Raymond James raises Fulgent Genetics stock price target to $36 on strong performance

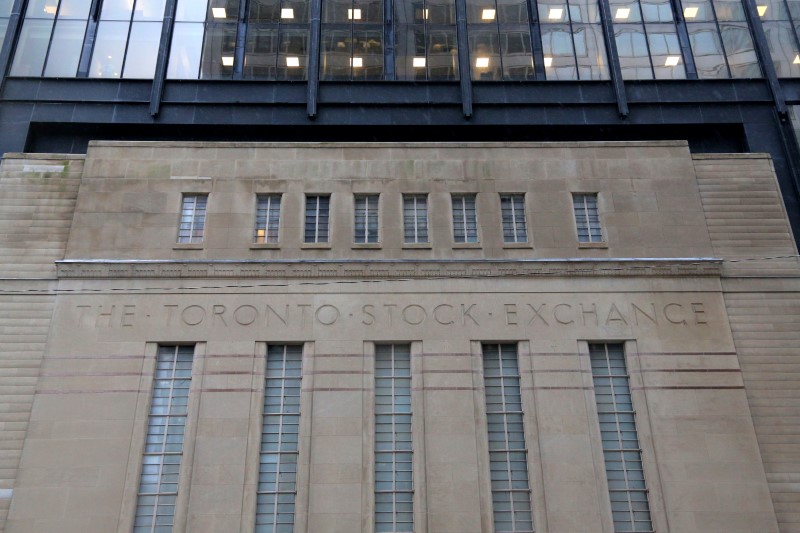

Investing.com -- Canada’s main stock index fell on Monday, as investors awaited renewed trade talks between the U.S. and China in London.

Toronto Stock Exchange’s S&P/TSX composite index closed downward by 53.3 points, or 0.2%.

Elsewhere, Beijing signaled that it would be open to fostering improved relations with Canada after Prime Minister Mark Carney spoke with Chinese Premier Li Qiang late last week.

By the 4:00 ET close, the S&P/TSX 60 index finished lower by 5.4 points, or 0.3%.

Underpinning sentiment were Canadian and U.S. job market data points which suggested that the labor market in both of the North American economies was slowing at a steady enough pace to avoid a potential recession.

Optimism around the prospect of today’s talks between U.S. and Chinese officials also pushed up oil prices, bolstering the Canadian index.

Prime Minister Mark Carney announced plans for Canada to reach NATO’s 2%-of-GDP defense spending target by the end of the fiscal year, expediting the uptick in military spending by 6 years, as the previous timeline projected 2032.

In alignment with NATO’s defense industrial pledge, Ottawa will commit to developing a strengthened domestic defense manufacturing base and investing in advanced technology across cyber, AI, quantum computing and space domains. These efforts aim to curb Canada’s reliance on foreign suppliers and close longstanding capability gaps.

U.S. stocks close higher

Wall Street’s main indexes showed minimal gains on Monday amid caution ahead of renewed trade talks between Washington and Beijing, as well as key inflation data later in the week.

At the 4:00 ET close, theDow Jones Industrial Average was flat, the S&P 500 gained 5.5 points, or 0.1%, and the NASDAQ Composite gained 61.3 points, or 0.3%.

Risk appetite has been rattled by signs of steadily increasing civil unrest in Los Angeles, after the national guard was deployed over the weekend to quell widespread protests against President Donald Trump’s immigration policies.

The markets were bolstered by a 4.6% uptick in Tesla (NASDAQ:TSLA) stock, as U.S. President Donald Trump signaled easing tensions with Tesla CEO Elon Musk, following last week’s back-and-forth. In a press conference, Trump said he only wishes Musk “well, very well.”

Apple (NASDAQ:AAPL) held day one of its WWDC (Worldwide Developers Conference), sending shares down 1.2% on the day, as lack of AI focus bored and concerned investors. Among the conference announcements, the company showcased an array of incremental advancements, including a new "liquid glass" design for its operating systems, which will now bear yearly names instead of sequential numbers to simplify and unify the naming conventions across various Apple devices.

Elsewhere, Nvidia (NASDAQ:NVDA) CEO Jensen Huang is partaking in a tour around Europe, with a stop today in the U.K. The CEO previously hinted at many potential Europe data center-focused deals just weeks ago, and the chipmaker’s stock rose 0.6% on the day.

U.S.-China trade talks

Top White House officials are meeting their Chinese counterparts in London, in an attempt to reach an agreement and resolve a bitter trade dispute between the world’s biggest economies.

U.S. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer will meet with top-level Chinese officials, Trump said last week.

China’s foreign ministry confirmed over the weekend that vice premier and top trade negotiator He Lifeng will be in the U.K. this week, and that trade talks with Washington will take place.

Both sides have been at odds over Trump’s threat of elevated tariffs and the supply of rare earth minerals from China, despite a preliminary agreement reached in Geneva last month that included a temporary pause and lowering of punishing tit-for-tat levies. Trump’s so-called "reciprocal" duties on China are now on hold until August 12.

Data released earlier Monday showed that China’s export growth decelerated to a three-month low in May as the country grappled with U.S. tariffs that weighed on shipments.

Though there have been no announcements regarding the talks, the representatives will meet again tomorrow, pointing to productive talks today and adding to anticipation of a potential deal .

The focus this week will also be on key consumer price index inflation data, due Wednesday, for more cues on the world’s biggest economy.

The print is expected to show inflation picking up slightly in May amid higher electricity prices and trade tariffs, with the annual figure seen rising to 2.5% from 2.3% the prior month.

Investors are looking to more U.S. economic readings to gauge the impact of Trump’s policies on growth, especially the uncertainty surrounding trade policies.

Gold steadies

Gold prices ticked slightly higher, as risk appetite improved in anticipation over the high-level U.S.-China trade talks.

Bullion was sitting on strong gains from last week, as a mix of U.S. economic uncertainty and a soft dollar kept traders largely biased towards havens. While stronger than expected nonfarm payrolls data did slightly offset this trend, gold remained strong and about $200 away from record highs.

By 5:35 ET, Gold Futures were mostly level, while Gold Spot gained 0.5% at $3,325.70/oz.

Crude retains recent strong tone

Oil prices steadied Monday, retaining most of last week’s gains as traders watched for news from the U.S.-China trade talks in London.

WTI Crude was up 1.3% at $65.39 a barrel by 5:45 ET, while Brent Oil gained 1%, pricing in at $67.13 per barrel.

The prospect of a U.S.-China trade deal has boosted some investors’ risk appetite and supported oil prices amid hopes a deal will boost economic growth and thus demand for energy.

(Scott Kanowsky and Pratyush Thakur also contributed to this article)