US LNG exports surge but will buyers in China turn up?

* Germany's Delivery Hero tops STOXX 600

* Europe launches cross-border vaccination programme

* Germany's DAX index ends at record high

* London markets shut for Boxing Day

* Automakers cheer Brexit deal

(Updates to market close)

By Shashank Nayar and Ambar Warrick

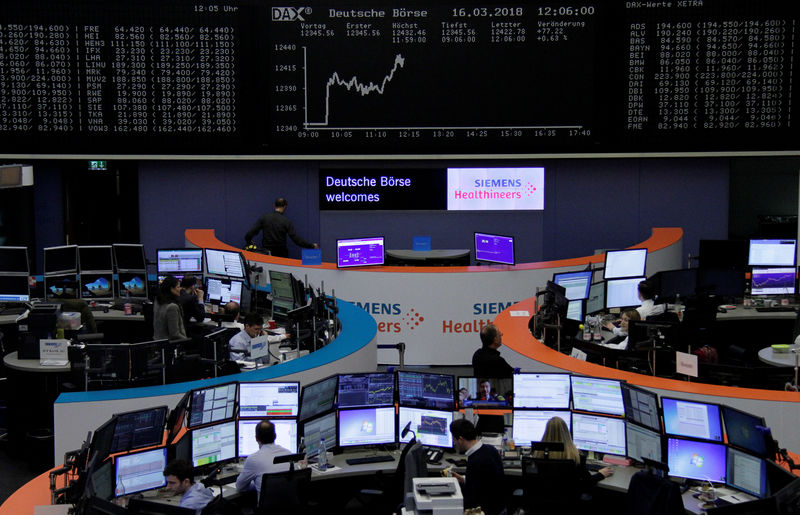

Dec 28 (Reuters) - European shares marked their strongest

close in 10 months on Monday, with German shares hitting a

record high as relief over long-awaited U.S. coronavirus relief,

a Brexit trade deal and a vaccine programme lifted spirits in

thin holiday trade.

U.S. President Donald Trump on Sunday signed into law a $2.3

trillion pandemic aid and government spending bill, causing some

optimism over near-term economic prospects. The launch of a cross-border European vaccination programme

on Sunday also fuelled hopes of a pandemic-free second half in

2021 and of a strong economic rebound. Britain and the European Union signed a Brexit trade deal

late on Thursday, preserving several trade provisions for both

sides and limiting the scale of disruption resulting from the

divorce. The benchmark European stock index .STOXX rose 0.7% in a

fourth straight day of gains, while German stocks .GDAXI ended

1.5% higher at a record peak.

German food delivery firm Delivery Hero DHER.DE topped the

STOXX 600 with a 9.1% gain, ending at a record high after it

said it will sell South Korean food delivery app Yogiyo as part

of the conditions for regulatory approval of its takeover of top

South Korean food delivery app owner Woowa Brothers.

Automobile makers were among the top boosts to the German

index, given that the country is a major supplier of autos to

the UK. The striking of a trade deal appeared have cleared

several regulatory doubts over the future of the EU-UK auto

supply chain.

"We can finally breathe a big sigh of relief and say that

chaos over the stimulus bill is over," said Hussein Sayed, chief

market strategist at FXTM.

"A sell-off has been averted and this could provide one last

boost to risk assets in the last four trading days of the year."

However, many aspects of Britain's future relationship with

the EU remain to be hammered out, possibly over years..

Huge amounts of stimulus and vaccine optimism have seen the

STOXX 600 recover nearly 43% from its March lows, though it is

on course to end the year about 4% lower due to a severely

damaging second wave of coronavirus infections.

Among other European bourses, France's CAC 40 index .FCHI

and Spain's IBEX .IBEX ended 1.2% and 0.5% higher,

respectively.

Dutch technology firm Prosus PRX.AS bottomed out the STOXX

600 in the wake of a Chinese probe into local technology majors,

in one of whom Prosus holds a stake. London markets were shut due to Boxing Day.

(Editing by Alison Williams and Jonathan Oatis)