Verizon to cut 15,000 jobs amid growing competition pressures - WSJ

Stocks finished the day lower, but the FX market had a lot more action, especially in the Japanese yen, which moved sharply against the Australian dollar, the US dollar, the euro, the Canadian dollar, and even the peso.

The move in the yen was broad-based across the market, and it looks like a massive unwind is taking place globally.

Perhaps it is fear of a rate hike next week from the BOJ, fear of more FX intervention, or just the shorts getting squeezed out of positions. Whatever the case, the move is significant.

You rarely see 1% and 2% moves in a currency pair, let alone the numbers seen yesterday. More importantly, it places the yen in an essential place as it approaches the lows seen on July 18. A break of that support level could send the USD/JPY perhaps back into the low 150s.

The AUD/JPY’s positioning is the same: It sits on support 103.00. A break of 103 could open the door to lower levels on the AUD/JPY.

The AUD/JPY is one of the more critical risk-on/off gauges, and risk assets like the S&P 500 tend not to deviate too far from this FX pair.

So, if the AUD/JPY does break support, it would be a risk-off signal that suggests treading cautiously in the US equity market.

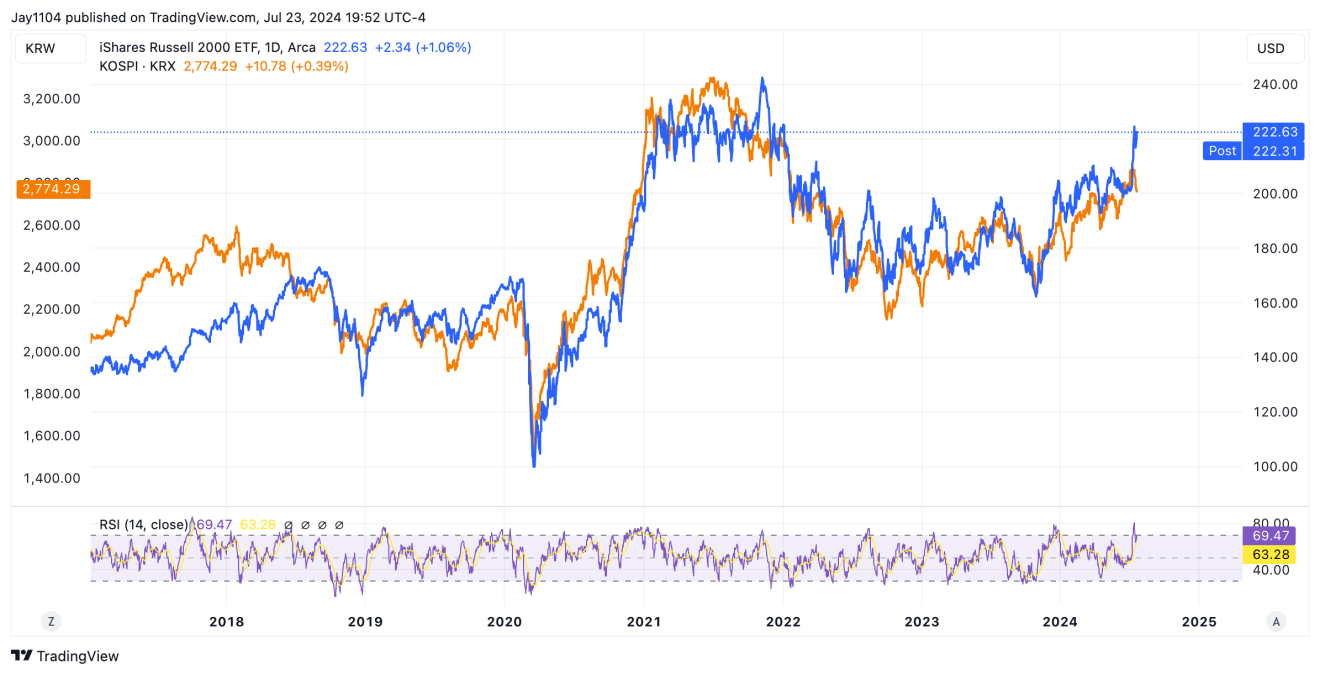

Russell 2000 to Follow Kospi Lower?

The Russell 2000 was up again yesterday, but I have my doubts it has much further to go at this point because the Kospi is suggesting a turn lower is due. The Russell and the KOSPI in South Korea have always had a strong relationship. The Kospi had moved higher ahead of the Russell, and now the IWM is catching up to the Kospi. However, the Kospi has turned lower more recently.

Tesla Eyes $200

I noted yesterday that Tesla (NASDAQ:TSLA) options appeared to be too bullish before earnings. The stock was trading lower by around 8% after hours. Revenue and overall gross margins were better, but earnings missed, as did cash flow. The Robotaxi announcement was officially pushed back to October, which did not help.

One could make a case that the inverse head and shoulders pattern is complete, and the stock is now reversing and heading back to lower levels. I wouldn’t be shocked if the stock moved back down to $200, based purely on the technical charts.

Alphabet's (NASDAQ:GOOGL) results were better, with no real surprises, and dull. The stock was mostly higher after hours until we got to that part of the earnings call when analysts asked about monetizing AI. That part really failed to impress; patience is key, which was the main takeaway.

If 2Q turns into a show-me quarter, meaning investors want to see the results of all this AI investment, it may be a long earnings season because, based on my trivial use of some of these products, the hype is much larger than the benefit. Yeah, sure, Chatgpt is better than Siri, but it is probably not good enough to justify the valuations that the market has assigned.

Disclaimer: Michael Kramer and the clients of Mott Capital Own GOOGL