SoFi stock falls after announcing $1.5B public offering of common stock

- SVB became the biggest U.S. bank to fail since 2008

- SVB Financial specialized in lending to technology companies and start-ups with high growth prospects

- The bank's failure caused concern with investors fearing a widespread contagion in the banking sector

Thursday, March 9, marked the 14th anniversary of the global financial crisis market bottom. From March 9, 2009 to March 8, 2023, the S&P 500 was up +490%, which equates to an annualized return of +13.5%, excluding dividends.

But interestingly enough, 14 years later, the market chose the same period of the year to revisit some of the ghosts from that time. Let me briefly explain what happened and why.

1. What Does SVB Financial Group Do?

SVB Financial Group was the 16th largest U.S. bank based on total assets in 2022. It had $160 billion in deposits at the end of 2022, and half of that money was invested in U.S. government bonds and mortgage-backed securities.

It was a bank specialized in lending to technology companies, start-ups, and new technology-related projects. This bank financed companies with high growth prospects that were very young.

According to Reuters, it was the banking partner of almost half of the technology and healthcare companies listed in 2022.

2. What Happened?

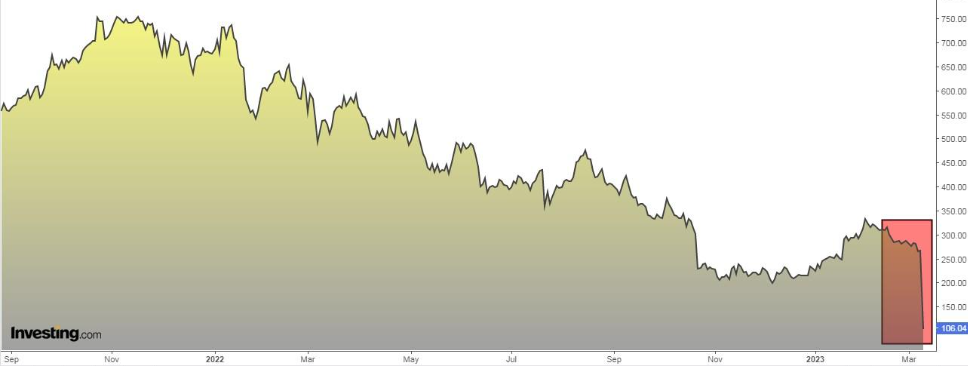

On Thursday, SVB plunged 60.4% during trading hours; on Friday, it fell more than 40% in the premarket. Finally, it was shut down by regulators.

3. Why Did It Happen?

SVB became the largest U.S. bank to fail since 2008 after its tech startup customers got worried and withdrew deposits. The bank run forced the company to sell a $21 billion portfolio at a loss to gain some liquidity.

This has led to a strong outflow of money, with asset managers recommending that investors get out of the company as quickly as possible.

Rising interest rates have left banks saddled with low-yielding bonds that cannot be sold quickly without a loss. So if too many customers withdraw their deposits simultaneously, there is a risk of a vicious cycle being sparked.

4. The Domino Effect

All of this has spooked investors in general. Many investors decided to liquidate or reduce their equity positions and fled to fixed-income securities.

The most obvious example was the United States 10-Year Treasury bond. Its yield (which is inversely related to its price) fell to 3.59% from 4%.

U.S. banks lost more than $100 billion in market value between Thursday and Friday, and European banks lost another $50 billion, according to a Reuters estimate.

In the U.S. banking sector, the reaction was swift, with First Republic Bank (NYSE:FRC) falling 14.8% and PacWest Bancorp (NASDAQ:PACW) falling 38%.

Among the majors, since last Thursday, Bank of America (NYSE:BAC), JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC) and Citigroup (NYSE:C) are down 17%, 6.3%, 14.28 and 5.9%, respectively.

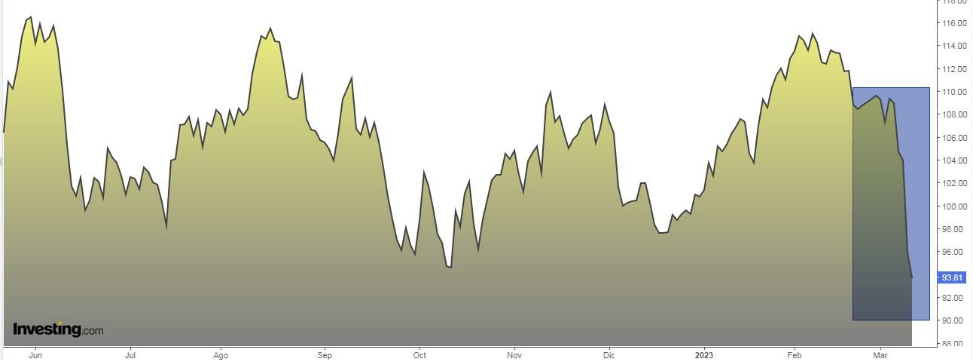

The regional bank index's weekly losses extended to 16%, its worst week since 2009. The bank index, which includes large and mid-sized banks, extended its weekly losses to more than 11%.

While the SPDR® S&P Regional Banking ETF (NYSE:KRE), which tracks the performance of U.S. regional banks, was down 4.39%, the Invesco KBW Regional Banking ETF (NASDAQ:KBWR) was down 2.5%

The KBW Bank, which focuses on large banks, was down 4%.

Friday's biggest losers in the financial sector of the S&P Composite 1500:

- PacWest Bancorp: -38%.

- First Republic Bank: -14.84%.

- Signature Bank (NASDAQ:SBNY): -22.9%.

- Bank of Hawaii (NYSE:BOH): -7.5%

- Axos Financial (NYSE:AX): -6.2%

- B. Riley Financial (NASDAQ:RILY): -11.9%

- East West Bancorp (NASDAQ:EWBC): -6.1%

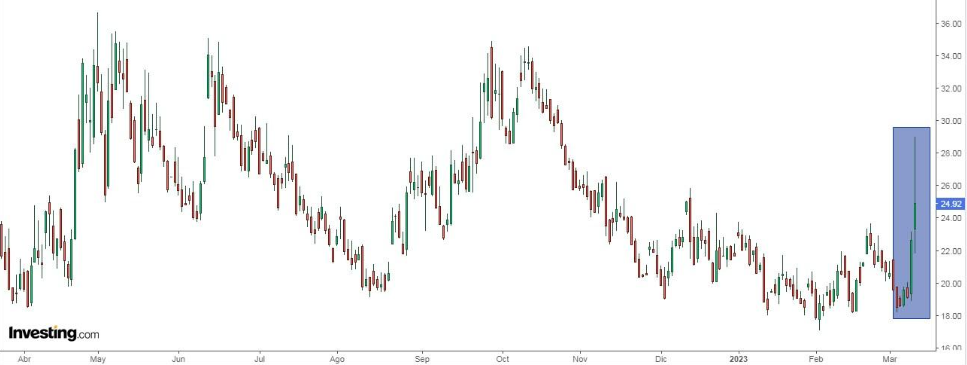

The VIX or "Wall Street Fear Index" rose from 18.88 to 29 in two days (Thursday and Friday).

In Europe, the Stoxx 600 Banks index was down 3.8%, with the IBEX 35 Banks index down 6.4%.

Some stocks such as Deutsche Bank (NYSE:DB) fell as much as -6.63%, HSBC (NYSE:HSBC) -3.8%, Societe Generale (OTC:SCGLY) the same, and BNP Paribas (OTC:BNPQY) -4%.

Not only that but the fallout extended to Alecta, Sweden's largest pension fund. At the end of last year, Alecta was SVB's fourth-largest shareholder after doubling its stake in the California bank.

Alecta is also the fifth-largest shareholder in First Republic Bank and the sixth-largest in Signature Bank. Both banks took a big hit.

5. Cause for Concern?

SVB has historically been considered a solid and well-run bank. Based on the situation it is in today, investors naturally fear what other less solid banks might be like. There is also concern that its difficulties are just the tip of the iceberg in the sector, with funding constraints for companies.

However, I believe the market's knee-jerk reaction was a bit exaggerated. It has caused a major psychological shock that has awakened old market demons. But we know that investors sell first when something happens, then analyze it.

It is also true that the European banking sector, especially the Spanish banking sector, has appreciated significantly in recent months due to the ECB's interest rate hikes, so many investors also took the opportunity to sell and take profits.

Spanish banks rose by an average of +27%; in the rest of Europe, they rose more than twice as much as the Stoxx 600.

For now, the FDIC has announced the closure of SVB due to insolvency. The FDIC has also announced measures to ensure the protection of all insured deposits, and all customers with insured funds will have full access to those funds by Monday at the latest.

Those with uninsured deposits will receive a dividend from the FDIC this week and a certificate for the remainder of their funds, which will be returned when the bank's assets are sold.

U.S. Treasury Secretary Janet Yellen commented that the U.S. banking system remains resilient and that regulators have effective tools to address the consequences of SVB's collapse. Her words were an attempt to calm the markets and prevent further panic among investors.

Former Treasury Secretary Lawrence Summers also weighed in, saying that the bank should not pose a risk to the financial system.

Investor Sentiment (AAII)

Bullish sentiment, or expectations that prices will rise in the next six months, rose 1.8 percentage points to 23.4%. However, it is still below its historical average of 37.5%.

Bearish sentiment, or expectations that prices will fall in the next six months, rose 6.2 percentage points to 44.8%, its highest level since December 29, 2002 (47.6%) and above its historical average of 31%.

The year-to-date rankings of the major European and U.S. stock exchanges are as follows:

- Italian FTSE MIB +11.53%

- Spanish IBEX 35 +10.04%.

- French CAC 40 +9.32%.

- Euro Stoxx 50 +8.90%

- German DAX +8.13%.

- Japanese Nikkei 225 +6.66%

- NASDAQ Composite +6.42%

- Chinese Shanghai Shenzhen CSI 300 +3.54%

- UK FTSE 100 +2.24%

- S&P 500 +0.58%

- Dow Jones Industrial Average -3.73%

Disclosure: The author does not own any of the securities mentioned.