InvestingPro stock screener to search for high quality undervalued tech gems to buy amid the current market environment.

I first scanned for companies with an Investing Pro ‘Fair Value’ upside greater than or equal to 10%. I then filtered for names whose Investing Pro ‘Fair Value’ grade was either ‘Undervalued’, ‘Bargain’, or ‘Fair’.

And those companies with a market cap of $5 billion and above made my watchlist.

Source: InvestingPro

Once the criteria were applied, I was left with a total of 33 companies.

Of those, Cognizant Technology Solutions (NASDAQ:CTSH) and NetApp (NASDAQ:NTAP) were the two that stood out the most to me. Source: InvestingPro

Source: InvestingPro

For the full list of the stocks that met my criteria, start your free 7-day trial with InvestingPro today!

If you're already an InvestingPro subscriber, you can view my selections here.

1. Cognizant Technology Solutions

Cognizant Technology Solutions stock is up 12.3% year-to-date and should continue appreciating, according to the InvestingPro models, as it cements its status as one of the premier go-to names in the information technology (IT) services industry.

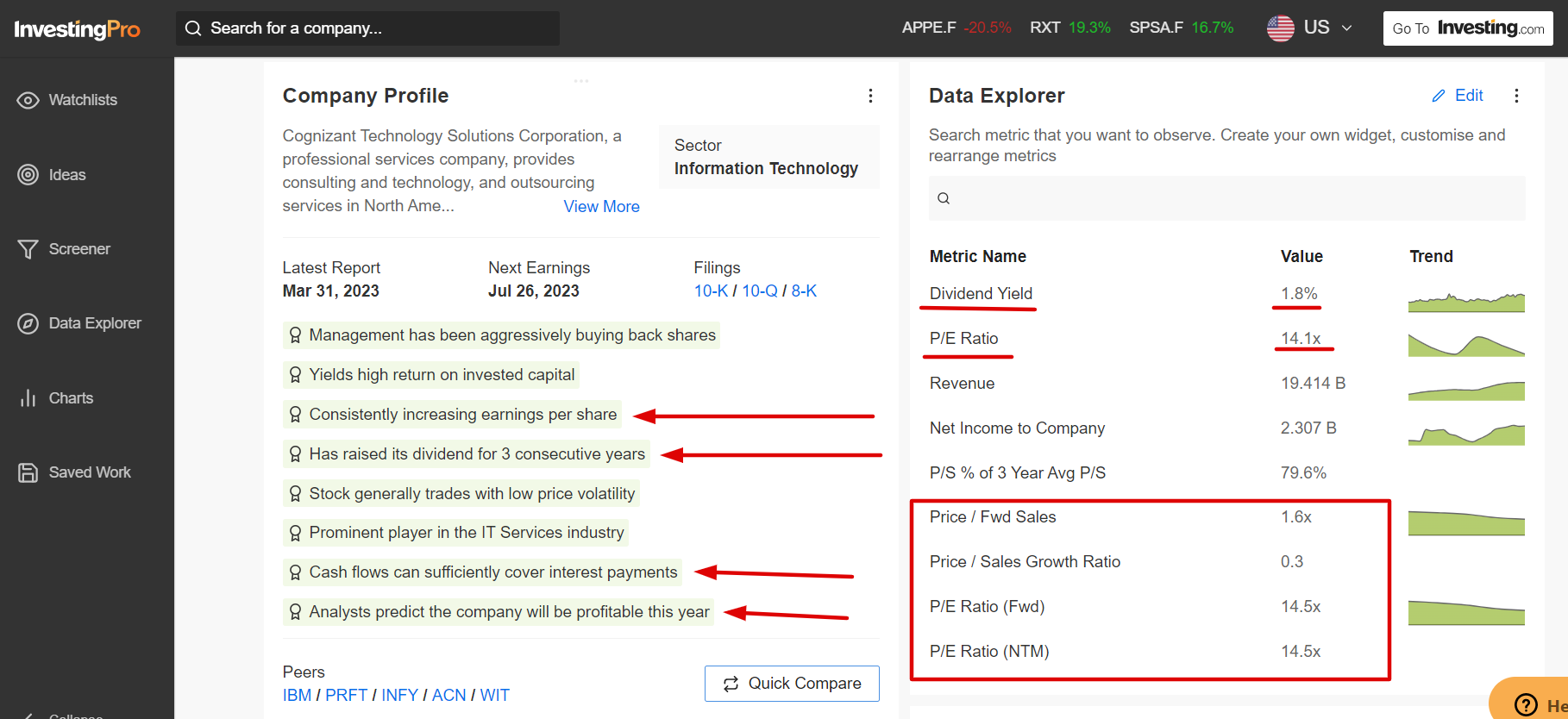

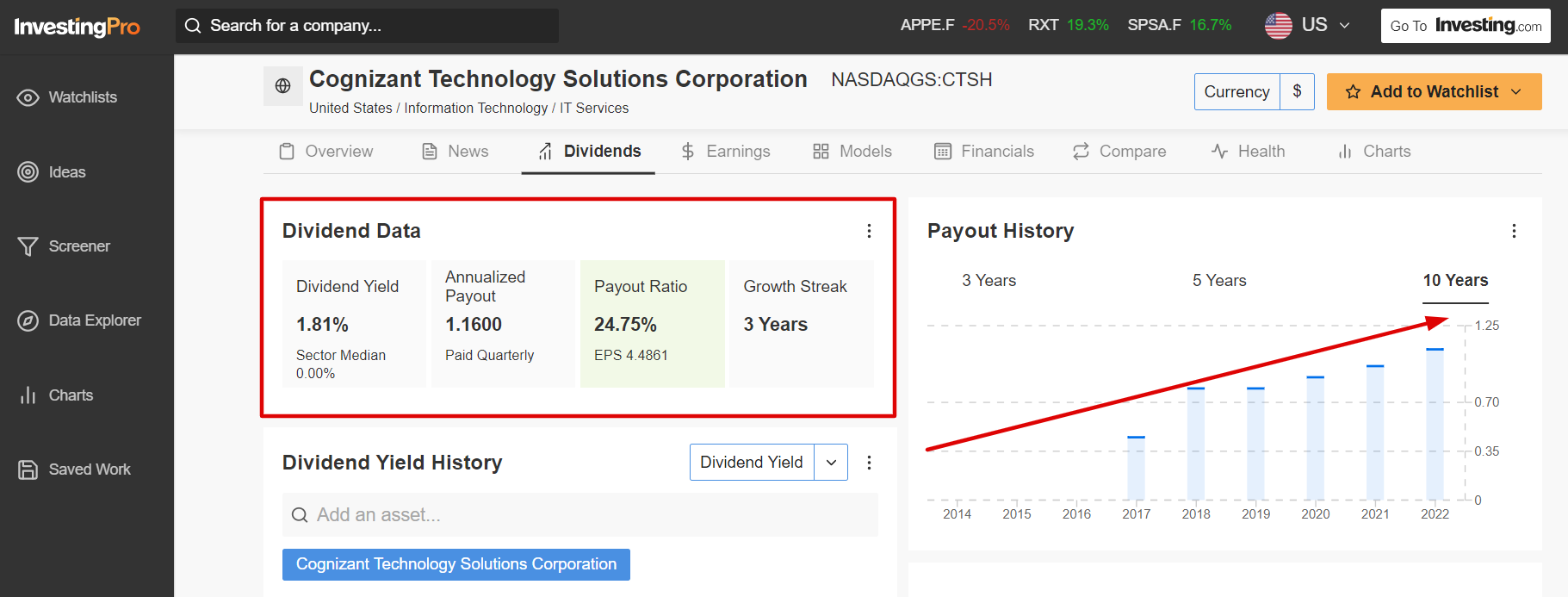

Cognizant has several tailwinds that are expected to fuel further gains in its stock in the months ahead, with highlights including strong earnings prospects, and a healthy profitability outlook, as well as robust growth in free cash flow yields which should allow it to increase dividend payments.

Source: InvestingPro

The Teaneck, New Jersey-based IT services and consulting firm has raised its annual dividend payout for three consecutive years. Shares currently yield 1.81%, which is slightly above the 1.48% implied yield for the S&P 500 index. Source: InvestingPro

Source: InvestingPro

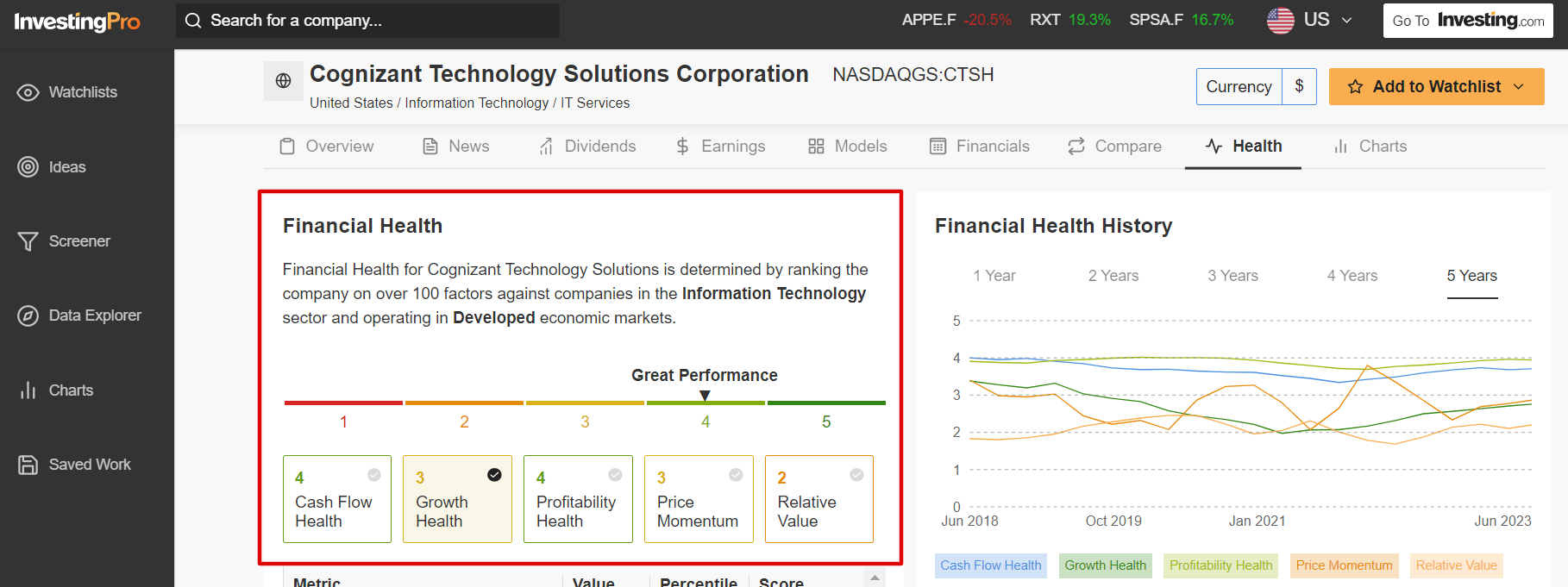

As Investing Pro points out, Cognizant currently enjoys a ‘Financial Health’ score of 3.2. That’s important as companies with Investing Pro health scores higher than 2.75 have consistently outperformed the broader market by a wide margin over the past seven years, dating back to 2016.

Source: InvestingPro

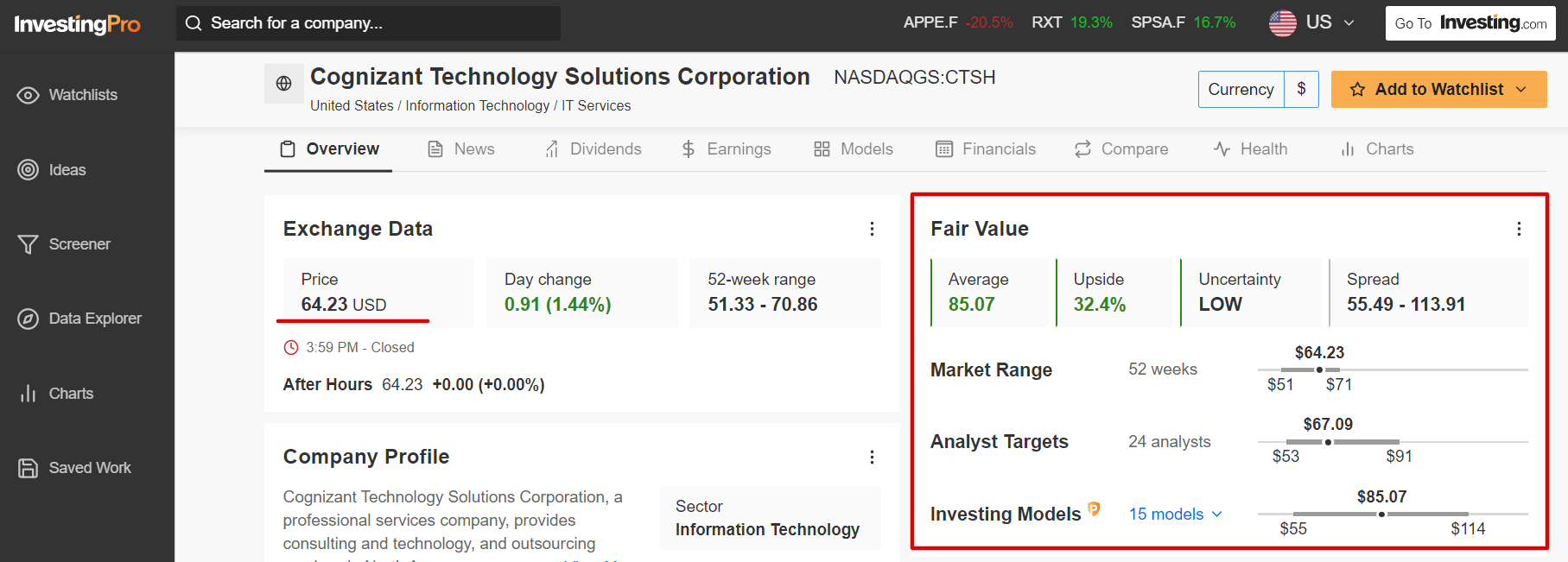

Not surprisingly, CTSH stock is substantially undervalued according to the quantitative models in Investing Pro: with a ‘Fair Value’ price target of $85.07, Cognizant shares could see an upside of roughly 32% from current levels. Source: InvestingPro

Source: InvestingPro

Cognizant’s stock trades at a price-to-earnings (P/E) ratio of 14.1, which makes it an absolute bargain compared to its major competitors, such as Accenture (NYSE:ACN) (28.7 P/E ratio), Infosys (NYSE:INFY) (22.0 P/E ratio), Wipro (NYSE:WIT) (19.1 P/E ratio), and IBM (NYSE:IBM) (60.8 P/E ratio).

As such, I believe shares of the IT services giant are a smart buy, especially at current valuations.

With Investing Pro, you can easily access comprehensive information and insight on any given company all in one place, eliminating the need to gather data from multiple sources, and saving you time and effort. Try it out for free for a week!

2. NetApp

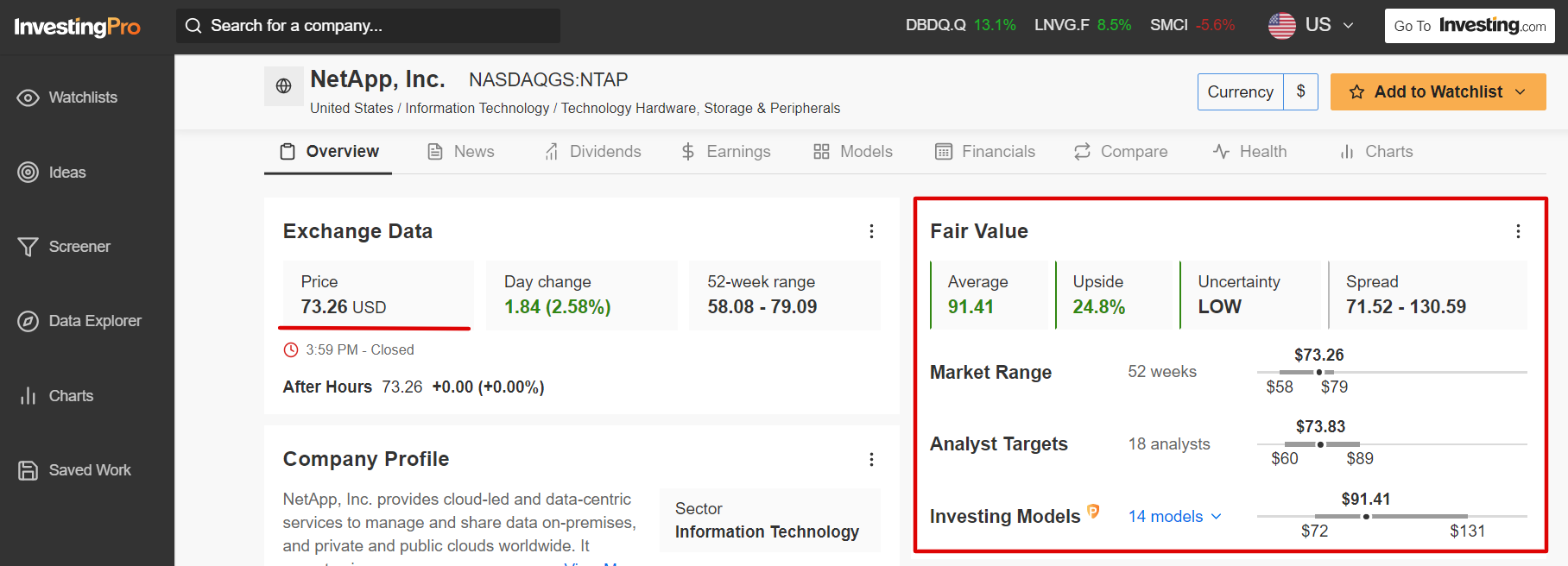

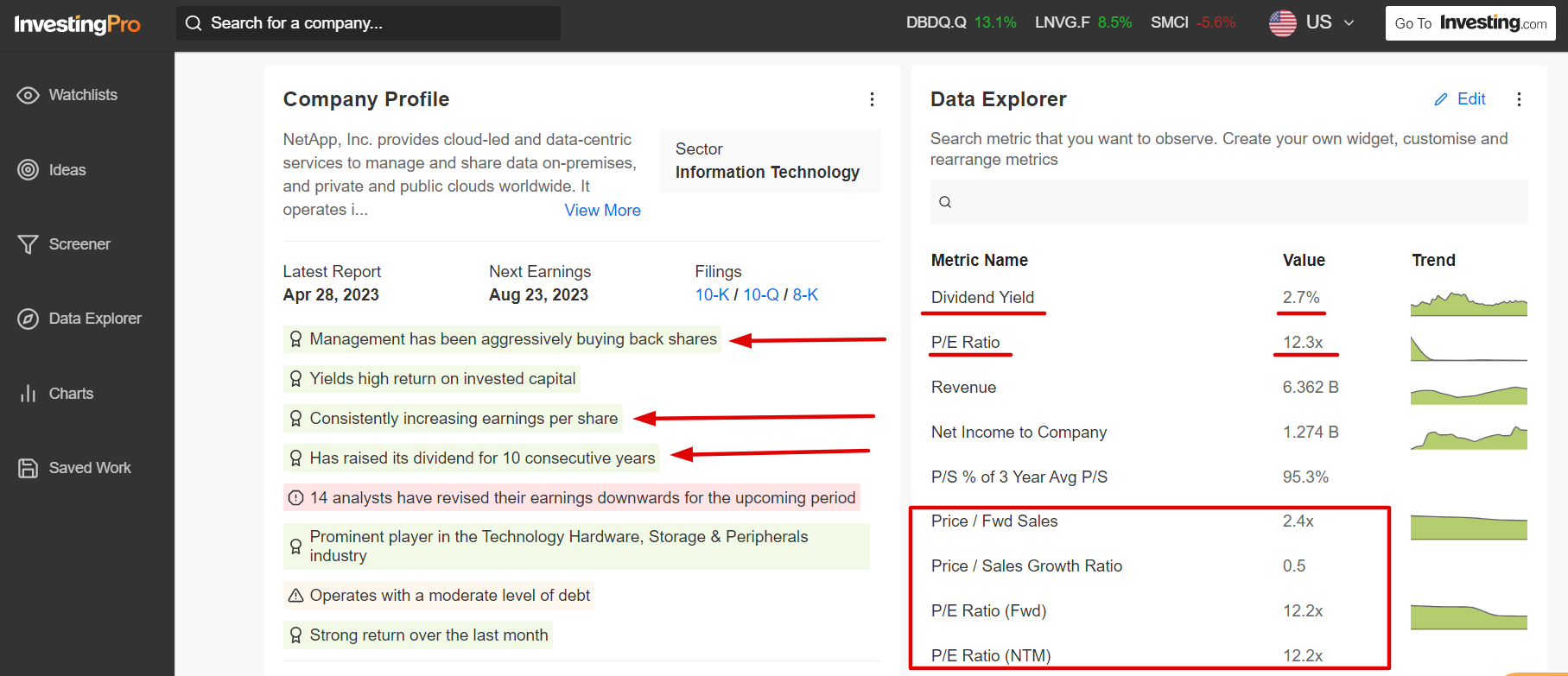

At a current price point of around $73, Investing Pro has flagged NetApp to provide significant long-term value for shareholders in the months ahead.

NetApp is a data storage and data management solutions company headquartered in San Jose, California. Founded in 1992 with an IPO in 1995, the tech company provides cloud data services for management of applications and data both online and physically.

As Investing Pro points out, NTAP stock could see an increase of around 25% from Tuesday’s closing price, according to a number of valuation models, bringing it closer to its ‘Fair Value’ price target of $91.41 per share. Source: InvestingPro

Source: InvestingPro

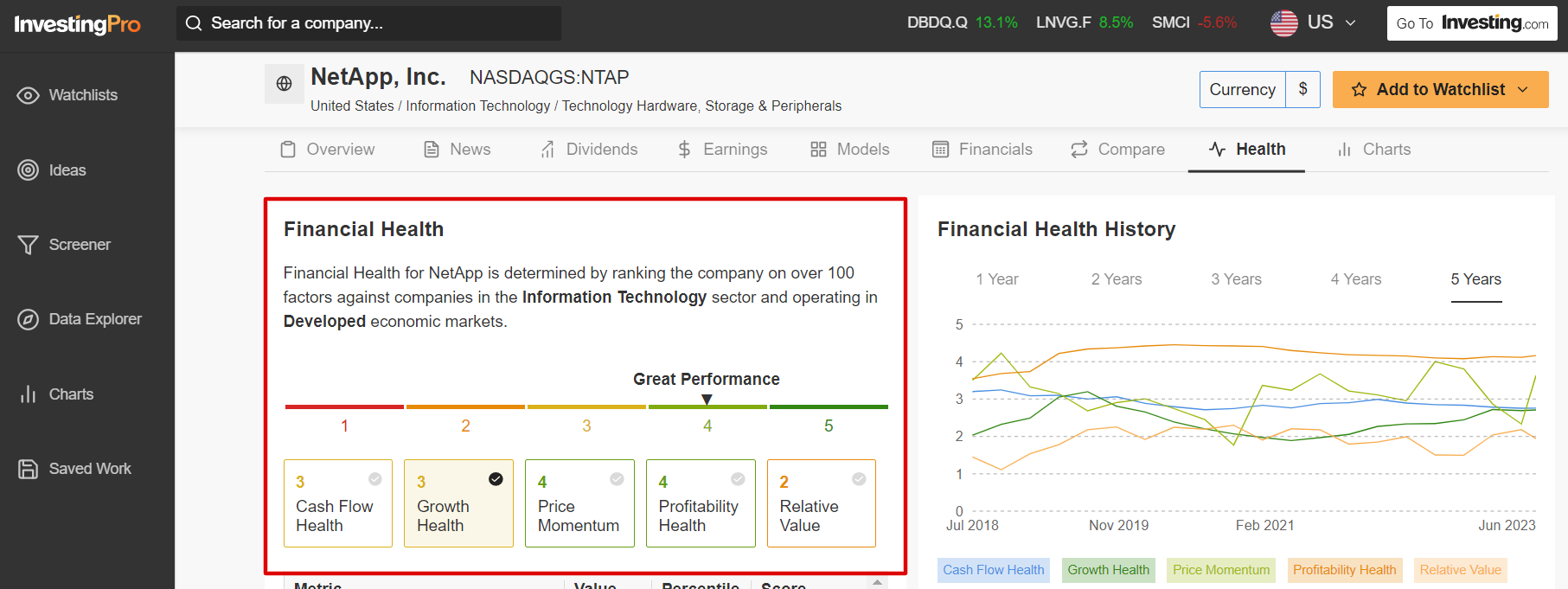

Demonstrating the strength and resilience of its business, NetApp sports a near-perfect Investing Pro ‘Financial Health’ score of 4 out of 5. The Pro Health score is determined by ranking the company on over 100 factors against other companies in the Information Technology sector.

Source: InvestingPro

Investing Pro also highlights several additional tailwinds NetApp has going for it, including healthy profitability, increasing earnings per share, solid cash flow growth, and a relatively cheap valuation. Source: InvestingPro

Source: InvestingPro

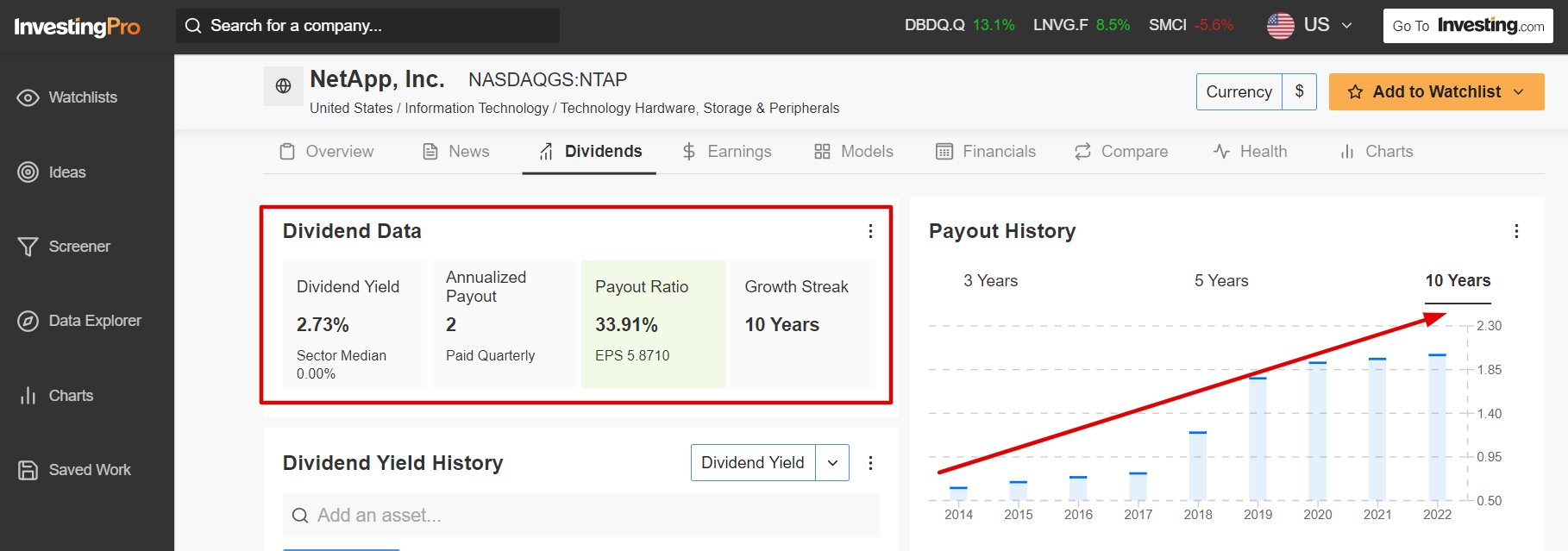

Taking that into account, NTAP is a strong buy to add to a portfolio, especially when you consider its continuous efforts to return more cash to shareholders in the form of higher dividend payouts and share buybacks. Source: InvestingPro

Source: InvestingPro

The cloud services and data management company has raised its annual dividend for 10 years running, highlighting its exceptional track record when it comes to returning excess cash to stockholders. At Tuesday’s closing price, shares currently yield a market-beating 2.73%.

Looking for more actionable trade ideas to navigate the current market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.