Can anything shut down the Gold rally?

* Travel, mining stocks lead gains

* BA owner IAG jumps on multiple PT hikes

* Spain's Amadeus tops STOXX 600

* Positive EU manufacturing data boosts sentiment

(Updates with market close)

By Sruthi Shankar and Ambar Warrick

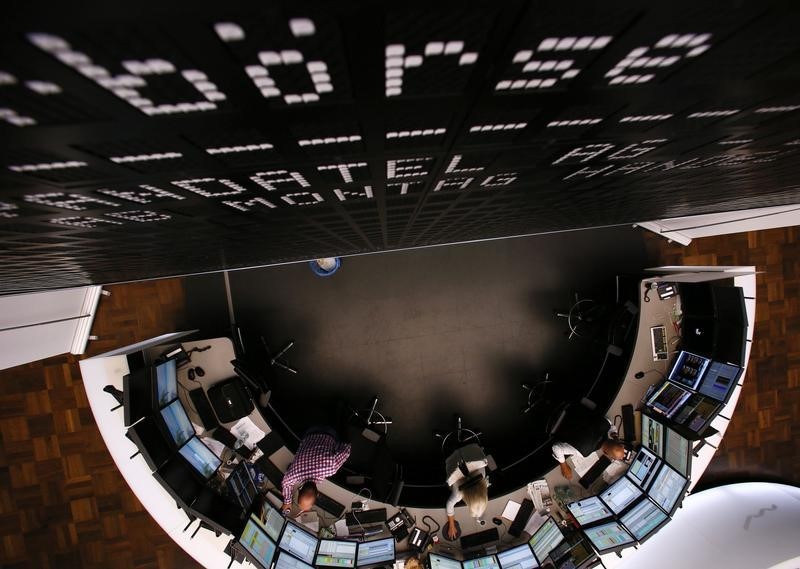

March 1 (Reuters) - European stocks ended higher on Monday

after bond markets stabilized from a sharp selloff last week,

with travel and leisure stocks leading gains on optimism over

COVID-19 vaccination programmes and a large U.S. stimulus

package.

The pan-regional STOXX 600 index .STOXX rose 1.8%, its

best day since early November, after losing more than 2% last

week. Travel and leisure stocks .SXTP added more than 3%.

Data also showed manufacturing activity picked up pace in

major euro zone economies in February, inspiring some confidence

about an economic recovery this year, while a separate reading

showed German inflation held steady in the month. European stocks had retreated from one-year highs last week

as the possibility of rising inflation and higher bond yields

fuelled concerns over monetary policy tightening by central

banks.

Accommodative policies and bumper stimulus measures have

enabled stocks to recover from pandemic-driven lows last year.

Global stocks rallied on Monday tracking a pullback in

yields, while the rollout of a third COVID-19 vaccine in the

United States, along with progress towards a $1.9 trillion

stimulus package, also boosted sentiment. MKTS/GLOB

"Equities should prove resilient, but the recent pick-up in

real yields deserves to be watched. It is more toxic for highly

valued risk assets, including growth stocks," analysts at

Generali Investments wrote in a note.

Overall, the analysts said they maintained "a moderate

pro-risk tilt", with potential pullback in stocks providing

buying opportunities as economies look to re-open.

British stocks rose in anticipation of Finance Minister

Rishi Sunak announcing more borrowing on top of his almost 300

billion pounds ($418 billion) of COVID-19 spending and tax cuts

in a budget statement on Wednesday. Homebuilders such as Persimmon PSN.L , Taylor Wimpey TW.L

and Barratt Developments BDEV.L were the top gainers on the

FTSE 100.

Among other movers, Spanish travel booking group Amadeus

AMA.MC topped the STOXX 600 as expectations of a 2021 recovery

in travel demand drove a slew of price target hikes by major

brokerages.

British Airways-owner IAG ICAG.L also jumped 7% on similar

upgrades.

French food group Danone DANO.PA rose 1.4% after it said

it was taking a first step toward selling its stake in its

Chinese dairy partner Mengniu Dairy 2319.HK , and would use the

gains to buy back its own shares. Swiss-listed shares of computer goods maker Logitech

International LOGN.S rose 1.6% after it raised its sales

growth forecast to about 63% for fiscal 2021, up from the 57-60%

range it previously expected.