ION expands ETF trading capabilities with Tradeweb integration

- U.S. data, Fed rate outlook in focus this week.

- Apple stock is a buy ahead of highly anticipated WWDC23 event.

- Nio shares set to underperform with downbeat earnings on deck.

- Looking for a helping hand in the market? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

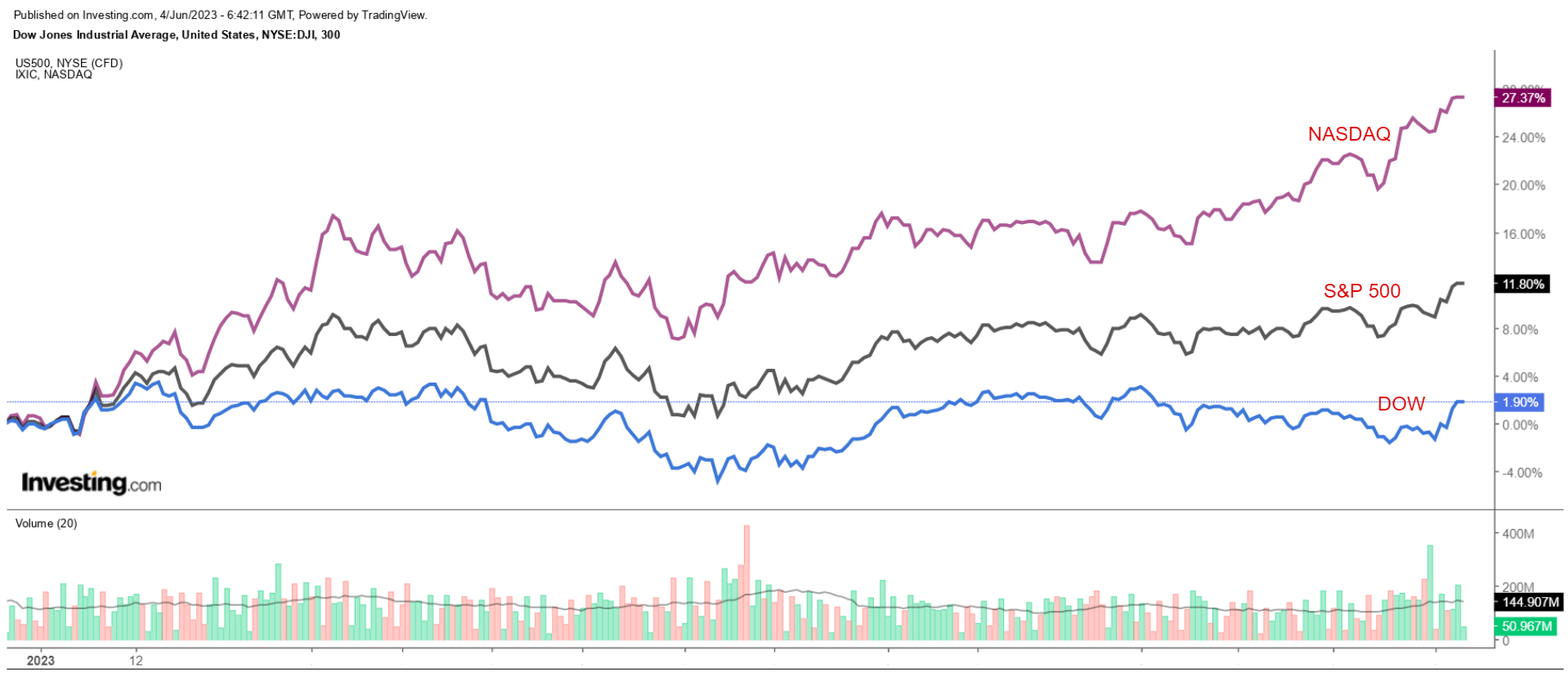

Stocks on Wall Street ended sharply higher on Friday, with the S&P 500 rallying to its best level since August 2022 as investors cheered a strong jobs report and the passage of a debt ceiling bill that averted a catastrophic default.

For the week, the blue-chip Dow Jones Industrial Average rose 2%, the benchmark S&P 500 tacked on 1.8%, while the tech-heavy Nasdaq jumped 2% to notch its sixth-straight week of gains.

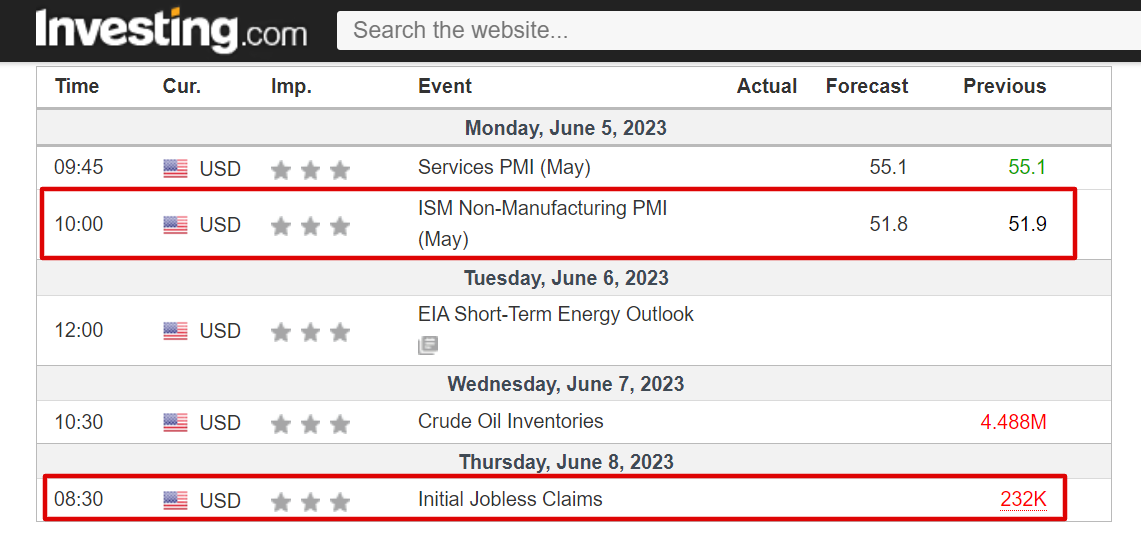

The week ahead is expected to be a relatively quiet one as market players continue to assess the outlook for interest rates, the economy and inflation.

On the economic calendar, most important will be the Institute for Supply Management's (ISM) service-sector PMI survey scheduled for Monday, followed by the latest jobless claims report due on Thursday.

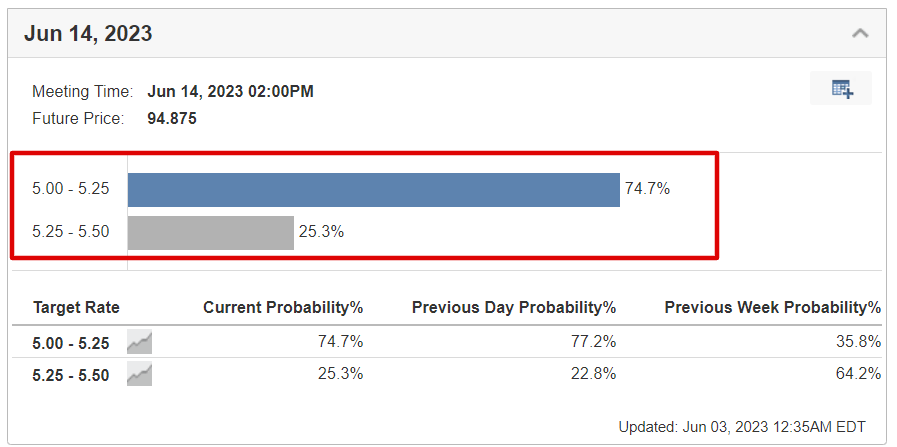

Meanwhile, there are no Fed speakers on the agenda for this week as the U.S. central bank goes into its pre-FOMC meeting blackout period ahead of its June 14 policy decision.

As of Sunday morning, financial markets are pricing in a roughly 75% chance of a pause later this month and a near 25% chance of a 25-basis point rate increase, according to Investing.com’s Fed Rate Monitor Tool.

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including DocuSign (NASDAQ:DOCU), Stitch Fix (NASDAQ:SFIX), Campbell Soup (NYSE:CPB), JM Smucker (NYSE:SJM), GameStop (NYSE:GME), Signet Jewelers (NYSE:SIG), Vail Resorts (NYSE:MTN), and Ciena (NYSE:CIEN).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, my timeframe is just for the week ahead, June 5 to June 9.

Stock To Buy: Apple

After ending the week at a fresh 52-week high, I expect Apple's (NASDAQ:AAPL) stock to extend its uptrend in the days ahead as the tech giant hosts its Worldwide Developers Conference (WWDC), at which it is likely to unveil its long-awaited augmented reality headset and show off its latest hardware and software innovations.

Apple’s WWDC event has a history of moving AAPL shares, often resulting in sizable single-day moves. The stock has rallied in the past when new products, features and growth initiatives were announced at the annual event.

The five-day extravaganza will kick off at Apple’s headquarters in Cupertino, California on Monday, June 5, beginning with a keynote address by CEO Tim Cook that is set to take place at 1PM ET / 10AM PT.

The consumer electronics conglomerate is widely expected to unveil its highly anticipated mixed reality headset, seemingly called ‘Reality Pro’, in what would be the company’s first new hardware product since the debut of the Apple Watch in 2015.

Besides this, Apple is also expected to reveal a new 15-inch MacBook Air and an Apple Silicon-powered Mac, as well as the latest operating system updates for the iPhone, iPad, Mac, Apple TV, and Apple Watch.

In addition, Apple could also detail its AI strategy for the first time. While the tech behemoth has remained relatively quiet about its AI plans, the company’s job listings indicate that it is searching to hire people who specialize in the field.

AAPL stock ended Friday’s session at $180.95, its highest closing price since Jan. 4, 2022. Shares currently stand less than 2% away from a record high of $182.94 reached in January 2022.

At its current valuation, Apple has a market cap of $2.85 trillion, making it the most valuable company trading on the U.S. stock exchange, ahead of Microsoft (NASDAQ:MSFT), Google-parent Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Nvidia (NASDAQ:NVDA).

Shares are up 39.2% year-to-date, outperforming the broader market by a wide margin over the same timeframe amid the ongoing rally in mega-cap tech stocks.

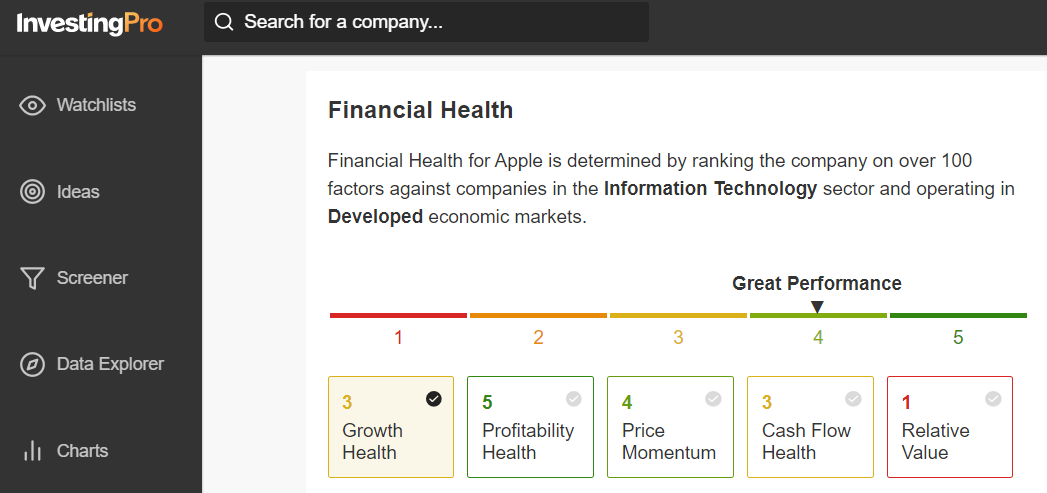

Not surprisingly, Apple currently boasts an above-average ‘Financial Health’ score of 3.2 out of 5.0 on InvestingPro.

Source: InvestingPro

That should bode well for Apple investors as companies with health scores greater than 2.75 have consistently outpaced the broader market by a wide margin over the past seven years, dating back to 2016.

Stock To Sell: Nio

I believe shares of Nio (NYSE:NIO) will suffer a challenging week, as the struggling Chinese electric vehicle maker will deliver disappointing earnings in my view and provide a weak outlook due to the negative impact of various headwinds on its business.

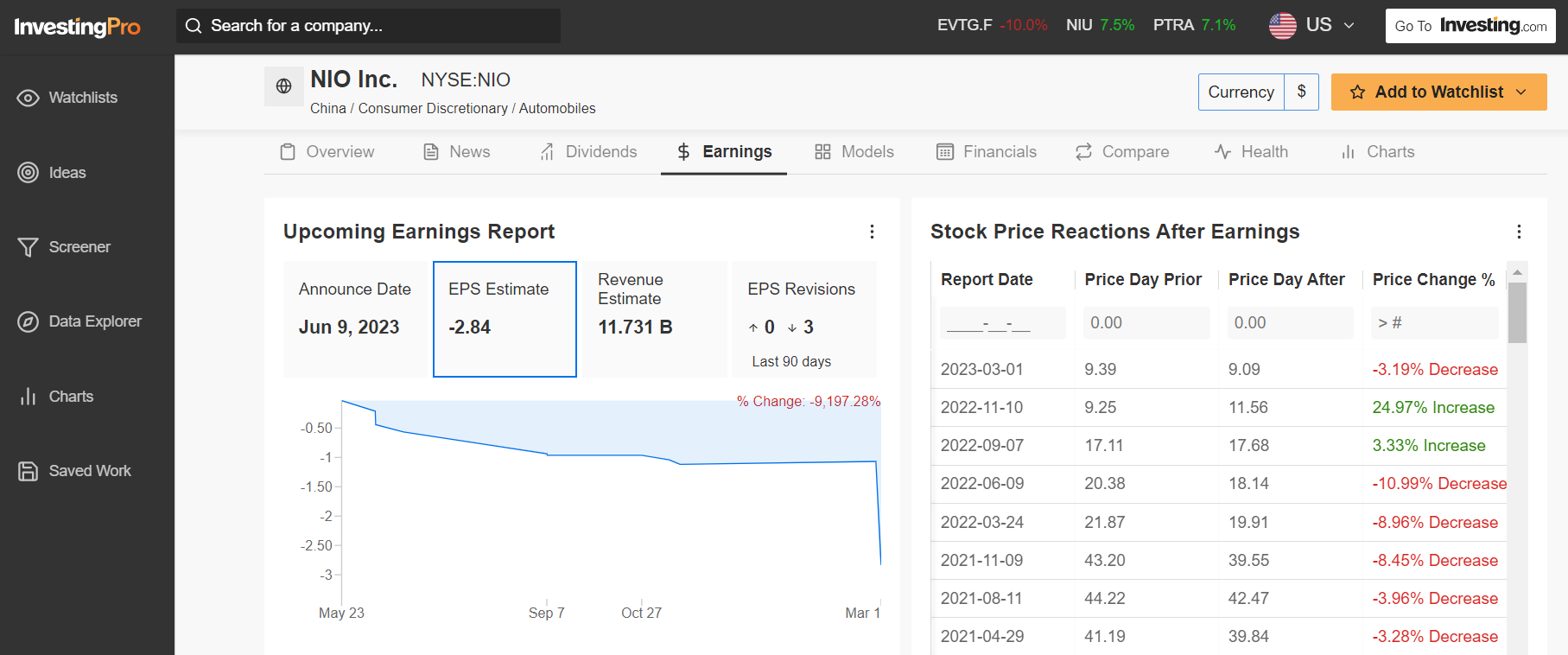

Nio’s financial results for the first quarter are due ahead of the opening bell on Friday, June 9, and are likely to reveal another quarterly loss and slowing sales growth due to the tough economic climate.

Market participants expect a sizable swing in NIO stock following the Q1 update, with a possible implied move of roughly 15% in either direction, according to the options market.

Ahead of the report, analysts have slashed their EPS estimates three times in the last 90 days, compared to zero upward revisions, as per an InvestingPro survey.

Source: InvestingPro

Wall Street sees the EV company losing $0.40 a share (¥2.84) in the first quarter, worsening from a net loss of $0.11 (¥0.79) in the year-ago period, as it spends heavily to fend off competition from domestic rivals such as Li Auto (NASDAQ:LI), Xpeng (NYSE:XPEV), and BYD (OTC:BYDDY), as well as more established global automakers, including Tesla (NASDAQ:TSLA), and Volkswagen (ETR:VOWG_p).

Meanwhile, revenue is forecast to increase 18.6% annually to $1.66 billion (¥11.73 billion), however, that would mark a sharp slowdown from the sales growth of 62% seen in the previous quarter as Nio struggles in the face of weakening demand amid a deteriorating EV market.

That leads me to believe that there is a growing downside risk that Nio could cut its sales guidance and delivery outlook for the rest of the year.

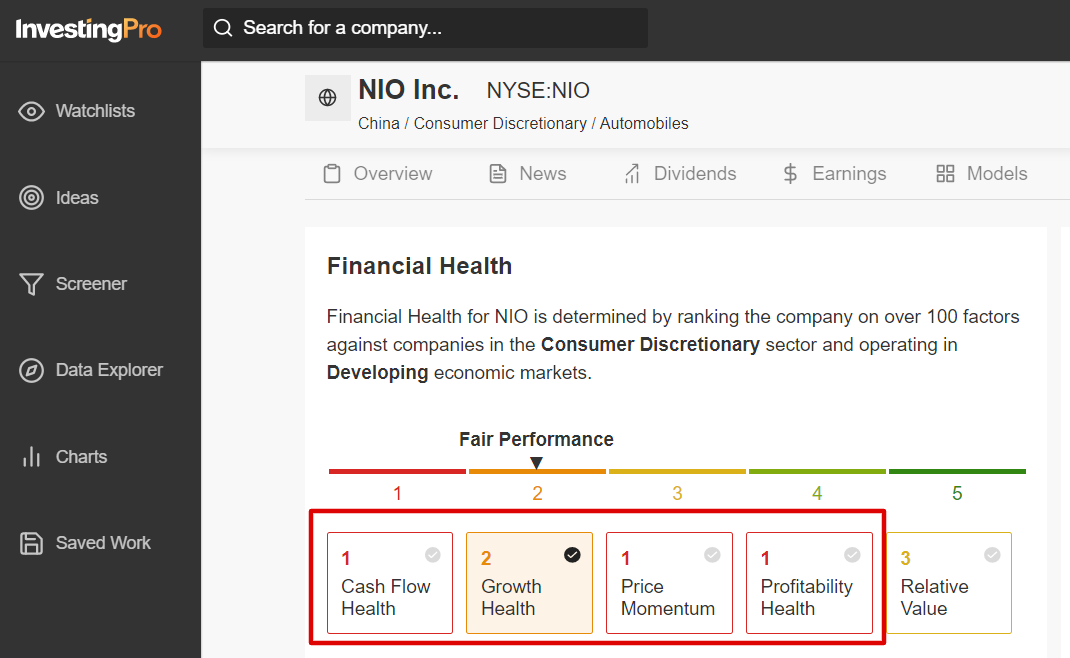

Underscoring the negative impact of several near-term headwinds, Nio currently has an extremely poor InvestingPro ‘Financial Health’ score of 1.6 out of 5.0 due to concerns about profitability, growth, and free cash flow.

Source: InvestingPro

The Pro health metric is determined by ranking the company on over 100 factors against other companies in the Consumer Discretionary sector.

NIO stock fell to a low of $7.00 on Thursday, a level not seen since June 2020, before recovering slightly to end at $7.56 on Friday. At current valuations, Shanghai-based Nio has a market cap of $12.6 billion.

Shares are down 22.4% so far in 2023, trailing the comparable returns of domestic rivals such as Li Auto, and Xpeng, as well as other notable global automakers, including Tesla, Toyota, Honda, Ford, and GM.

Even more alarming, NIO remains nearly 90% below its January 2021 all-time high of $66.99.

If you’re looking for more actionable trade ideas to navigate the current volatility on Wall St., the InvestingPro tool helps you easily identify winning stocks at any given time.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.