AlphaTON stock soars 200% after pioneering digital asset oncology initiative

(For a live blog on European stocks, type LIVE/ in an Eikon

news window)

* Banks hit three-week high as yields rise

* UK midcap stocks surge as Brexit hopes grow

* Logitech slides as Apple removes rival products

(Updates to market close)

By Sruthi Shankar

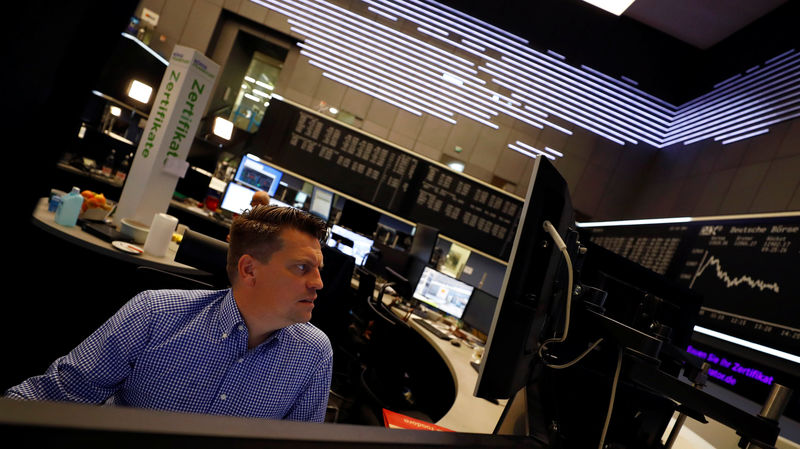

Oct 6 (Reuters) - European stocks stretched their gains for

a fourth session on Tuesday, with banks surging more than 3%

over growing hopes for a U.S. stimulus package, a Brexit trade

deal as well as upbeat German data.

After shedding as much as 0.5% at one point, the

pan-European STOXX 600 index .STOXX gradually erased the

losses to close 0.1% higher.

Europe's banking index .SX7P hit its highest level in

almost three weeks, as rising U.S. Treasury yields - a benchmark

for global borrowing costs - hit multi-month highs, supporting

lenders on both sides of the Atlantic. US/

Aside from banks, sectors considered more exposed to the

economic cycle, namely travel & leisure .SXTP , oil & gas

.SXEP , automakers .SXAP and insurers .SXIP , rose between

1% and 2.9%.

Global markets saw a relief rally on Monday on reassurances

about U.S. President Donald Trump's improving health after he

tested positive for COVID-19 last week, as well as political

progress towards more fiscal stimulus measures. "Stock markets have been dominated by indecision this week,

with the U.S. indices following their European counterparts in

what looks like a distinct end to the 'Trump left hospital'

bounce," wrote IG's Joshua Mahony.

Technology .SX8P and healthcare stocks .SXDP , among the

top performers in Europe this year, slid about 0.9%, weighing on

the STOXX 600.

Wall Street technology majors also came under pressure after

news that the U.S. House of Representatives' antitrust report on

Big Tech firms contained a "thinly veiled call to break up" the

companies. Germany's DAX .GDAXI jumped 0.6% as data showed orders for

German-made goods rose 4.5% in August, more than expected,

boosting hopes for a robust third quarter in Europe's largest

economy after the coronavirus shock. Britain's midcap index .FTMC , composed of stocks exposed

to the UK economy, jumped 1.2% after sources told Reuters that

Britain and the EU were close to agreement on reciprocal social

security rights for their citizens after Brexit. Puma PUMG.DE slid 1.1% after French luxury group Kering

PRTP.PA said it had completed the sale of a 5.9% stake in the

German sportswear group. Swiss technology accessories maker Logitech LOGN.S fell

5.1% after Apple AAPL.O stopped selling headphones and

wireless speakers from rivals. French waste and water firm Suez SEVI.PA jumped 4.6% after

rival Veolia VIE.PA succeeded in buying a large stake in the

company from power group Engie ENGIE.PA .