IonQ CRO Alameddine Rima sells $4.6m in shares

This will be a quiet week with very little data and a day off mid-week. The retail sales data will come on Tuesday; Tuesday will also be VIX Opex; Wednesday, the markets will be closed, and Friday will be quarterly OPEX.

So this will be a bit strange from that perspective. Having some mushy data from the last two weeks, retail sales may take on some extra importance, with expectations for an increase of 0.3% m/m from a flat month. The control group is expected to rise by 0.4% versus a decline of 0.3% last month.

It is possible that, like the job data, the retail sales data in April was weaker due to the Easter holiday falling in March, making the May data even more critical. A better-than-expected retail sales data point would undoubtedly ease some fears that the economy is truly slowing. At the same time, a weaker number would see a slower growth narrative take hold.

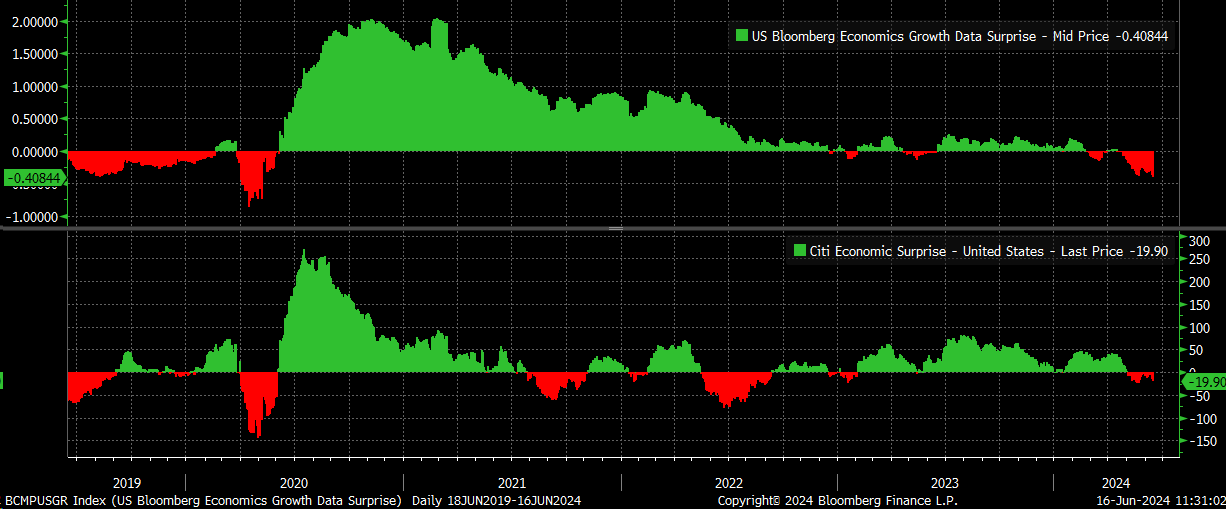

Both the Citi Economic Surprise Index and the Bloomberg Economic Growth Surprise Index have turned negative in recent weeks, solidifying the idea that the data has been notably softer recently.

The thing with the CPI report is that generally speaking, a weak CPI would suggest weak retail sales since retail sales are reported in nominal terms. Additionally, a CPI report of 0.0%, while just one, is a big concern for me because typically, the only time we have seen weak inflation or changes in the inflationary trend is around times of recession.

The real clue here as to what the market is thinking about is if we start to see Treasury rates move lower and high-yield spreads widen. That is a sign that the bond market is beginning to price in some risk to the soft landing narrative.

It is tough to tell at this point because we are seeing the stress in France rippling across Europe, with French and German spreads widening out and causing a flight to safety into US bonds. The spread between the two bonds widened to 76 bps on Friday, the widest since 2017 and the European debt crisis in 2011.

This fits in perfectly with what we have been seeing across the USD/MXN FX pair and the spread between the Italian and German 10s, which we have been discussing now for several weeks. Whether the events in France are the true source of concern for stability across Europe or whether the market is merely using the headlines as a “reason” to derisk, the derisking is real. It is taking place across high-yield spreads in Europe and the US, and so far, the only entity immune has been the market cap weight S&P 500, as noted by the falling earnings yield.

Before making conclusions as to why rates are falling in the US, look globally; if rates in Europe are down sharply, realize that the move lower in US rates is a move a flight to safety. This means that paying attention to spreads is more critical than ever because right now, the idea of falling rates leading to rising stocks is wrong; stocks will rise on falling rates if spreads are narrowing, and right now, spreads are widening, and that is why the IWM is not rallying and instead falling.

If the HYG ETF is dropping, and ETFs like the IEF and TLT are rising, it is the best signal one can use that spreads are widening and, as a result, the Russell is likely falling.

Right now, the IWM is in an important spot, at $198.75, which was resistance and support going back to August 2022. A break of this region will set up an even more critical test of the neckline of a double top around $191.50.

Softer data and wider spreads would not benefit regional or any banks. So, the KRE should be watched, especially if it breaks support at around $46. That is a significant level, especially with a gap open about 8 to 9% below the current price.

The Stoxx 600 broke a major uptrend last week, also broke support at 513, and has a downtrend clearly in place on the RSI. For now, the next region of support appears to come somewhere around 502.50, followed by 495.

Nasdaq 100: Is a Trend Reversal Possible at This Point?

If there is a significant market turn, it could be near; the NASDAQ 100 recently extended 100% off its intraday October 2022 low, July 2023 high, and October ’23 low. So, when using things like Fibonacci levels, it doesn’t mean it has to turn lower, but if there were a place, based on the Fibs, this is the region where such a move lower could start.

Given how stretched valuations are and the weakness we are seeing across the rest of the market, along with the widening of credit spreads and the timing of VIX and Equity Options expiration, this seems like a time and a place that is ideal to see a reversal of a trend, with a drop back to 18,000 a reasonable first stop.

I’m not sure how many have seen this chart on UPS recently, but it is interesting as it sits on support from 2018. A break of this support level could potentially result in the stock dropping further and filling a gap from July 2020, which is nearly $125.

The Workday (NASDAQ:WDAY) chart is one of the uglier charts I have seen recently. The region between $200 and $220 is very important because a move below $200 opens a path to significantly lower levels, perhaps into the $170, with very little, if any, support between, even if the stock is already oversold on the RSI.