Paul Tudor Jones sees potential market rally after late October

The news flow will be heavy again this week, with inflation reports, a Fed meeting, and Treasuries being auctioned off in the 1 PM ET time slot. Additionally, today, Nvidia (NASDAQ:NVDA) will start trading at its post-split adjusted price.

On Tuesday morning, we get the NFIB small business data, and the data in this report can give us one last preview of what the CPI report on Wednesday may hold. Right now, the expectations for Wednesday’s CPI report are relatively low for the headline, with analysts estimating a 0.1% m/m gain, down from 0.3% in April. Meanwhile, CPI y/y is expected to rise by 3.4%, which aligns with April. Core CPI is expected to be hot again, rising by 0.3% m/m and flat with April. Core CPI is also expected to rise by 3.5% y/y, down from 3.6%.

Of course, the Fed meeting will occur later that day. While no changes to monetary policy are expected, it seems reasonable to assume that the Fed is likely to upgrade its outlook for the economy, possibly increasing its inflation forecast while reducing the number of rate cuts and potentially raising its longer-term run rate.

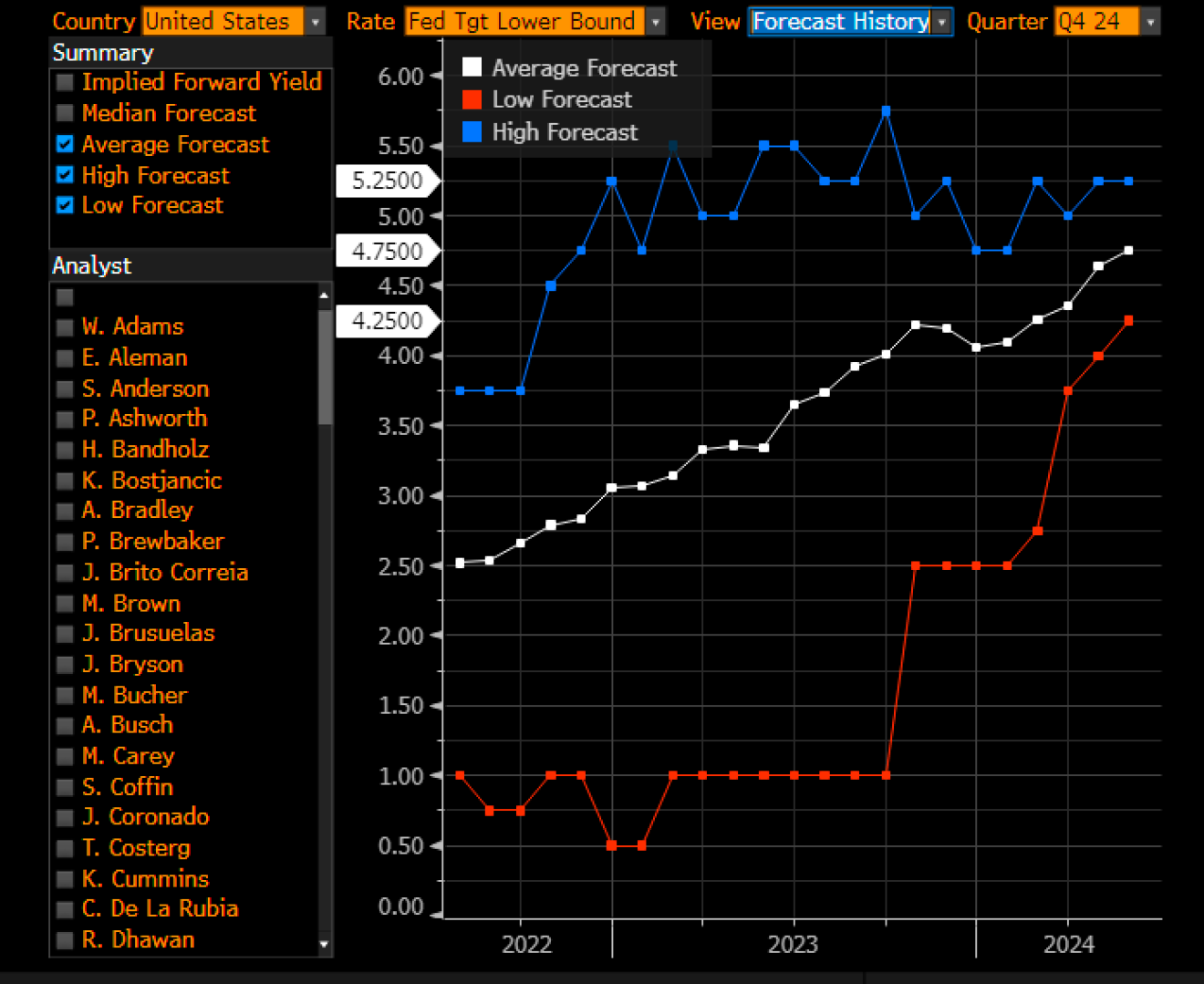

While the bond and even currency markets have already made adjustments and priced in fewer rate cuts in 2024, it isn’t entirely clear that the equity markets have. That may surprise some, especially those who follow the bond market expectations as closely as we do here. But both JPMorgan and Citigroup indeed moved their first-rate cutback from, get this, from July?!? Yes, July. Come on. Wall Street analysts are still predicting that the Fed Funds Rate will be 4.75% by the end of this year.

(BLOOMBERG)

Meanwhile, Fed fund swaps for December only see one rate cut. The bond market has been looking for only one rate cut basically since the middle of April. Meanwhile, analysts had been pricing in a rate of 4.64% in the middle of April, which is closer to three rate cuts.

So when talking about the equity market not caring about rate cuts, be careful—it isn’t that the equity market doesn’t care. It would seem that the equity market just never came into agreement with the bond market’s viewpoint. Even now, sell-side analysts are still looking for two rate cuts in 2024.

So be careful when you think the equity market doesn’t care; the equity market does care; it cares because the advance has slowed materially in recent months, and the Nvidia-less Dow and the Russell tell a different tale than the S&P 500 and Nasdaq 100.

I would expect that after this week, even fewer sell-side will be seeing rate cuts because my best guess from listening to the Fed speakers is that the median dots were almost split between two and three rate cuts in March and are likely to be split between 0 and 1 rate cut in June and that the longer-term run rate is likely to move higher.

In the meantime, the job report and hot wage data call into question, I think, where monetary policy is. I know that there has been plenty on social media about how bad the data was. However, I struggled to find the bad data. It was healthy NFP growth, and the household survey is always very volatile.

The unemployment rate was 3.96% in May, so you only need a few thousand new workers to be added for it to fall back to 3.9%. It is just like all those who opined last year that inflation was vanishing because if you take this out and put that in, the CPI rate is 2%.

Unfortunately, that just isn’t how it works; we don’t get to pick and choose the data points we like and omit those we don’t like. We care about the trends, and the trend in employment overall is solid and inconsistent with 2% inflation, with wage growth at 4.1% and productivity at 0.2% in the first quarter. Even if the CPI prints at 0.1% on the headline this month, you will need nearly six months of 0.1% and 0.2% readings to be sure inflation is beat, and I don’t see that happening anytime soon.

So, when we look at the 2-year at this point, we see what could be a giant cup-and-handle pattern. If that is correct, the 2-year rate is heading much higher and could surpass the highs it saw in October 2023 at around 5.25%.

Meanwhile, the USD/CAD broke out to the upside on Friday, as I have been waiting for. If this break out sticks and we start to see it move back to and test that 1.385 level it would probably come in conjunction with equity prices moving lower.

Meanwhile, the S&P 500 has reached the 100% extension off the lows witnessed in March 2023 and appears to have formed an ending diagonal triangle. If the 2-year does break out to the upside and the USD/CAD moves higher, then it seems like the odds for a significant pullback in the S&P 500 could happen, finally.