Bitcoin price today: retreats to $121k after record highs amid US shutdown caution

Investing.com - Canada’s main stock exchange gained solidly on Friday, as investors eyed an intensifying trade war between the United States and China.

By the 4:00 ET close, the S&P/TSX 60 index added 34.6 points, 2.5%.

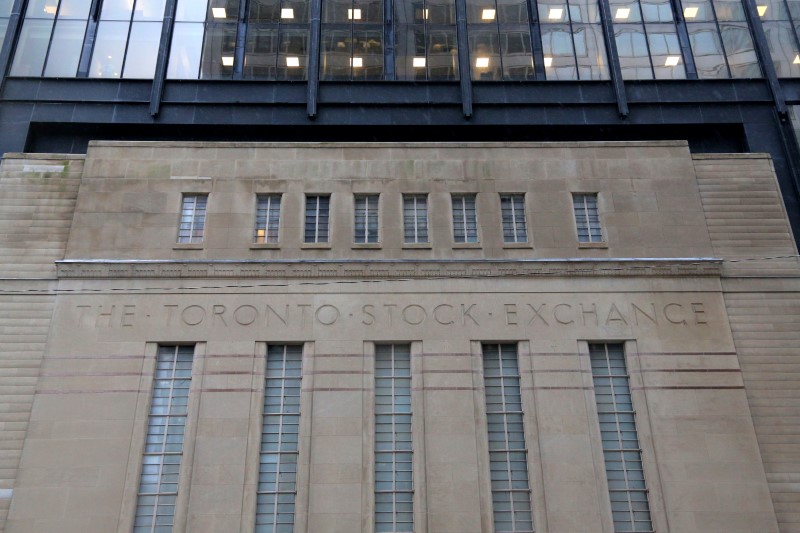

The Toronto Stock Exchange’s S&P/TSX composite index was up 572.9 points, or 2.5%. The index finished lower on Thursday, erasing much of the day’s steep gains. In Wednesday’s session, the average notched its biggest advance since 2020.

Canadian Prime Minister Mark Carney said he would be convening a meeting of his top advisers on Friday to discuss the threat posed by U.S. tariffs.

Elsewhere, China announced that it will raise its import tariffs on U.S. goods to 125% in retaliation to a recent hike in levies imposed by Trump.

The duty is an increase from 84% announced by Beijing on Wednesday, and is the latest escalation in an intensifying trade war between the U.S. and China. It will take effect from Saturday, Beijing said.

U.S. stocks up

U.S. stock indexes finished modestly higher after China raised its duty on U.S. imports.

At the 4:00 ET close, the Dow Jones Industrial Average rose 619 points, or 1.6%, S&P 500 added 95.3 points, or 1.8%, and NASDAQ Composite advanced by 337.2 points, or 2.1%.

The successful day comes after main Wall Street indices resumed their losing ways on Thursday, wiping out some of the previous session’s massive gains after U.S. President Donald Trump announced a 90-day reprieve on some of his “reciprocal” tariffs.

In Thursday’s trading, the broad-based S&P fell 3.5%, the blue chip Dow tumbled 2.5%, and the tech-heavy Nasdaq ended 4.3% lower.

Oil heading for losing week

Oil prices gained on Friday, but remained on course for a second consecutive losing week, as worries remained that the trade tensions between the U.S. and China -- the two largest economies in the world -- will hit crude demand.

As of 4:45 ET, Crude Oil WTI Futures gained 2.3% to $61.45 per barrel. Brent Oil Futures also enjoyed a rise, up 2.1% to $64.65 a barrel.

Both benchmark contracts are set to drop around 4% this week, adding to their 11% falls in the prior week.

Traders are concerned that deepening international trade tensions will hurt demand, especially given that China, now the major focus of Trump’s punishing tariffs, is the world’s biggest crude importer.

Gold touches record high

Gold prices surged to a fresh record high, extending a recent run-up, as demand for safe-haven assets remained underpinned by heightened concerns over an intensifying U.S.-China trade war.

By 4:50 ET, Gold Futures were up 2.4%, pricing in at $3,252.79/oz. XAU/USD was also up 1.9% to $3,235.04 an ounce.

The yellow metal clocked stellar gains this week, outpacing all other metals, as investors piled into bullion and the yen as perceived safe havens. Weakness in the dollar helped spark some gains.

Demand for gold was supported by heightened volatility in risk-driven assets that has been driven by the U.S. and China imposing steep trade tariffs on each other.

(Scott Kanowsky also contributed to this article)